Cracking the SEC’s Code: The Future of Bitcoin ETF Approval

All eyes are currently fixated on the SEC in the cryptocurrency realm, where the highly anticipated catalyst for Bitcoin’s next phase is the approval of a spot Bitcoin ETF.

Asset managers, including giants like Fidelity and BlackRock, have been eagerly awaiting the SEC’s green light for their spot Bitcoin ETF applications for nearly a year.

BlackRock’s application in June brought this topic to the forefront, raising hopes for a successful approval and pushing the spot Bitcoin ETF into the limelight.

Notably, in August, Grayscale, a crypto asset manager, achieved a significant legal victory against the SEC when a court ruled against the SEC’s outright rejection of Grayscale’s bid to convert their largest Bitcoin trust fund, GBTC, into a spot Bitcoin ETF.

The SEC was given until midnight on October 13 to respond to the court order or reevaluate Grayscale’s application.

However, as the clock struck midnight on that pivotal October night, the SEC chose not to appeal the court’s decision. This silence has left analysts pondering whether this inaction signals a forthcoming ETF approval or reflects a predetermined inclination to dismiss Grayscale’s application with minimal scrutiny.

The SEC’s position on spot BTC ETF approval centers on concerns about risks associated with such products, despite having approved futures ETFs based on underlying spot prices. This stance raises questions about the consistency and reasoning behind their decisions.

While it’s challenging to pinpoint the SEC’s primary rationale for delaying spot Bitcoin ETF approval, one possible explanation is their quest for more comprehensive Bitcoin custody solutions and improved market surveillance mechanisms.

The custody of actual cryptocurrencies in spot assets presents unique security challenges compared to futures contracts traded on regulated exchanges with established custody solutions.

Moreover, the decentralized nature of the cryptocurrency market complicates monitoring and curbing market manipulation and other risks, unlike traditional financial markets with centralized exchanges.

The SEC may be hesitant to approve spot Bitcoin ETFs due to concerns about these risks and their potential impact on retail and institutional investors. They may be waiting for more robust market surveillance solutions and regulatory frameworks to be in place, ensuring that investors can engage in this emerging asset class with confidence.

In response to the SEC’s concerns, spot ETF applicants like BlackRock, Fidelity, and Invesco have taken significant steps to address these issues. They have submitted updated prospectuses that detail their plans for robust market surveillance, asset safety, and compliance with accounting standards.

BlackRock recently updated its spot Bitcoin ETF application, addressing the SEC’s concerns by highlighting custody arrangements with Coinbase, Bitcoin’s volatility risks, and the complexities surrounding its valuation. They have committed to fair value assessment and Financial Accounting Standards Board (FASB) ASC 820-compliant financial reporting.

Fidelity has also filed an updated ETF application, emphasizing pricing consistency with Generally Accepted Accounting Principles (GAAP) for financial reporting and including risk disclosures.

>>> Tesla Holds Steady on Bitcoin and AI Amid Earnings Disappointment

A recent incident involving erroneous news about BlackRock’s ETF approval serves as a reminder of the high anticipation and excitement surrounding the eventual approval of a spot Bitcoin ETF. While this was a case of misinformation, it underscores the potential impact of a genuine ETF approval.

The coordinated updates to ETF applications by asset managers suggest ongoing dialogue with the SEC, indicating their readiness to meet regulatory requirements.

Some Bitcoin purists, often self-custody advocates, are concerned that the introduction of investment vehicles like spot ETFs may affect Bitcoin’s inherent decentralization. However, many believe that for Bitcoin to achieve mainstream global adoption, regulation is an inevitable step in its journey.

In related news, the approaching 2024 Bitcoin halving may bring about a different outcome than previous events, as its impact on prices could be more complex and influenced by changing demand dynamics.

Rethinking the 2024 Bitcoin Halving: A Shift in Dynamics”

The forthcoming Bitcoin halving event, scheduled for April 2024, is raising questions about whether it will follow the same script as its predecessors. While Bitcoin’s halving has traditionally been viewed as a major catalyst for bull markets, some analysts believe that the dynamics might play out differently this time around.

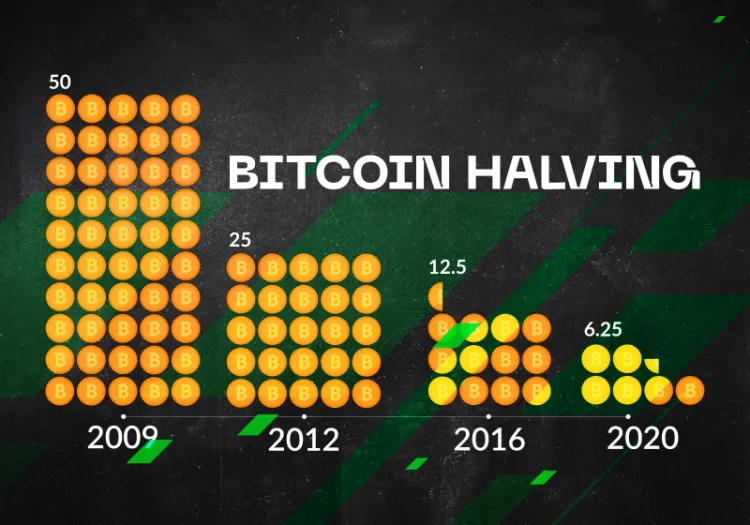

The Bitcoin halving, occurring approximately every four years, slashes the rate at which new BTC is created in half, and it is often considered a key driver of significant upward price movements in the cryptocurrency. However, there is growing skepticism about whether the halving event alone can guarantee a surge in Bitcoin’s price.

One common misconception is that the impact of the Bitcoin halving on crypto prices is frequently overestimated. While supply reduction is a vital aspect of the halving, it must be accompanied by substantial demand to drive price increases. Simply reducing the supply of new BTC does not automatically result in a surge in prices.

Furthermore, the predictability of the halving event is a significant factor to consider. The cryptocurrency community and market participants are well aware of when the next halving will occur, unlike unexpected market events that often lead to price rallies. Consequently, some argue that the market may already price in the halving’s impact before it happens, potentially mitigating its immediate effect.

Bloomberg analyst Mike McGlone points out that widely anticipated events often fail to deliver the expected outcomes. He notes that the consensus surrounding the Bitcoin halving is a cause for concern, as it may not result in the significant price surge that many anticipate.

Additionally, with each halving, the impact on the supply of new Bitcoin gradually decreases. Over time, this impact may become less relevant as changes in demand become the dominant factor influencing Bitcoin’s price. This shift in the balance between supply and demand dynamics suggests that future halvings may not produce the same price increases as those observed in the past.

Conclusion

In conclusion, while the Bitcoin halving has been a historically significant event, the landscape of the cryptocurrency market is evolving. The 2024 Bitcoin halving might play out differently due to factors such as the market’s growing understanding of the event, the need for substantial demand to drive price increases, and the diminishing impact of each successive halving on the supply of new Bitcoin.

This raises questions about the traditional bullish narrative associated with the halving and highlights the evolving dynamics in the cryptocurrency space.