Over the weekend, Pepe coin’s price received a boost after the SEC Chair hinted at the potential approval of spot Ethereum ETF S-1s by the end of summer. On Monday, during European trading hours, PEPE was priced around $0.0000118, marking a 1.4% increase in 24 hours. With this price surge, PEPE bulls might seize the momentum to drive the price towards its previous all-time high.

PEPE Price Analysis Suggests 63% Breakout Potential

On May 21, PEPE broke out of an ascending triangle and reached a new all-time high (ATH). However, as investors began to take profits, the price retraced, dipping to $0.00001057.

After nearly a month of downward movement, PEPE’s price found support at a critical resistance-turned-support level. Such support structures are typically robust and can maintain price stability if conditions remain constant. Additionally, PEPE is currently in a falling wedge pattern, which is a bullish market indicator.

The current PEPE price level aligns with the 0.786 Fibonacci retracement level, which often provides strong support for a price rebound. Furthermore, the price retracing to this level is part of a breakout test from the three-month ascending triangle that PEPE had previously exited.

If PEPE breaks out upwards from the falling wedge, it may surge back to its previous ATH. Considering the 0.27 Fibonacci extension level, PEPE could rise by 63% from its current price to reach a new ATH of $0.00001948. Conversely, the support level at $0.00001057 is expected to hold.

Pepe Price Analysis Future Outlook

Historically, Pepe’s price has moved in tandem with Ethereum’s, and this instance is no different. According to FOX Business journalist Eleanor Terret, Gary Gensler, Chair of the U.S. SEC, indicated that spot ETH ETF S-1s are likely to be approved by the end of the summer.

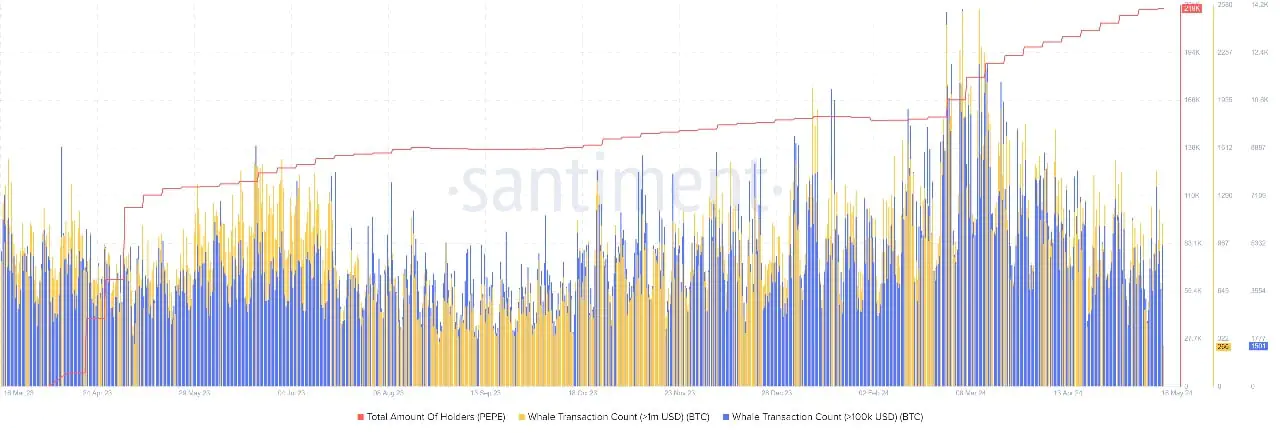

As Ethereum investors turned bullish on this news, so did PEPE bulls. According to on-chain analysis firm Santiment, the number of PEPE holders has reached an all-time high, while the number of whale investors holding $100,000 to $1,000,000 worth of PEPE has decreased. This metric is significant as it indicates a redistribution of supply among smaller investors. Projects dominated by whales may not have long-term stability, as whales often drain liquidity from the market.

With Ethereum buy fever driven by the SEC Chair’s statement before Senator Hagerty, ERC20 meme coins are expected to perform well, with PEPE leading the charge. This could mark a crucial turning point for PEPE’s long-term price trajectory.