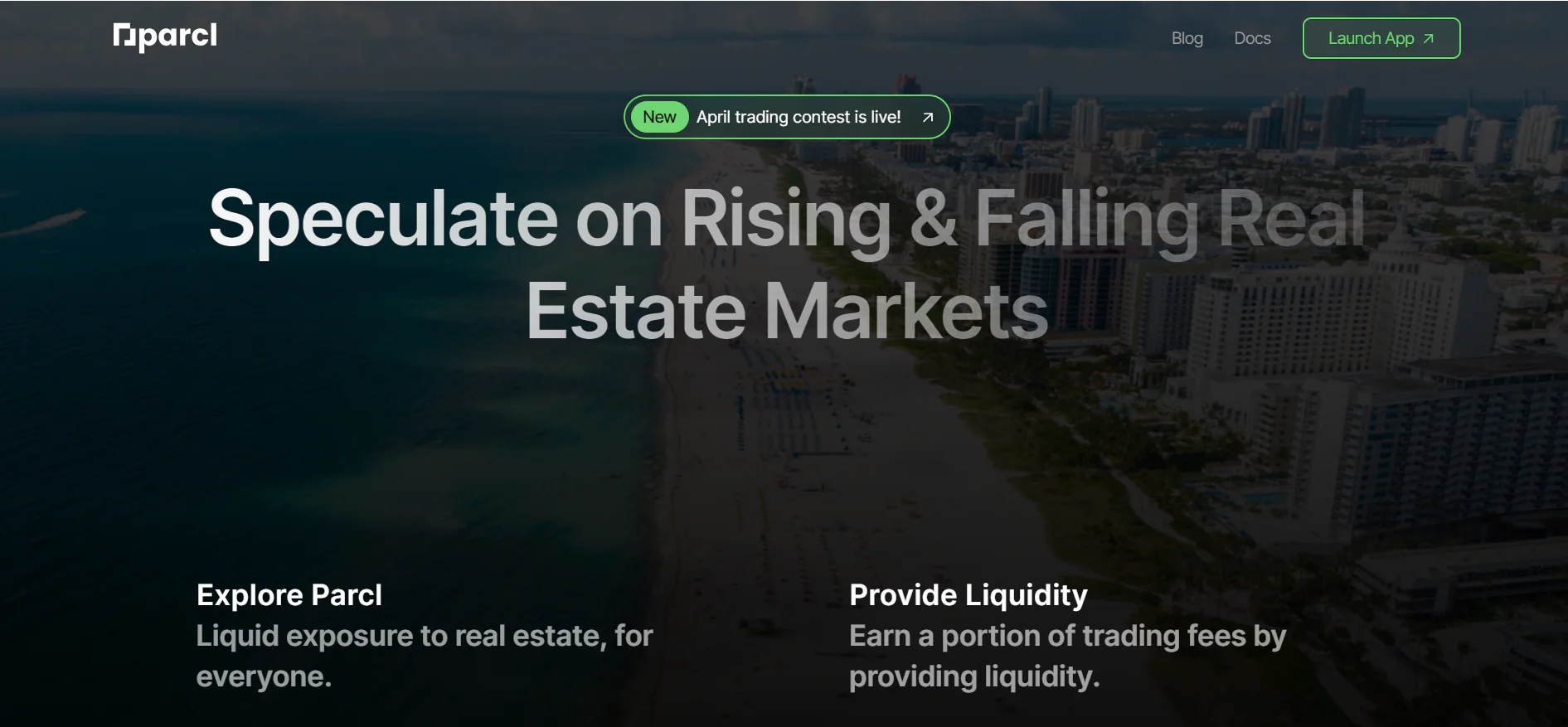

What is Parcl?

Parcl is a groundbreaking perpetual exchange platform focused on Real World Assets (RWA) built on the Solana blockchain. Parcl’s design aims to expand access to real-world assets for Web3 users through synthetic assets in the real estate sector.

