On May 8, PEPE surged nearly 35% as Bitcoin broke past the key psychological level of $100,000. Reclaiming the $0.000010 price zone, PEPE has sparked hopes of a new meme coin season. Following this impressive overnight breakout, PEPE’s open interest is now nearing record highs, with nearly 65% of Binance traders shifting to long positions. Given these conditions, could PEPE’s price gain another 22%?

PEPE Price Analysis: Targeting $0.000013344

The latest rally began on May 6 with a long-legged doji candle, completing a “morning star” reversal pattern. This technical signal triggered a strong 35% surge on May 8, forming a robust bullish candle—an indication of a potential trend shift in the broader market.

Currently, PEPE is trading around $0.00001091, a level last seen on February 4. However, after the steep rally, the coin is experiencing a slight pullback with a daily drop of around 1.84%.

PEPE has broken above the 200-day Exponential Moving Average (EMA), suggesting a possible continuation of the uptrend. Momentum indicators like the MACD and signal line crossover also support the bullish outlook.

According to Fibonacci retracement levels, PEPE has surpassed the 23.6% mark at $0.00001025 and is now targeting the 38.2% level at $0.000013344—representing a potential 22% upside from the current price. This provides an optimistic price projection for the near term.

However, a pullback to retest the 23.6% level may result in a 6% drop and risk losing the 200-day EMA support—a critical psychological level for investors. Failure to hold this zone could see PEPE decline by 18% to revisit the $0.000008832 region.

Investor Confidence Grows as Open Interest Approaches All-Time High

After months of quiet, meme coins are making a strong comeback, with PEPE leading the charge amid a surge in derivatives trading. PEPE’s open interest has risen to $531 million—just shy of its all-time high of $555 million—reflecting growing bullish sentiment.

Additionally, the weighted funding rate has spiked to 0.0118%, indicating a sharp rise in long positions. The forced liquidation of over $5.71 million in short positions further supports the bullish momentum.

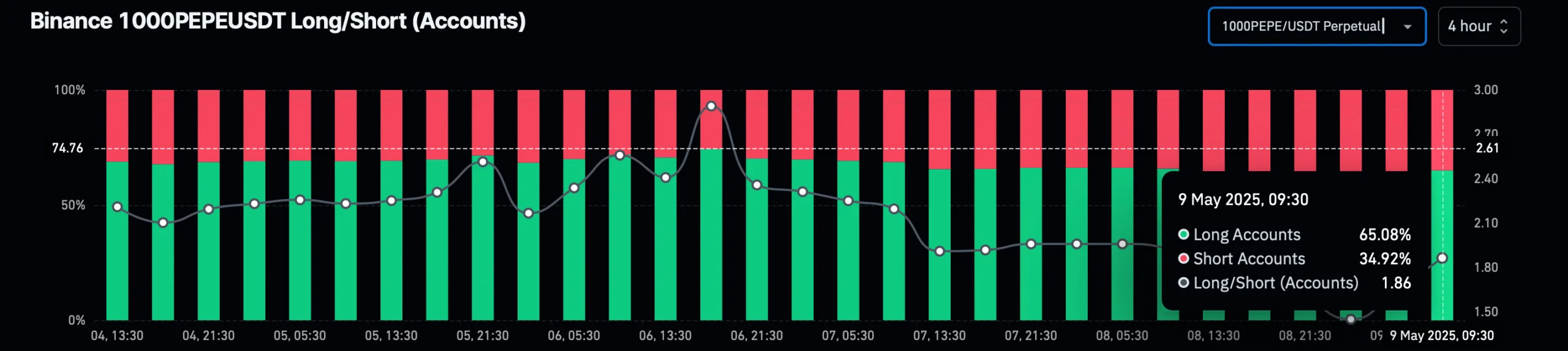

On Binance, optimism is clearly dominant, with 65% of traders holding long positions in PEPE, pushing the long/short ratio to 1.86. As long positions continue to dominate the derivatives landscape, PEPE’s price may have the fuel it needs to break through its next resistance level.