Fresh on-chain indicators are surfacing in the Bitcoin market as long-dormant coins begin returning to circulation, right when investors await the upcoming policy decision from the U.S. Federal Reserve. Although markets have largely priced in a 25-basis-point rate cut at the December meeting, on-chain data reflects a notable sense of caution.

Long-Dormant Bitcoin Supply Suddenly Reactivates

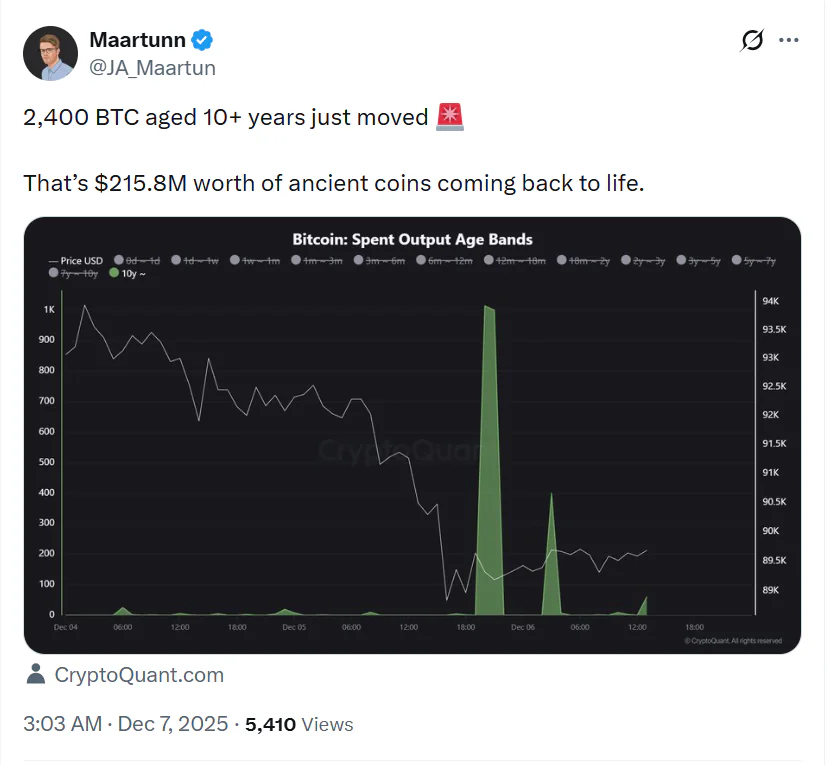

This week, more than 2,400 BTC — untouched for over a decade — moved for the first time, representing over $215 million in previously inactive supply. These older coins rarely move, and when they do, it typically signals distribution rather than accumulation.

Another signal flashing red is the Coin Days Destroyed metric, indicating that long-term holders are shifting their Bitcoin — often to sell into market strength.

While demand earlier in the year was able to absorb such supply, analysts now note that buyer momentum is weakening, even as experienced holders send coins back into circulation.

Historically, when old supply resurfaces during periods of weak demand, Bitcoin price tends to come under pressure. ETF inflows have also cooled, reflecting reduced institutional appetite compared to earlier peaks.

Institutional Outlook Remains Optimistic

Despite short-term concerns, major institutions remain confident in the broader Bitcoin cycle. Bernstein suggests the asset may have broken away from its traditional four-year halving rhythm and entered a phase of accelerated global adoption.

-

Bitcoin could reach $150,000 by 2026

-

Cycle peak could extend to $200,000 by 2027

Federal Reserve – The Key Market Catalyst

In the near term, Bitcoin’s trajectory hinges on the Fed’s decision:

-

If the Fed cuts rates as expected → liquidity could improve, supporting risk assets and revitalizing ETF demand.

-

If the cut is delayed or smaller than expected → volatility may surge, especially with long-dormant supply now being reactivated.

Analysts caution that the market will require strong buy-side absorption to offset the reintroduction of old BTC supply.