This ambitious platform enables users to experience cross-margined perpetual trading across various real estate markets. Currently, Parcl has supported vibrant markets such as New York, Miami Beach, Brooklyn, San Francisco, and many others.

Beyond providing engaging trading features, Parcl invites users to act as Liquidity Providers (LPs) by providing liquidity to the protocol, opening up opportunities for attractive profits.

Related: What is Real World Assets (RWA)? Top 5 Outstanding Projects

How does Parcl work?

Parcl operates based on three main components:

- Trader: Traders profit from the price fluctuations of real estate.

- Liquidity Provider (LP): LPs provide liquidity to markets on Parcl by depositing USDC, enhancing liquidity for easier trading. LPs profit from providing liquidity.

- Price Oracle: Prices of City Indexes (representing the aggregated value of real estate in a city) traded on Parcl rely on price feeds developed by Parcl Labs. The data is then sent on-chain via the Pyth Network.

Parcl V3

Parcl has recently launched version V3 with many enhancements and superior features compared to its previous versions V1 and V2. Two prominent features in the architecture and governance model of V3 include:

- Single Liquidity Pool per Exchange Model: V3 introduces an expanded liquidity pool model to better protect Liquidity Providers (LPs) while promoting neutrality through more effective risk management.

- Traditional Margin Model: Unlike the mathematical leverage method of V2, V3 implements a cross-margin system to manage leverage more effectively.

Additionally, Parcl V3 brings many other significant improvements, including:

- Single LP Pools: Each market on Parcl will have a separate liquidity pool, making Long/Short trading on each market more efficient.

- Delta Neutral and Leverage Model: Improves risk management for LPs through a model that rewards traders for maintaining market balance and stability.

- Cross Margin System: In Parcl V3, traders can use profits from an open position to maintain the operations of other positions, optimizing capital efficiency.

- Flexible Governance: Both market and exchange settings on Parcl V3 can be adjusted to best suit the needs of both Traders and Liquidity Providers.

Highlights of Parcl

With a different approach compared to many other RWA protocols on the market, Parcl has introduced notable innovations:

- Instead of following the model of tokenizing real estate ownership, Parcl focuses on creating “city indexes” representing the value of real estate markets in different locations. This method helps Parcl achieve higher scalability, minimize initial capital requirements, and thereby offer lower transaction fees for users.

- Each city index on Parcl has only one unique liquidity pool (single LP pool). This model helps Parcl limit liquidity fragmentation issues, minimize slippage, and enhance the trading experience for users.

- Parcl also develops a cross-margin model, allowing investors to use profits from an open position to maintain the operations of other positions. This feature helps users optimize capital efficiency while minimizing cases of unexpectedly liquidated assets.

Development Team

The core founding team of Parcl includes:

- Trevor Bacon (CEO & Co-founder): Trevor has experience working at traditional investment funds such as Force Hill Capital Management LP, Millenium, and Hutchin Hill Capital. He founded Parcl in May 2021.

- Jason Lewris (CDO & Co-founder): Jason has 3 years of experience in data for Microsoft, as well as working for companies like Deloitte and Capital One.

- Kellan Grenier (COO & Co-founder): Kellan graduated with a Bachelor of Business Administration from Northeastern University. Prior to that, he worked as an Analyst at Gfk and Force Hill Capital Management LP, and held the position of Vice President at Nomura for 9 months.

Overall, the development team of Parcl consists of individuals with many years of experience and established reputations before joining Parcl.

