In just the past 24 hours, the PUMP token surged by 15% after the project transferred $18 million to a buyback wallet. This move has quickly drawn the attention of investors. But is this truly the start of a sustainable recovery—or just a temporary sentiment-driven spike before the bubble bursts?

Buybacks: Smart Strategy or Short-Term Gimmick?

Following its successful ICO, Pump.fun has become a hot topic in the crypto community. Despite being valued at a staggering $4 billion, many are skeptical of the project due to PUMP’s lack of real utility, governance structure, or revenue-sharing mechanisms for token holders.

However, recent on-chain data shows that Pump.fun has transferred $18 million into a dedicated buyback wallet. According to EmberCN, the platform used transaction fee revenues to repurchase 3.04 billion PUMP tokens, thereby reducing supply and pushing prices up.

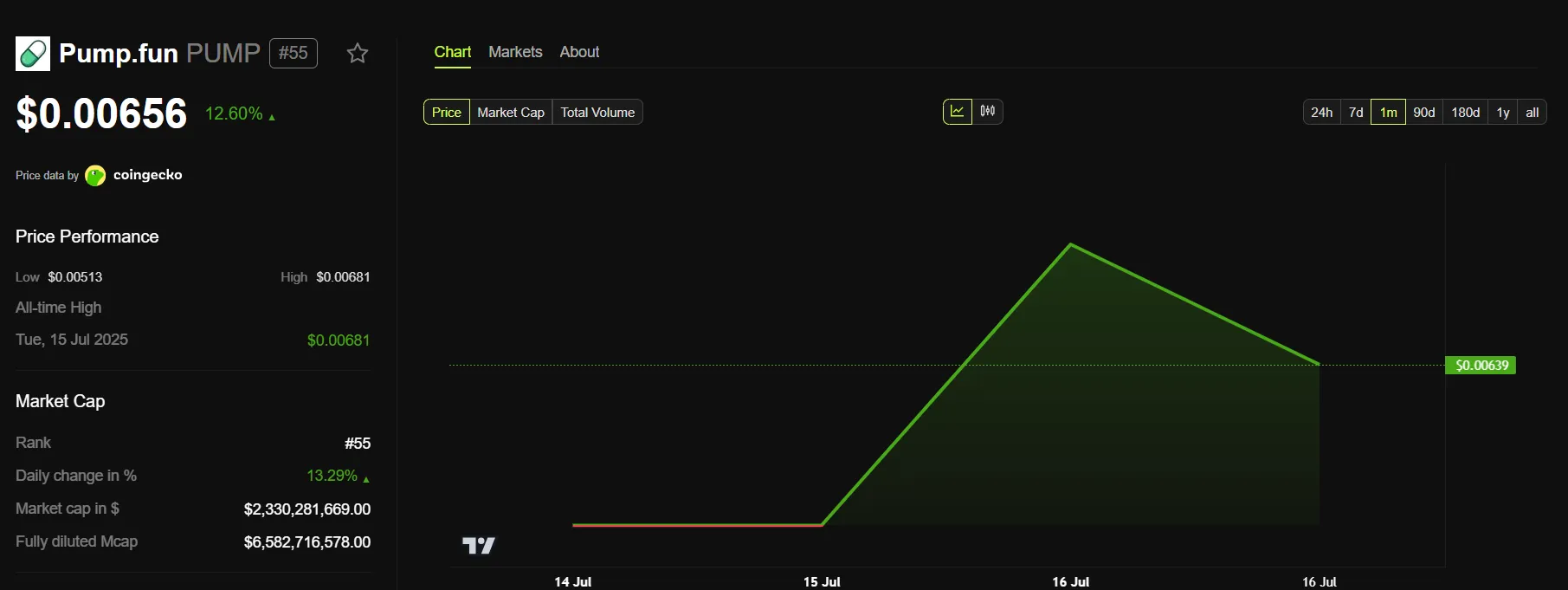

At the time of writing, PUMP is trading at $0.00656, up around 12% over the past 24 hours.

Buybacks are widely used in both traditional finance and crypto to reduce token supply, creating upward price pressure. They also act as a positive market signal, boosting short-term investor confidence. Still, not everyone is convinced this is a long-term solution.

Hype or Hope: What’s Behind the Buyback Curtain?

Skepticism still lingers. One user on X sarcastically commented:

“Pump.fun sold tokens at $0.004 just a few days ago and is now buying them back at $0.006 with the same money. Crypto is not a serious industry.”

Pump.fun isn’t alone in this trend. Several other major projects such as FET, AAVE, IOST, and Polyhedra (ZKJ) have also announced large-scale buyback plans, some involving tens of millions of dollars.

However, sudden price spikes driven by buybacks—without strong fundamentals or clear value for holders—can lead to artificial rallies, vulnerable to sharp corrections if market sentiment shifts.

Final Thoughts: Pumping with Purpose or Just for Show?

For now, Pump.fun is still largely operating within the meme coin and presale niches—areas often associated with high speculation and limited transparency.

While buybacks can be effective tools to generate short-term momentum, their impact may quickly fade if the project lacks a clear development roadmap and real-world utility.