The recent surge in the cryptocurrency market brought about a bullish trend, resulting in gains for various digital assets, and Ethereum [ETH] was no exception. Despite this sudden upturn fostering optimism among investors for a sustained bull rally, a dissenting opinion emerged.

Ethereum’s fortunes took a positive turn

After a week-long downtrend, Ethereum investors finally witnessed a resurgence in profitability as the token’s daily chart displayed a vibrant green.

As per the latest data from CoinMarketCap, ETH recorded a gain of over 5% in the past 24 hours. At the time of this report, Ethereum was trading at $2,318.33, boasting a market capitalization exceeding $278 billion.

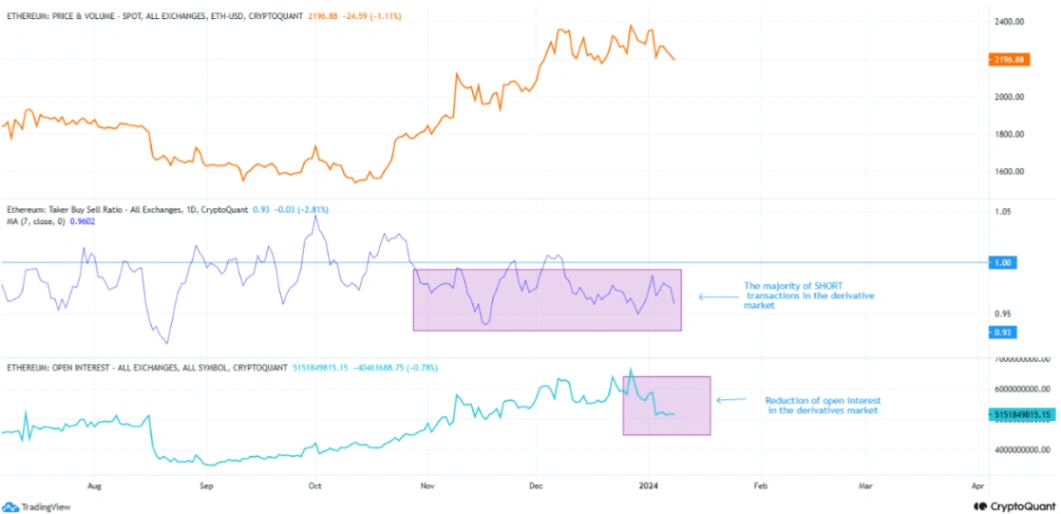

However, CryptoQuant’s recent analysis introduced a note of caution, suggesting a likelihood of Ethereum’s price remaining within a constrained range. CryptoOnChain, an analyst and contributor at CryptoQuant, highlighted in the analysis the presence of a notable number of short transactions in the derivative market, signaling a bearish sentiment.

The analysis also noted that the initiation of a bullish rally for ETH seemed improbable until Bitcoin [BTC] surpassed a crucial resistance level of $43,500. Interestingly, Bitcoin has already surpassed this resistance level, currently trading at $46,770.41 at the time of writing.

Consequently, AZC News decided to delve deeper into Ethereum’s metrics to assess the potential for the leading altcoin to reach the $2,500 mark in the near future.

Ethereum’s fundamental indicators signal optimism

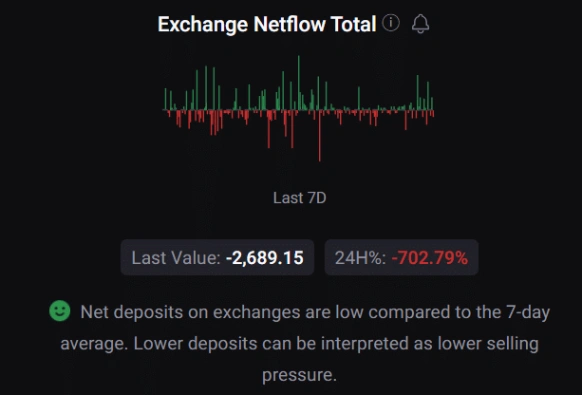

Upon scrutinizing CryptoQuant’s data, AZC News found encouraging signs in Ethereum’s metrics, pointing towards a bullish scenario. Notably, the token exhibited a strong buying pressure, evident in its low net deposit on exchanges compared to the preceding seven-day average.

