Current market signals suggest that the memecoin is gearing up for a potential price surge, aiming to reclaim its May peak of $0.00001725, with the possibility of further gains as key factors align.

Whale Activity Brings Hope for PEPE A recent report from Lookonchain disclosed a significant transaction involving a whale—an investor holding a substantial amount of tokens—who moved 4 billion PEPE, worth around $29.87 million, from the centralized exchange Bybit to a private wallet.

Such transfers from centralized exchanges to private wallets typically indicate growing investor confidence in the asset, potentially leading to a supply shortage.

A supply squeeze occurs when the available cryptocurrency becomes limited, often pushing prices higher if demand remains steady, as buyers compete for the increasingly scarce asset.

Despite this optimistic activity, the immediate impact on PEPE’s price has been modest, with a 3.93% drop in daily candle movements. However, a price rally may be on the horizon.

The Golden Cross and Symmetrical Pattern Position PEPE Favorably

PEPE is currently trading within a bullish symmetrical triangle pattern, characterized by converging diagonal support and resistance lines that form an upward-sloping structure.

In this pattern, the price typically fluctuates between these levels until a breakout occurs near the convergence point.

PEPE is now at this critical juncture, having rebounded from the lower support line—a key catalyst for its movement. This rebound aligns closely with the point of convergence.

Should a breakout occur, PEPE could return to the pattern’s peak, recorded in May at $0.00001725, with potential for even greater growth.

Additionally, the Moving Average Convergence Divergence (MACD), a valuable tool for identifying asset trend reversals by providing potential buy and sell signals based on trend strength, indicates that PEPE may be poised for an upward move soon.

A bullish crossover becomes evident as the MACD line (blue) crosses above the Signal line (yellow), accompanied by increasing volume—an encouraging scenario that PEPE memecoin has recently mirrored, setting the stage for a potential price surge.

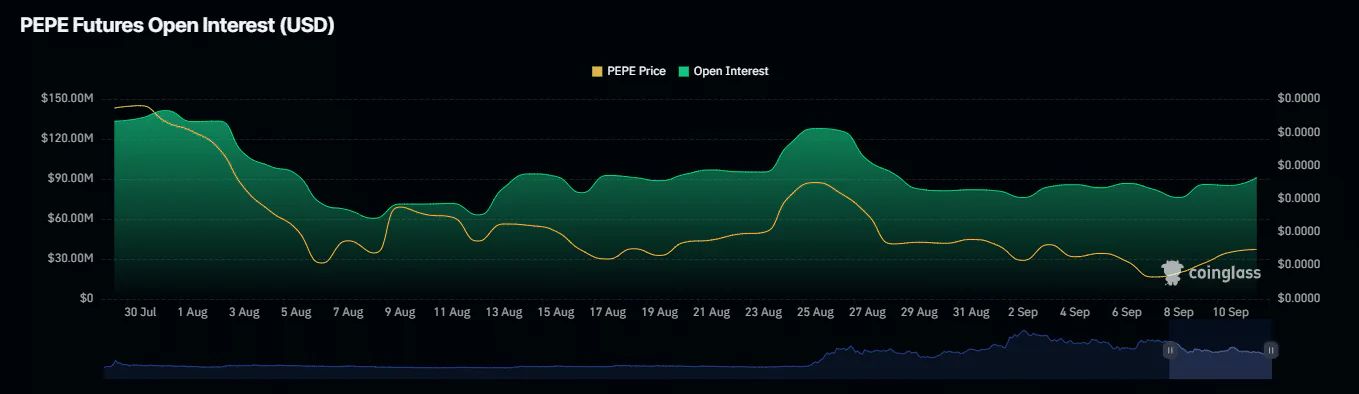

Rising Open Interest in PEPE Signals Potential for New Highs

PEPE’s open interest, a crucial indicator of retail trader activity, has seen a significant uptick, reflecting ongoing growth with the current figure at $91.16 million, according to Coinglass.

Essentially, rising open interest indicates an increase in unfulfilled contracts, signaling stronger market participation as new investments or positions enter. This development suggests a potential bullish outlook. If this trend maintains its current pace, a PEPE rally seems inevitable.