RAY Outperforms BTC

RAY’s performance so far, especially over the past two months, has shown growth that has outperformed Bitcoin [BTC], which also hit a new high on November 6.

When looking at RAY’s price trend, we can see a strong rally that started in September. At that time, the token was trading as low as $1.35, but by October, the bulls had taken over.

In the past 24 hours, RAY’s price has skyrocketed to $5.06, representing a 276% increase from its September low.

To put this into perspective, Bitcoin has only increased by 45% from its September low to its recent new high. Despite its remarkable performance, RAY still has plenty of room to grow before reaching its all-time high, as the token peaked at $17.80 in August 2021.

However, RAY price may face a short-term correction due to overbought conditions. The token has shown signs of bearish divergence with a lower high on the RSI. Additionally, the MFI indicator has also turned bearish, suggesting profit-taking is taking place.

Raydium’s performance reflects a strong growth momentum due to the prominent utility of the Solana blockchain in 2024. As a result, Raydium has benefited and become one of the top DEXs.

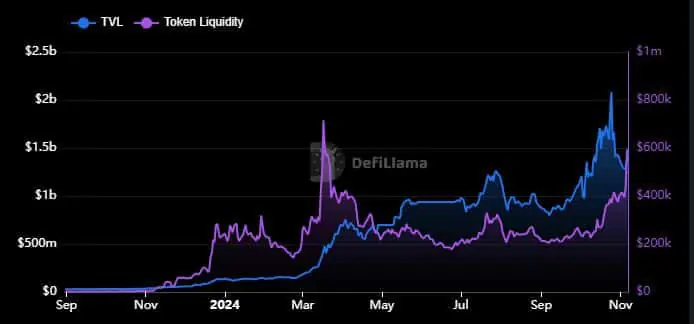

Raydium TVL surges in 12 months

Just 12 months ago, Raydium’s total value locked (TVL) was just under $40 million and its token liquidity had not exceeded $10,000. However, both of these metrics have seen explosive growth recently, with TVL peaking at $2.08 billion in October before falling back to $1.50 billion. RAY token liquidity has also exploded, soaring to $597 million. These numbers underscore the growth of the Raydium DEX in 2024, which is in line with the growth of the Solana ecosystem.

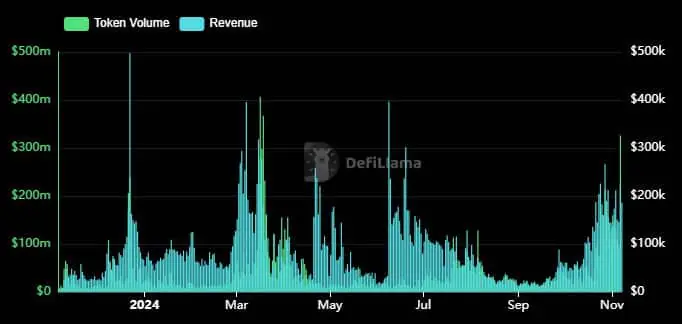

This growth is also evident in Raydium’s trading volume and revenue data. The highest peaks in volume and revenue occurred in March, June, and October, followed by a gradual decline in the remaining periods. Specifically, the highest token volume since the beginning of 2024 was around $406 million in March, and the highest revenue was $395,000 in the same month.

Read more: COW Price Soars 220% Following Binance Listing

Recently, since September, both volume and turnover have shown signs of increasing again, reflecting increased activity during bullish months. This suggests that the metrics are also cyclical, decreasing during quiet months and increasing during booming periods. Based on these observations, it can be seen that Raydium DEX activity has driven demand for RAY, and this trend is likely to continue as the bull market continues to heat up.