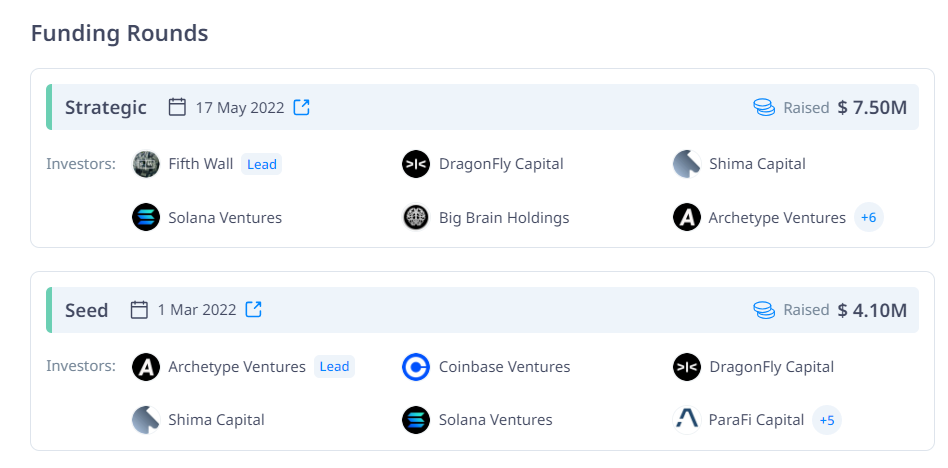

Investors

Parcl has gained trust from potential investors by successfully raising a total of $11.6 million from reputable investment funds in the crypto community.

In the Seed funding round in March 2022, Parcl raised $4.1 million led by Archetype Ventures, with participation from Coinbase Ventures, DragonFly Capital, Solana Ventures, and other investors. In May 2022, Parcl raised an additional $7.5 million in a strategic funding round led by Fifth Wall, with participation from Shima Capital, Big Brian Holdings, and other investors.

What is PRCL Token?

After understanding what Parcl is, let’s explore the project’s token – PRCL:

