Green Minerals AS, a Norwegian deep-sea mining company, has announced plans to raise $1.2 billion to establish a Bitcoin treasury and hold the cryptocurrency long-term. This bold move is at the core of a broader blockchain strategy aimed at diversifying its investments away from fiat currencies and supporting upcoming company projects.

“Bitcoin is an attractive alternative to traditional fiat; holding BTC will help us mitigate currency devaluation risks,”

— Ståle Rodahl, Chairman of the Board at Green Minerals

According to Rodahl, with substantial capital expenditures planned for mining equipment, adding Bitcoin to the company’s balance sheet offers a strong hedge against fiat currency debasement.

First Bitcoin Purchase Coming in Days

Green Minerals and its financial partners plan to issue convertible bonds maturing in 360 days, which can later be exchanged for company shares at a price of $20 per share. The proceeds — up to $1.2 billion — will be gradually deployed to build up the firm’s Bitcoin reserves.

At the current price of approximately $106,500 per BTC, Green Minerals could acquire around 11,255 Bitcoins if the full amount is invested. The company also plans to introduce a new key performance indicator (KPI) to reflect the Bitcoin value per share.

Blockchain Integration for Supply Chain and Efficiency

Beyond simply acquiring crypto assets, Green Minerals is also planning to implement blockchain technology across its mining operations to:

- Increase supply chain transparency,

- Certify mineral origins, and

- Improve operational efficiency.

The company says blockchain adoption will ensure it remains competitive and aligned with evolving regulatory demands.

Mixed Reaction from the Stock Market

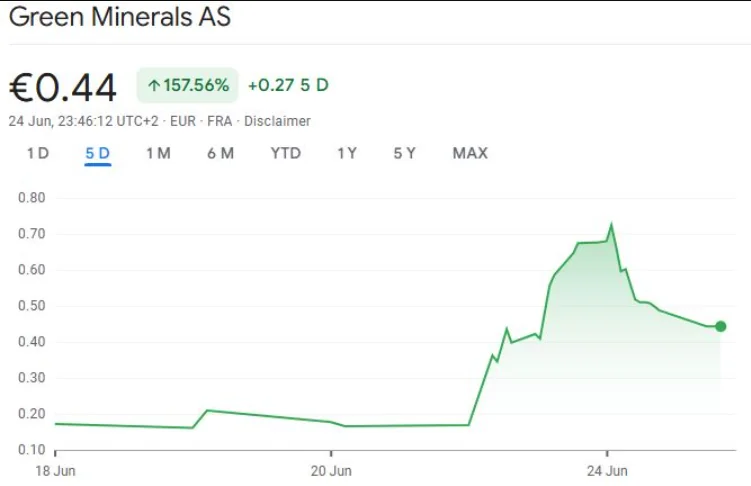

Following the announcement, Green Minerals shares surged 300% on Monday, reaching €0.68 ($0.79). However, the stock plunged over 34% on Tuesday, closing at €0.44 ($0.51), according to Google Finance.

Several companies have previously seen similar investor enthusiasm following crypto-related announcements. In May, Indonesian fintech firm DigiAsia Corp saw its stock jump 91% after revealing a $100 million Bitcoin acquisition plan.

However, not all saw positive momentum. Also in May, Norwegian crypto brokerage K33 announced its intent to buy and hold Bitcoin, but its share price remained flat, even dropping 1.96%.

While market reactions remain volatile in the short term, Green Minerals’ $1.2 billion Bitcoin play underscores the growing trend of traditional companies embracing cryptocurrency as a strategic reserve asset — particularly amid rising inflation and weakening fiat currencies.