Ethereum (ETH) Price Has Potential to Reach $2,500 in November

Over the past week, Ethereum’s price has shown consolidation in the range of $1,750 to $1,850. Insights from on-chain analysis provide valuable indicators that suggest the possibility of large investors driving ETH towards $2,500 in November.

Ethereum experienced a dip in comparison to Bitcoin (BTC) as the cryptocurrency market witnessed a rally last week. However, on-chain analysis reveals a potential resurgence in ETH’s price due to increased demand from institutional investors in November 2023.

Ethereum’s recent performance pales in comparison to Bitcoin’s surge to a new 2023 peak of $35,300 during the previous week, with BTC showing a 30% gain since September 30, while ETH managed a more modest 8% increase.

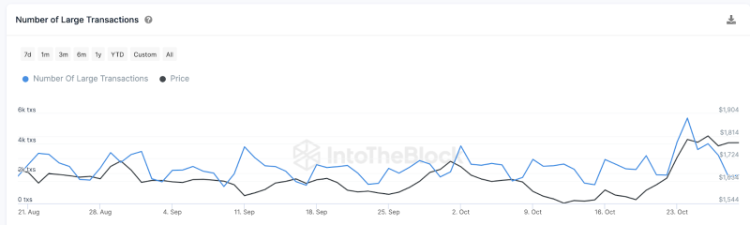

Nonetheless, on-chain data trends indicate a shift in favor of Ethereum in November, driven by the confidence of large institutional investors. According to data from IntoTheBlock, Ethereum recorded a substantial 5,700 Large Transactions on October 24, with the Large Transaction Count consistently remaining above 1,500 in the subsequent days.

In cryptocurrency terms, “Whale Transactions” refer to daily transactions exceeding $100,000 in nominal value. The increasing number of ETH Large transactions is a strong bullish signal, indicating the active participation of deep-pocketed corporate investors within the Ethereum market.

This trend aligns with the rally that began in mid-October, and if these whales continue to provide liquidity, ETH could be one of the significant gainers in the upcoming upswing.

>>> Price Forecasts: Ethereum’s Positive Outlook and Bullish XRP Expectations

Ethereum’s Coinbase Premium Index, another crucial on-chain indicator, underscores the bullish sentiment among Ethereum whales. This index has remained positive since October 14, demonstrating intense buying pressure among whale investors trading on Coinbase Pro.

This is significant because while Binance spot trading is predominantly driven by retail traders, Coinbase Pro attracts U.S.-based corporate entities and high-net-worth investors seeking a more regulated trading environment.

Historical data indicates that the last two instances of Ethereum’s Coinbase Premium Index trending positively for up to 20 consecutive days occurred in March and May 2023, coinciding with ETH’s price surpassing the $2,000 mark. Currently, as of October 30, this positive trend has lasted for 16 days. If whales maintain their dominance for another week, it could pave the way for Ethereum’s price to approach $2,500 in November.

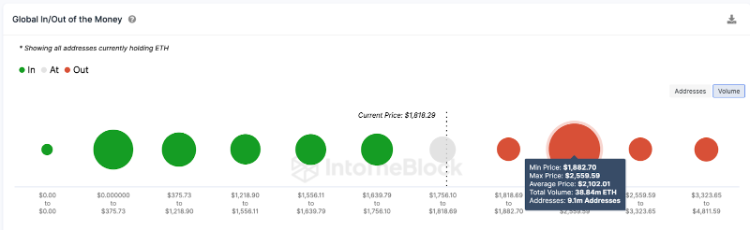

From an on-chain perspective, sustained demand among whales is a driving force that could push ETH towards $2,500 in the coming weeks. The Global In/Out of the Money Around Price (GIOM) data, which categorizes ETH holders based on their entry prices, supports this bullish scenario.

It identifies the $2,100 price point as the primary hurdle for Ethereum’s journey to $2,500. A significant number of addresses have purchased ETH at an average price of $2,102, which closely aligns with the current yearly peak. Overcoming this resistance will require intensified buying pressure from bullish whales.

On the downside, bears may aim for a retest of the $1,500 territory, but the initial support at $1,680 could present a formidable challenge in this regard. Given the current positive market momentum, holders who bought at an average price of $1,687 may be inclined to hold their positions. However, failing to defend this support level could potentially lead to a reversal towards $1,500.