Raydium’s native token, RAY, has plunged 25% following claims from an on-chain investigator that Pump.fun may be developing an automated market maker (AMM) protocol, potentially threatening a key revenue stream for the decentralized exchange (DEX).

The Solana-based DEX and AMM saw its token nosedive on Feb. 24 amid rumors that Pump.fun, a popular memecoin launchpad, is working on a competing AMM feature.

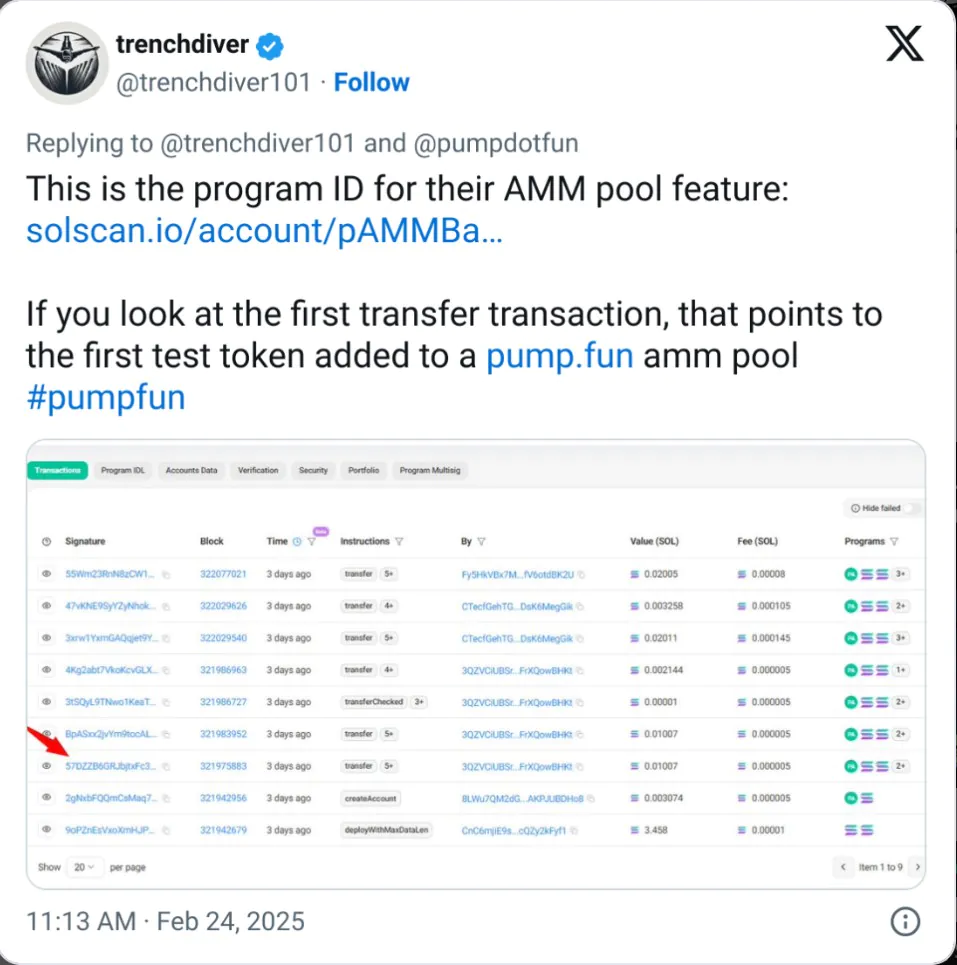

The speculation originated from the X account “trenchdiver,” which posted on Feb. 24 that Pump.fun was actively developing and testing its own AMM liquidity pools. This feature would enable users to trade crypto assets against liquidity in a smart contract rather than directly with a counterparty.

Supporting their claim, the account shared a link to a website displaying an AMM interface bearing Pump.fun’s branding, with a notice indicating that the feature is currently in beta.

A Potential Threat to Raydium’s Business

If Pump.fun were to launch its own AMM, it could siphon off a portion of Raydium’s market share. Presently, when a Pump.fun token garners sufficient trading activity, it completes a process known as a “bonding curve” before being listed on Raydium for further trading.

“It appears they plan to have Pump tokens transition to their own liquidity pools instead of Raydium’s, allowing them to either capture higher fees on Solana or implement a mechanism to reward token holders,” trenchdiver speculated.

A transaction from Feb. 20, shared by trenchdiver, seemingly confirms that Pump.fun has already conducted its first test, adding a token named Snowfall (CRACK) to its AMM liquidity pool.

Volatility in Snowfall’s Market Performance

Snowfall (CRACK), reportedly named after the 2017 TV series depicting the 1980s crack epidemic, experienced a meteoric rise following trenchdiver’s revelation. According to DEX Screener, the token’s market value surged to $5.4 million within an hour of the post. However, it has since faced extreme volatility, plunging 40% in the last hour, with its market capitalization dropping to approximately $1.8 million.

Pump.fun has yet to officially confirm or deny its plans to launch AMM liquidity pools.

Raydium’s RAY Token Faces Sharp Decline

Meanwhile, podcast host Tyler Warner remarked on X that Raydium was “falling off a cliff” in the wake of trenchdiver’s revelations. CoinGecko data indicates that RAY has tumbled 25% in the past 24 hours, currently trading at $3.22.

Gabriel Tramble, founder of Shoal Research, highlighted on X that Raydium’s AMM typically charges a 0.25% fee on swaps. In contrast, Pump.fun could potentially implement higher fees on its AMM pools, which, under favorable market conditions, might allow the platform to “double its revenue.”

“Degens are already accustomed to paying high fees for trades,” Tramble added.

According to DefiLlama, Pump.fun has generated over $500 million in fees since its launch in January 2024.