While most of the crypto market remains in a state of slumber, meme coin PENGU has emerged as a standout performer, jumping nearly 10% in the past 24 hours. However, behind this breakout lies growing concern about a potential short-term price correction.

PENGU Faces Selling Pressure and Bearish Sentiment

From May 14 to June 26, PENGU was trapped in a descending channel, struggling to gain upward momentum. It recently broke out of that pattern, pushing closer to its previous peak on May 14.

However, technical indicators now suggest the bullish momentum may be fading. PENGU’s Relative Strength Index (RSI) currently sits at 72.16 — well into the “overbought” zone above 70. This typically signals that buying pressure may be unsustainable and that a price reversal could be near.

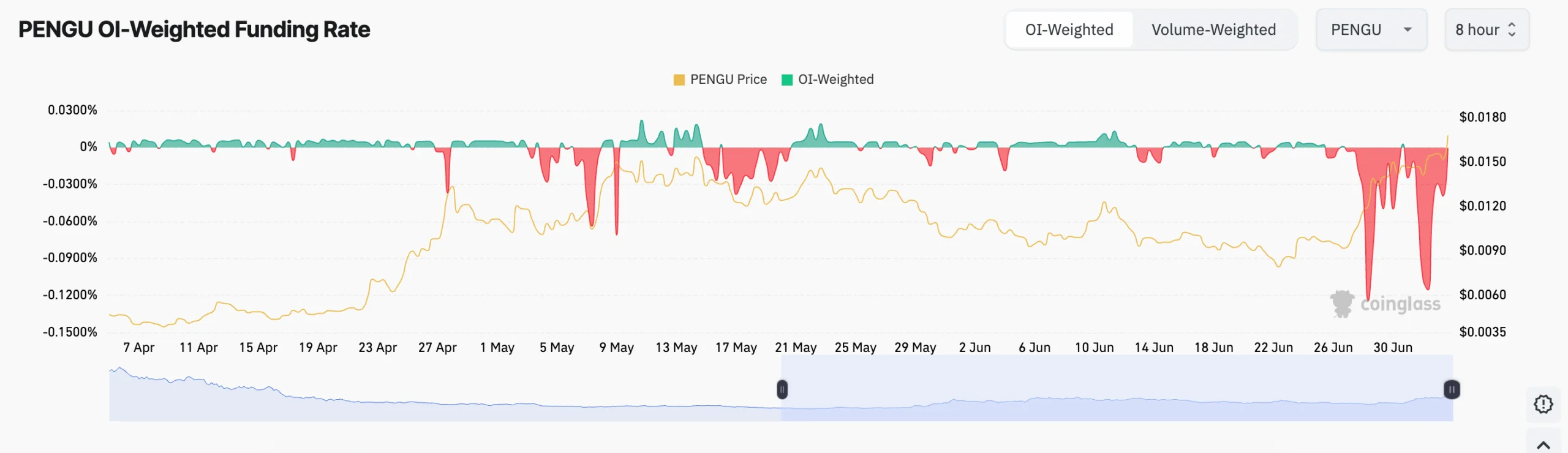

Adding to this concern, the coin’s funding rate in the derivatives market has remained consistently negative in recent days, now at -0.0005%. A negative funding rate means short positions are dominating, reflecting growing bearish sentiment among leveraged traders.

The combination of weakening buying interest and negative sentiment suggests that PENGU could face a correction in the coming days.

Price Faces Crucial Test Despite Breakout Potential

At the time of writing, PENGU is trading around $0.0160, just below strong resistance at $0.0170. If profit-taking begins, the meme coin could face downward pressure toward the $0.0137 support level. A break below that could send the price down further to $0.0128.

On the flip side, if demand strengthens and PENGU breaks through the $0.0170 resistance, it could open the door for a move up to $0.0175 — a price last seen before the downtrend began in mid-May.

In short, PENGU stands at a crossroads: either it continues its breakout or succumbs to a short-term correction. Investors should closely watch technical signals to make informed decisions.