Raydium has officially unveiled LaunchLab, a new memecoin creation platform designed to compete head-to-head with Pump.fun — the project that once contributed significantly to Raydium’s revenue. LaunchLab offers customizable bonding curves and zero migration fees, positioning itself as the next major launchpad for memecoins on the Solana ecosystem.

LaunchLab went live on April 16, just a month after Pump.fun severed ties with Raydium by shifting its token migration away from Raydium’s liquidity pools and onto its own decentralized exchange, PumpSwap.

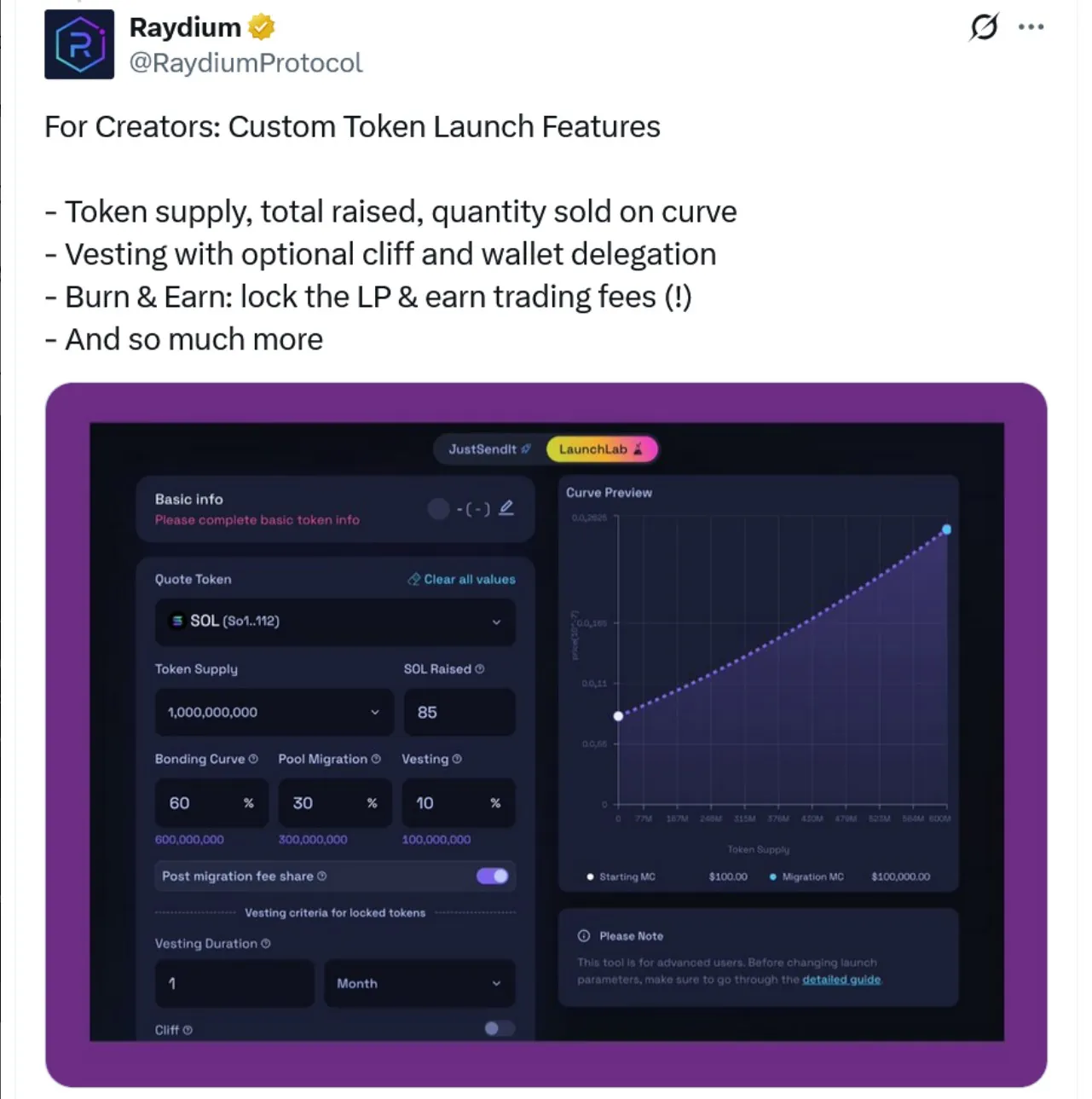

Raydium hopes to leverage its existing liquidity infrastructure to dethrone Pump.fun, offering memecoin creators a more powerful and flexible platform. According to the announcement, token launches on LaunchLab are free of charge, and creators can opt to earn 10% of trading fees from the AMM pool once their project “graduates.”

Any token that raises at least 85 SOL (currently around $11,150) will be automatically transitioned into Raydium’s AMM system. As of now, about 10 tokens on LaunchLab have already surpassed this milestone.

Trading fees on LaunchLab are fixed at 1%, with 25% of those fees allocated for RAY token buybacks — a move aimed at boosting ecosystem value. Following the announcement, the price of RAY surged nearly 14%, peaking at $2.41 within four hours before settling back to $2.21, according to CoinGecko data.

PumpSwap Keeps Gaining Momentum

Meanwhile, PumpSwap — Pump.fun’s newly launched DEX — continues to break records. On April 17, it recorded $460 million in trading volume, narrowly beating the $454.9 million from the previous day, marking the fifth consecutive day of exceeding $400 million in daily volume.

Since its launch on March 22, PumpSwap has processed a staggering $7.3 billion in volume, according to DefiLlama, highlighting the explosive growth and fierce competition in Solana’s memecoin space.