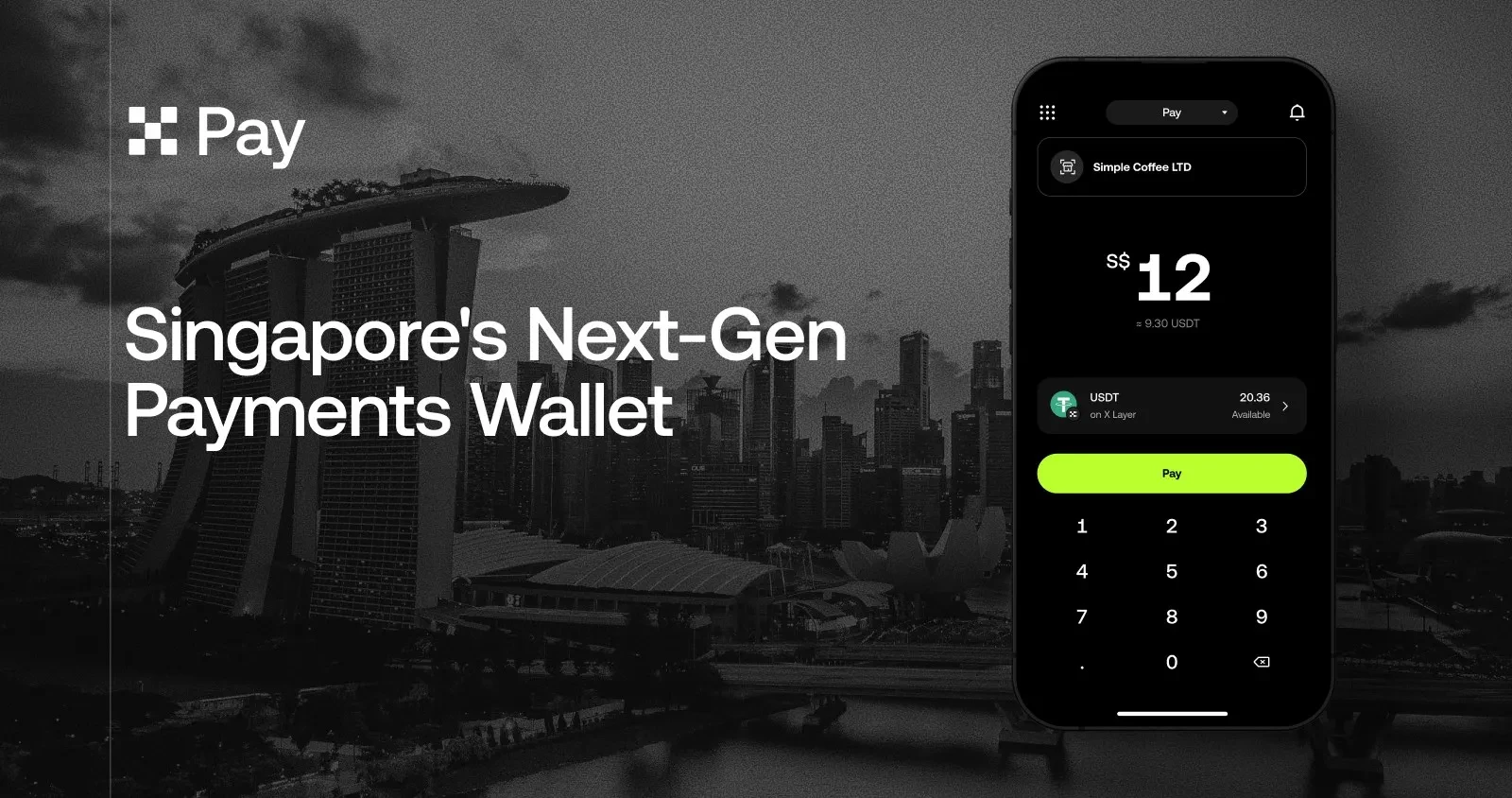

According to a September 30 announcement, the new feature, called OKX Pay, is the first service in Singapore enabling customers to scan a GrabPay SGQR code via the OKX SG app to complete payments. The amount is instantly deducted from the customer’s stablecoin wallet, while merchants receive payments in Singapore dollars (SGD).

The service is powered by a collaboration with StraitsX and Grab. Payments made in USDT or USDC are converted into XSGD — a Singapore dollar-backed stablecoin issued by StraitsX and fully collateralized by reserves at DBS Bank and Standard Chartered. This mechanism allows merchants to accept stablecoin payments without any additional integration hurdles.

With GrabPay’s extensive network of cafés, restaurants, retail stores, and hawker stalls, users can now use stablecoins for a wide range of daily purchases.

The move also strengthens Singapore’s position as a hub for regulated digital payments and stablecoins. With a Major Payment Institution (MPI) license from the Monetary Authority of Singapore (MAS), OKX can operate within the nation’s strict digital payments framework. Meanwhile, StraitsX’s XSGD is aligned with MAS’s Project Orchid initiative, ensuring transparency and compliance.

Industry analysts view this as a key step in bringing stablecoins out of trading platforms and into real-world applications. By enabling seamless scan-to-pay transactions for consumers and instant SGD settlements for merchants, OKX Pay bridges digital assets with traditional finance.

Through the partnership between OKX, Grab, and StraitsX, Singapore could emerge as a model for integrating cryptocurrencies into regulated financial ecosystems, marking a significant milestone for mainstream adoption of stablecoins.