After experiencing a surge a few weeks ago, Ripple (XRP) has found stability, but its momentum appears subdued compared to other altcoins. Despite briefly securing its position as the fourth-largest asset, the current outlook prompts a closer examination of its standing in the market.

The bearish trend persists for XRP, evident in its daily timeframe chart over the last 14 days, where it recorded price increases of just over 1% on three occasions. Following a notable 6% decline on December 11th, the subsequent sluggish performance underscores the challenges faced in recent weeks.

As of the latest analysis, XRP is trading at approximately $0.61, with a marginal increase of less than 1%. The short moving average (depicted by the yellow line) has emerged as immediate resistance, hovering around $0.63 and hindering any significant upward movement.

Adding to the cautious sentiment is the Relative Strength Index (RSI), indicating a persistently weak trend. The RSI has remained below the neutral line for nearly two weeks, underscoring the lack of strong bullish momentum.

Related: Whales Accumulate XRP: Is a Significant Price Volatility Imminent?

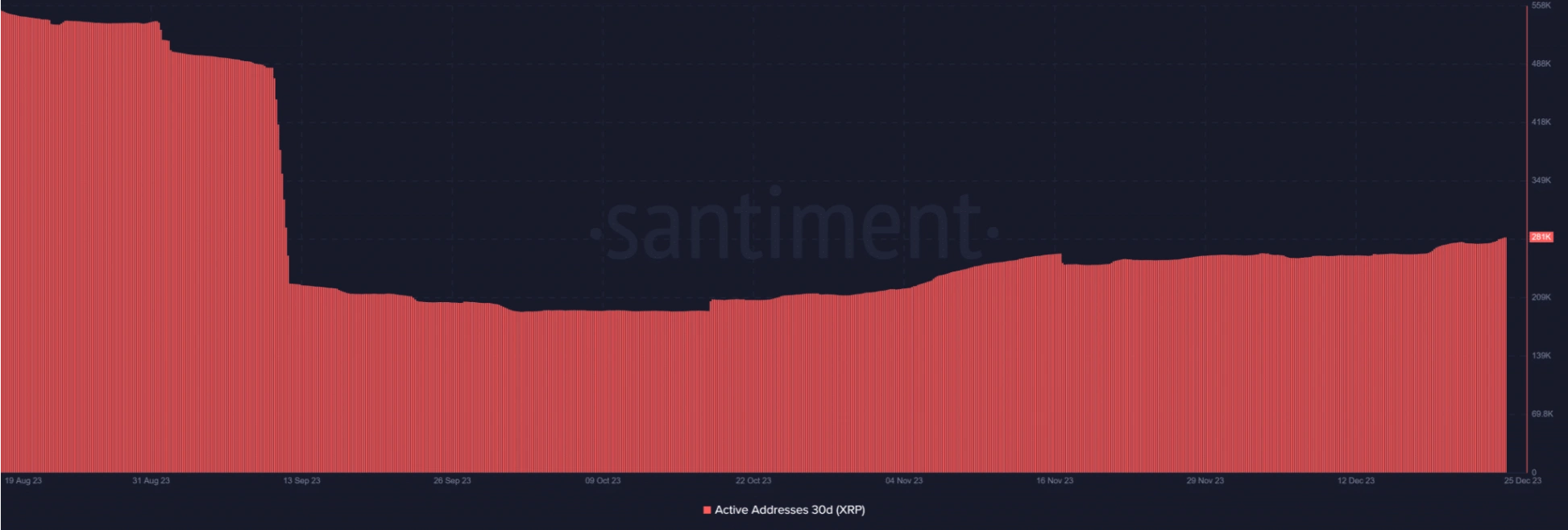

In terms of network activity, XRP’s Active Addresses have failed to recover since a substantial decline in September. The current data reveals a decrease from over 480,000 to approximately 281,000 active addresses. This decline suggests a contraction in the number of wallets actively participating in XRP trading, potentially signaling reduced volume and, consequently, an impact on the coin’s price.

While XRP enjoyed a positive market ranking a few weeks ago, recent market dynamics have caused a slip in its position. Formerly occupying the fourth spot based on market capitalization according to CoinMarketCap, it now sits at the sixth position with a market capitalization of approximately $33.8 billion. Notably, Solana (SOL) and Binance Coin (BNB) have overtaken XRP in the rankings, as reflected in their market caps in the past few days.

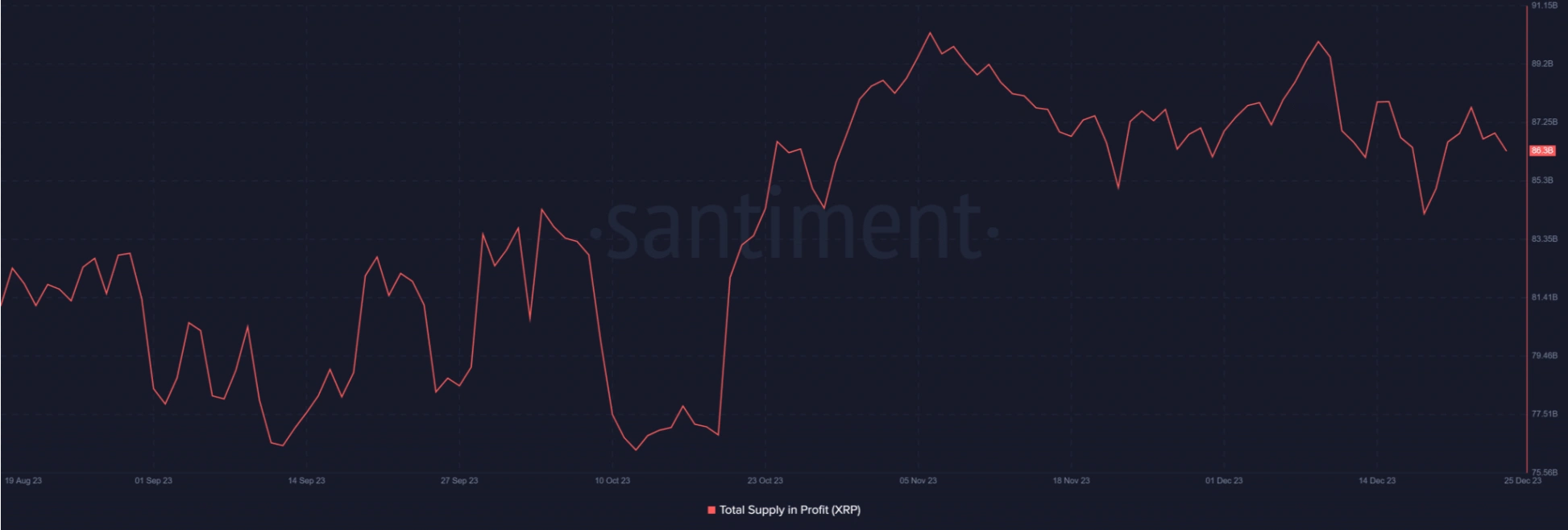

Despite the sluggish price movement, a significant portion of XRP’s circulating supply remains in a profitable position. Analyzing the total supply in profit on Santiment reveals that over 86 billion of the altcoin’s overall supply, constituting over 86%, is currently in a profitable state. This indicates that a substantial number of XRP holders are still experiencing positive returns despite the coin’s restrained market performance.