Currently trading at $4.72, TON is attempting to retest the $5 mark. On-chain analysis suggests that market participants interacting with Telegram’s native token may be hindering this upward momentum.

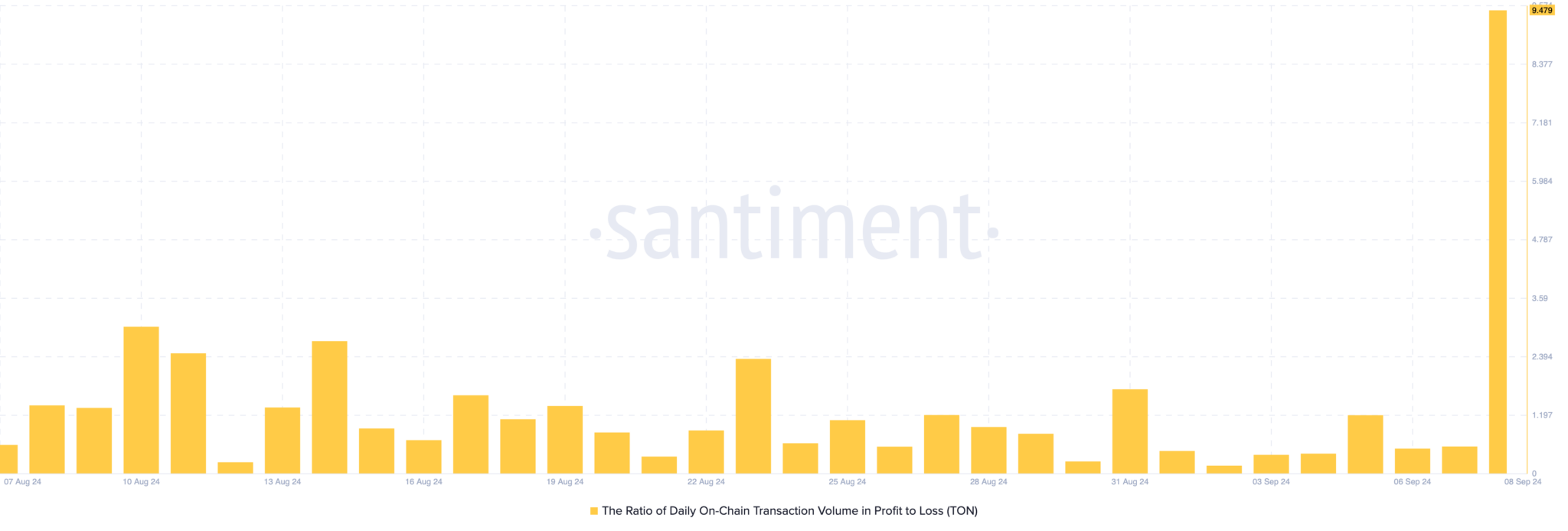

Toncoin Faces Setbacks According to data from Santiment, the daily on-chain volume ratio of profit to loss has reached its highest level since February. This indicator tracks the total number of tokens that have moved either in profit or loss.

A spike in this metric signals significant profit-taking activity, while a decline indicates that market participants are holding back and choosing to HODL.

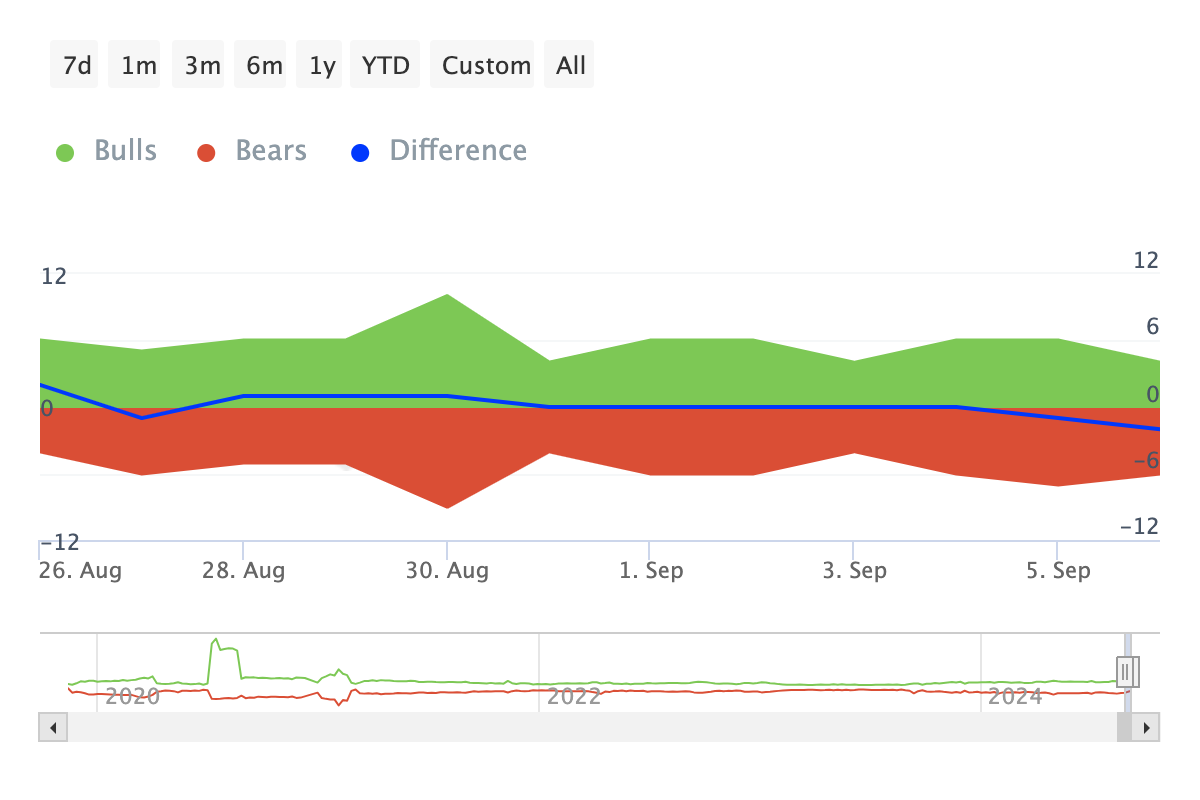

For Toncoin, this sudden surge heightens the risk of another downturn, especially as the token has recently shown signs of sustainable price growth. Adding to this outlook is the Bulls and Bears indicator, which monitors whether addresses trading around 1% of total volume are buying or selling. Bulls represent addresses that have purchased more than 1% of the volume, while Bears are those that have sold a similar amount.

A higher number of bulls typically signals a potential price increase, while a greater presence of bears usually leads to a faster decline. In Toncoin’s case, the recent rise in bears compared to bulls over the past 24 hours suggests that the recent uptrend may be nearing its end.

TON Price Prediction: Not the Right Time for $5 Yet Toncoin’s price has recently rebounded from $4.61 and is now trading at $4.90, with a target to break above $5. However, the Stochastic Relative Strength Index (Stoch RSI) indicates that this attempt might not succeed.

Stoch RSI, as it’s commonly called, compares recent highs and lows, allowing it to signal whether momentum is bullish or bearish, and whether an asset is overbought.

As seen in the chart below, the Stoch RSI on Toncoin’s daily price chart remains below the neutral line. If this trend continues, TON could erase some or all of its recent gains. Should this scenario play out, the price could fall to the support level of $4.69.

Losing this support could drive the price down to $4.47. However, TON could avoid this decline if realized profits decrease. In that case, TON might gradually rise to $5.25.