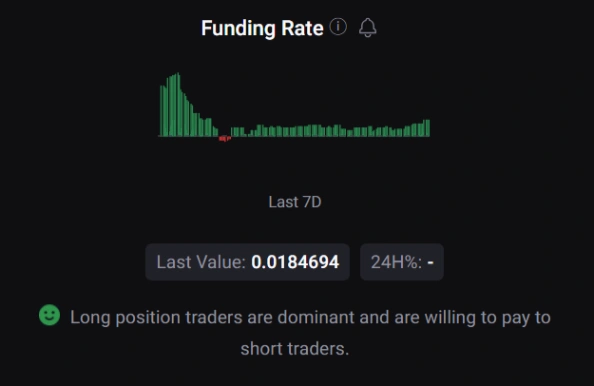

Adding to the positive outlook were the increasing active addresses, indicating growing engagement with the network. Moreover, the Coinbase premium, reflecting buying sentiment among US investors, was in the green. The derivatives market also contributed to the positive narrative, with Ethereum’s funding rate remaining in positive territory, suggesting active buying of ETH at higher price levels.

Related: Ethereum Scaling Solution Thrives in 2024

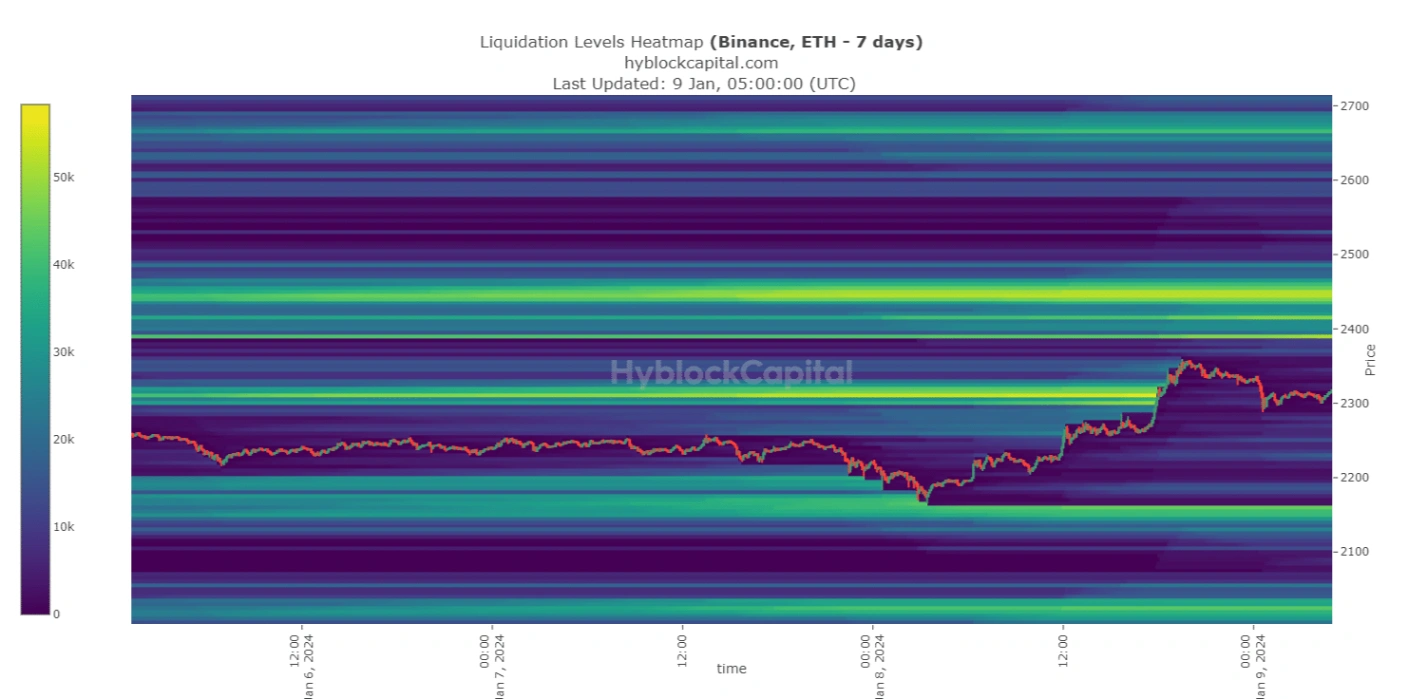

However, if Ethereum is to sustain its bullish momentum, potential resistance lies ahead in various zones. An examination of Ethereum’s liquidation levels emphasized the need for the coin to surpass the $2,400 mark and subsequently the $2,450 mark in the near future to maintain its bullish trajectory.

Despite these challenges, the likelihood of Ethereum reaching and surpassing these levels remains plausible, supported by overall bullish market indicators. The Money Flow Index (MFI) displayed an upward trend, and the Chaikin Money Flow (CMF) followed suit, reinforcing the prospects of a sustained uptrend in Ethereum’s value.