Polygon founder Sandeep Nailwal expressed surprise at the heightened transaction activity, speculating that it might be linked to the launch of a new Polygon-based nonfungible token (NFT) collection, as indicated in his Nov. 16 X post.

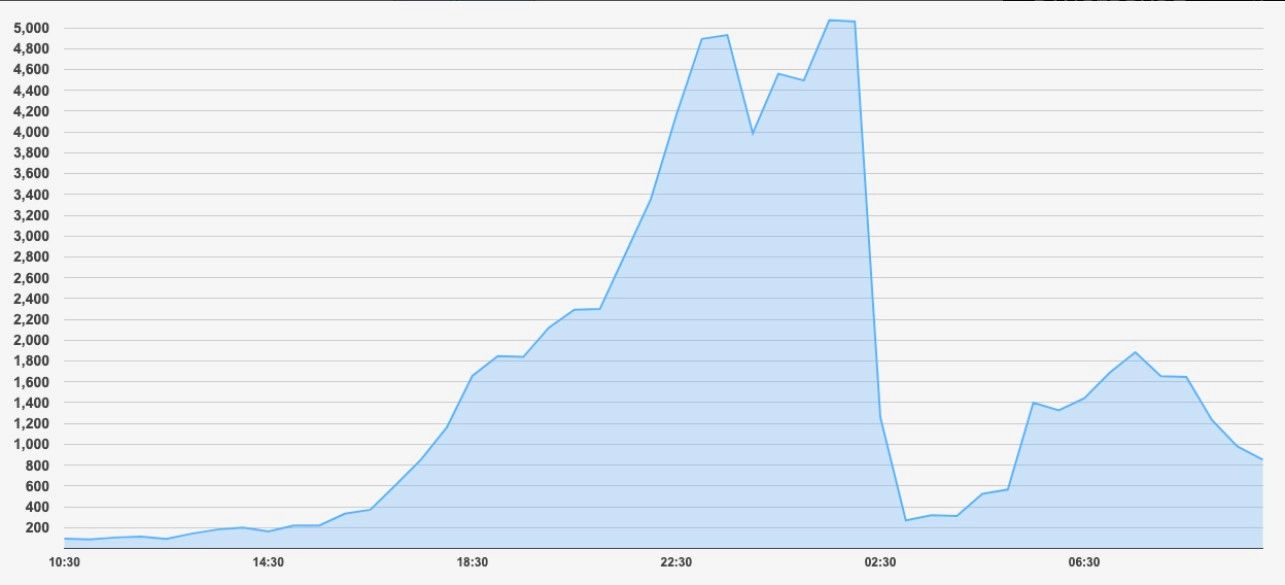

What is going on on @0xPolygon POS chain? 6m transactions in last 24 hrs. 170 TPS on average. 1mn+ MATIC burnt by the protocol. The chain worked smoothly, gas fees went crazy though but no reorgs or 0 blocks etc.

I hear there is some game Baby Shark Launching, could that be the…

— Sandeep Nailwal | sandeep. polygon 💜 (@sandeepnailwal) November 16, 2023

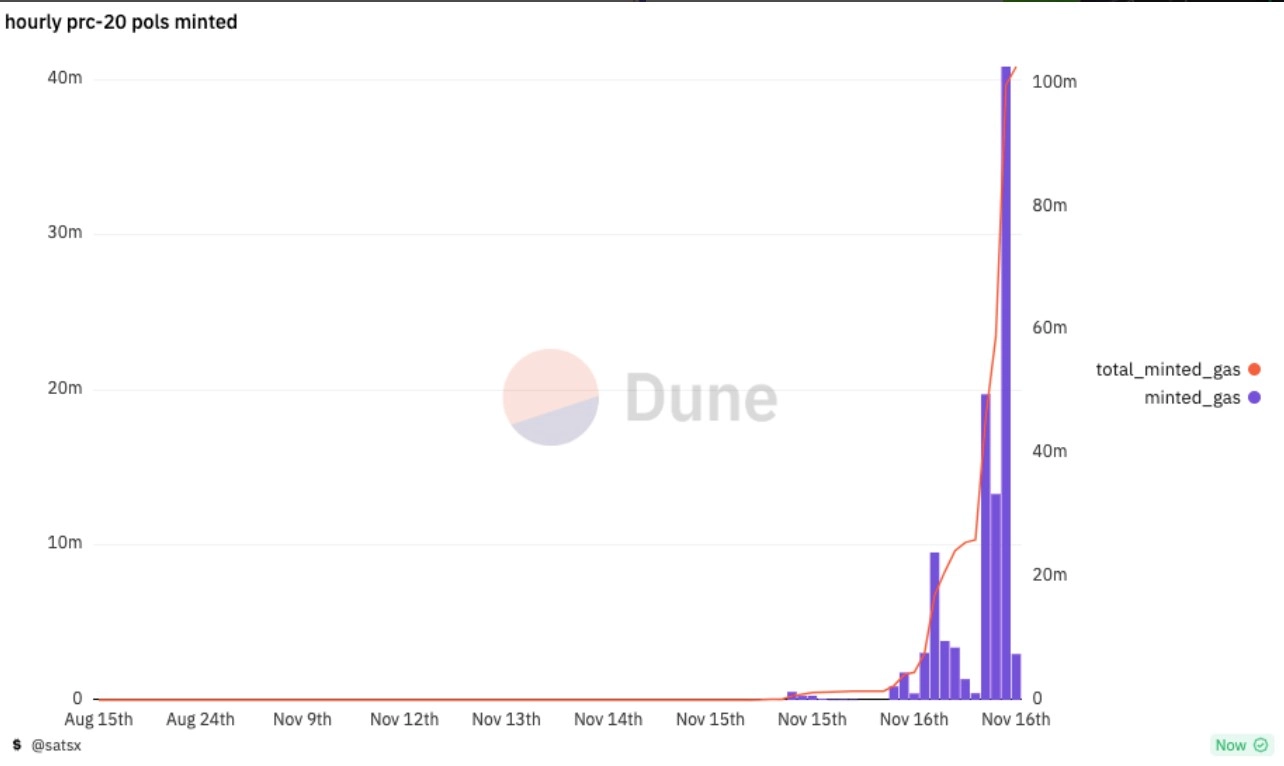

The surge in network activity and the subsequent spike in gas fees can be attributed primarily to the enthusiastic frenzy surrounding the minting of the POLS token. Dune Analytics data revealed that the rush to mint POLS coincided with the utilization of over 102 million MATIC tokens, equivalent to $86 million at current prices, for gas.

The POLS token, operating on the PRC-20 protocol, shares similarities with the Bitcoin Ordinals-derived BRC-20 token standard. EVM data from Ethereum Virtual Machine provider EVM indicated that only 8.7% of the total POLS supply has been minted, with just over 18,100 owners claiming the token.

Related: Bitcoin-Linked Token Skyrockets 100% in a Week Amidst Surging Ordinals Demand

As of the latest update, Polygon gas fees have returned to normal levels, settling around 882 gwei. Gas fees measure the computing effort required to execute a transaction on a blockchain, with 1 gwei approximately equal to 0.000000001 MATIC.

Comparisons were drawn to the Bitcoin network’s experience, which witnessed a prolonged spike in activity in May after the release of the Ordinals protocol, enabling users to mint NFTs directly onto the Bitcoin blockchain.

This surge led to Bitcoin fees reaching levels not seen since April 2021, prompting criticism from more traditional Bitcoin figures like Samson Mow and Adam Back, who denounced the NFT protocol and token standard as wasteful.