Basic Information about PRCL Token

- Token Name: Parcl

- Ticker: PRCL

- Blockchain: Solana

- Token Standard: SPL-20

- Contract: 4LLbsb5ReP3yEtYzmXewyGjcir5uXtKFURtaEUVC2AHs

- Token type: Utility & Governance

- Total Supply: 1,000,000,000 PRCL

- Circulating Supply: 120,000,000 PRCL

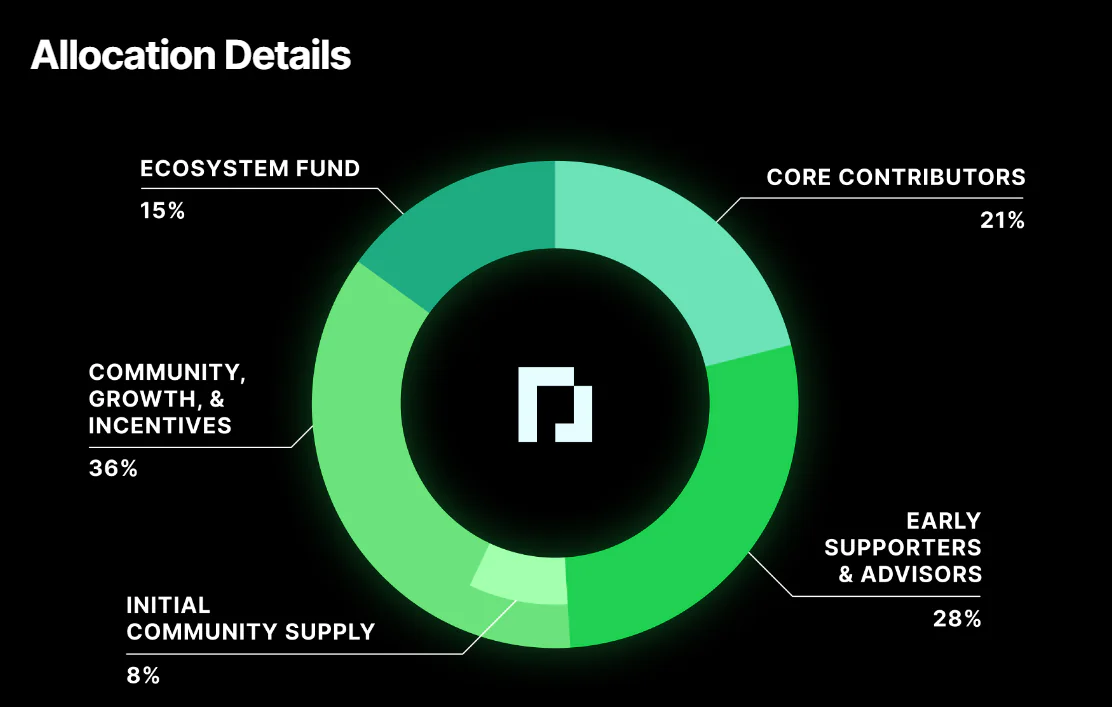

PRCL Token Allocation

- Community, Growth & Incentives: 36%

- Early supporters & advisors: 28%

- Core contributors: 21%

- Ecosystem Fund: 15%

- Initial Community Supply: 8%

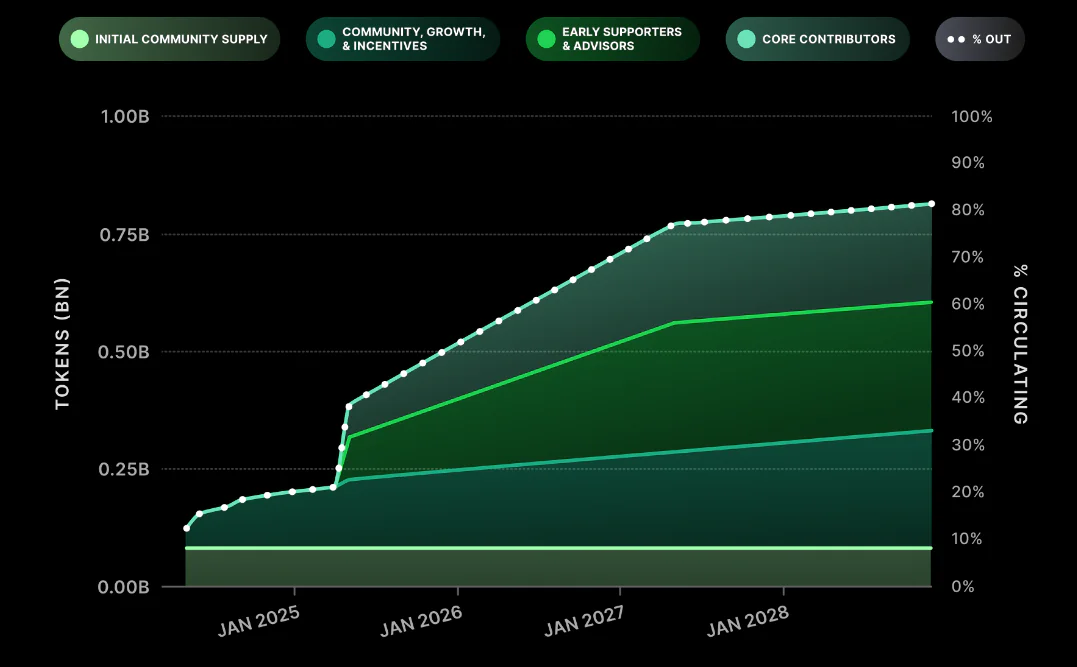

PRCL Token Release Schedule

PRCL Token Use Cases

Holders of PRCL can:

- Access valuable data sources through APIs provided by Parcl Labs, allowing unique and in-depth data mining about the real estate market.

- Enjoy special benefits from the protocol through a point-based system based on the amount of PRCL tokens held, opening up many attractive exclusive opportunities.

- Participate in voting for proposed changes to the project, thereby directing the development and progress of Parcl according to the community’s desires.

