Cardano [ADA] has witnessed a significant price downturn in the past month. While this decline might raise concerns about the Cardano network, there are factors that could contribute to ADA overcoming these challenges.

Noteworthy NFT Growth

During the previous month, Cardano’s NFTs emerged as dominant players in the market, marked by substantial transactions within various collections. Surpassing Ethereum and Solana in both sales volume and the overall value of each transaction, Cardano’s NFTs established themselves as formidable contenders in the NFT market.

The network’s supremacy in terms of transaction quantity and total sales value positions Cardano as an attractive choice for artists, creators, and collectors seeking a platform for NFT creation and trading. This success not only strengthens Cardano’s standing in the NFT market but also enhances its reputation and credibility within the broader blockchain industry.

Related: Cardano Enters Top 10 Leading Blockchains for NFT Transactions

The positive market sentiment generated by successful NFT sales has the potential to draw attention from investors and developers alike. This increased interest could lead to additional investments and the development of more decentralized applications (dApps) on the Cardano platform.

Challenges on the Horizon

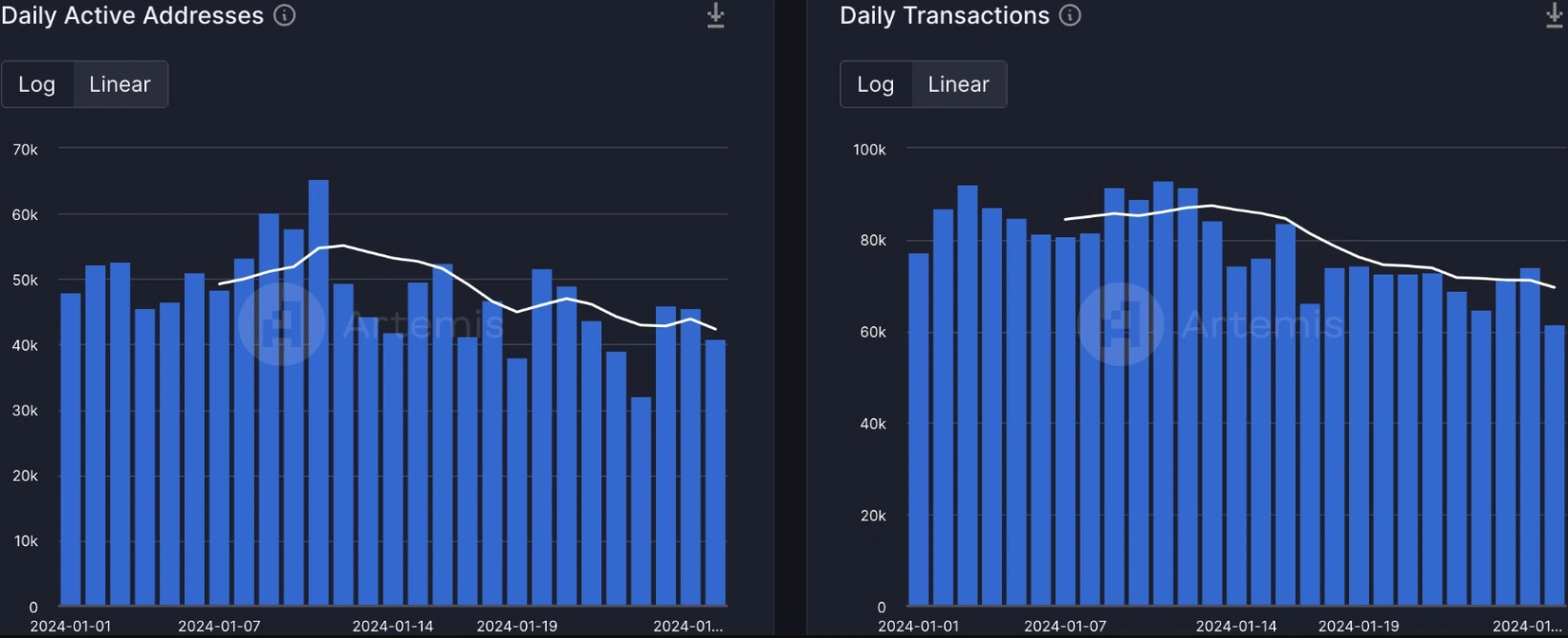

Despite the increasing trade volume of NFTs on the Cardano network, the overall protocol activity has been on a decline, paralleled by a decrease in network transactions. Consequently, the generated fees have witnessed an 11.3% decrease over the past month.

Notably, the code commits on Cardano’s GitHub repository have also experienced a decline, indicating a slowdown in development activities on the network. Turning to the ADA token’s value, it was observed trading at $0.505, reflecting a 4.26% decrease in the last 24 hours.

While ADA’s trading velocity has surged during this period, signaling an increased frequency of ADA transactions, these developments raise concerns about the network’s sustained growth and performance.