Amid a quieter phase for non-fungible token (NFT) marketplaces compared to the bustling activity of 2021, the landscape remains far from dormant. NFT enthusiasts have shifted their strategy towards prolonged asset holding, emphasizing a growing sense of community.

A recent NFT18 report highlights a nearly fourfold increase in the duration between NFT purchase and resale since 2021, now averaging just under 100 days. Despite this, OpenSea continues to boast a robust user base, with 192,500 active wallets, indicating sustained engagement.

The Rising Popularity of the Art Segment

The rising popularity of the art segment is noteworthy. Competing with OpenSea, Blur’s reported $213 million volume, though potentially influenced by incentives, adds complexity to assessing genuine trading activity. OpenSea secured the second-largest volume at $84.8 million in October, with a 4% increase in active projects compared to September.

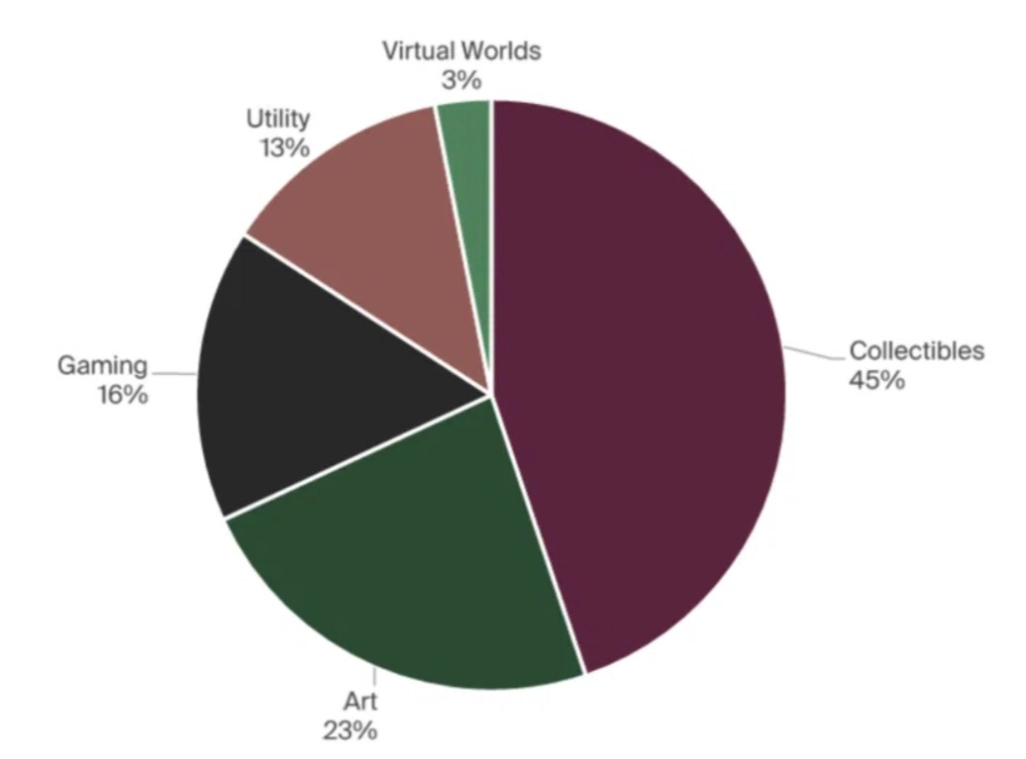

In terms of categories, collectibles like Azuki, Doodles, and Bored Ape Yacht Club collections remain dominant, representing 45% of active wallets. Surprisingly, art emerges as the second-most active category with 23,000 wallets, while gaming, utility, and virtual worlds account for the remaining 122,874 transacting addresses.

Despite art’s share comprising only 7% of the total volume traded in October, the segment is on an upward trajectory. Initiatives like fractionalizing art for shared ownership by platforms like 10101.art contribute to this growth, with some owners adopting a collector’s mindset, prioritizing ownership over speculation.

The Evolution of NFT Marketplaces: Embracing Community-Centric Models

Carlos Diaz, the head of UNCUT, emphasizing the future trajectory of NFT marketplaces and the crucial role of community integration. According to Diaz, upcoming NFT platforms should prioritize social features from the foundation, placing a greater emphasis on cultivating a collector community while minimizing speculative elements. UNCUT, a creator-centric NFT platform, embodies this philosophy with its core focus on social interaction.

Diaz critiqued OpenSea for its initial emphasis on revenue generation without a concurrent commitment to enhancing user experience. He highlighted the current industry shift towards prioritizing elements such as the social graph, social wallets, and social marketplaces. This shift reflects a departure from the hype-driven era, signaling a collective realization within the industry.

Related: Solana’s Expected Trading Range Between $50 and $60 in December

NFTs, Diaz asserted, serve as potent identity markers, showcasing the community to which a holder aspires. The social validation and compensation received by NFT creators from community members contribute to the formation of robust communities centered around shared interests, steering away from the pursuit of quick profits.

Diaz concluded by underlining the profound connection between NFT ownership and social bonds, stating that the unique assets linking individuals with a community become more than mere commodities. This shift in perspective fosters a reluctance to sell these assets, as doing so would mean severing the valuable social connections they represent.