Buying and Selling PRCL Token

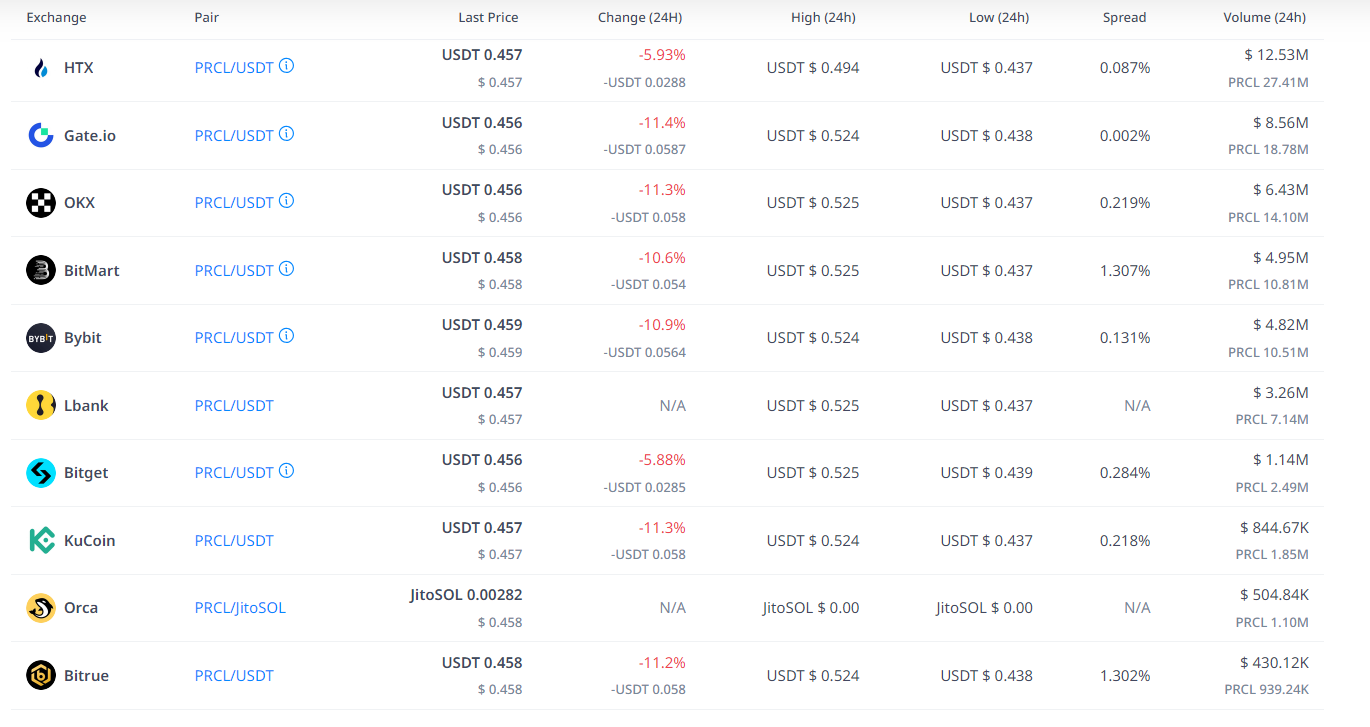

At the time of this publication, PRCL Token has been listed on exchanges such as OKX, HTX, Gate, etc.

Development Roadmap

After updating to version V3 and being listed on the OKX exchange, Parcl currently has no significant updates and is focusing on improving and upgrading its system.

Projects Similar to Parcl

Similar projects to Parcl that you might be interested in include:

- Ondo Finance: A real-world asset protocol offering financial products and services managed by reputable organizations.

- MakerDAO: A protocol for lending and borrowing backed by real-world assets, supporting users to use real-world assets to borrow the stablecoin DAI.

Project Information

- Website : https://www.parcl.co/

- Twitter : https://twitter.com/parcl

- Discord: https://discord.gg/parcl

Conclusion

Parcl, a pioneering project in the Long/Short real estate product sector on Solana, holds significant advantages. However, this also entails facing considerable risks as this sector is still relatively new and unexplored.

Have you understood the Parcl project through the article “What is Parcl? Information about PRCL Token“? If not, feel free to leave a comment below for us to address any of your questions!

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE

Research good

Inform me your newest Information, pls!