Chinese Web3 technology firm Nano Labs has announced the purchase of $50 million worth of BNB, the native cryptocurrency of the BNB Chain. The transaction was conducted via an over-the-counter (OTC) deal, acquiring 74,315 BNB at an average price of $672.45 per token.

Following the acquisition, Nano Labs’ total digital asset holdings — including Bitcoin and BNB — now stand at approximately $160 million. This move marks the first step in the company’s long-term strategy to build a $1 billion BNB reserve. Previously, Nano Labs also launched a $500 million convertible note offering, with the notes convertible into Class A shares at $20 per share.

According to the press release, the company aims to eventually hold between 5% and 10% of BNB’s total circulating supply. This reflects a growing trend among institutional investors to diversify their reserves beyond just Bitcoin and Ethereum. Earlier this year, Bhutan’s Gelephu Mindfulness City also included BNB alongside BTC and ETH in its reserve portfolio. In 2025, other digital assets such as Solana, XRP, and Hyperliquid are increasingly attracting institutional interest.

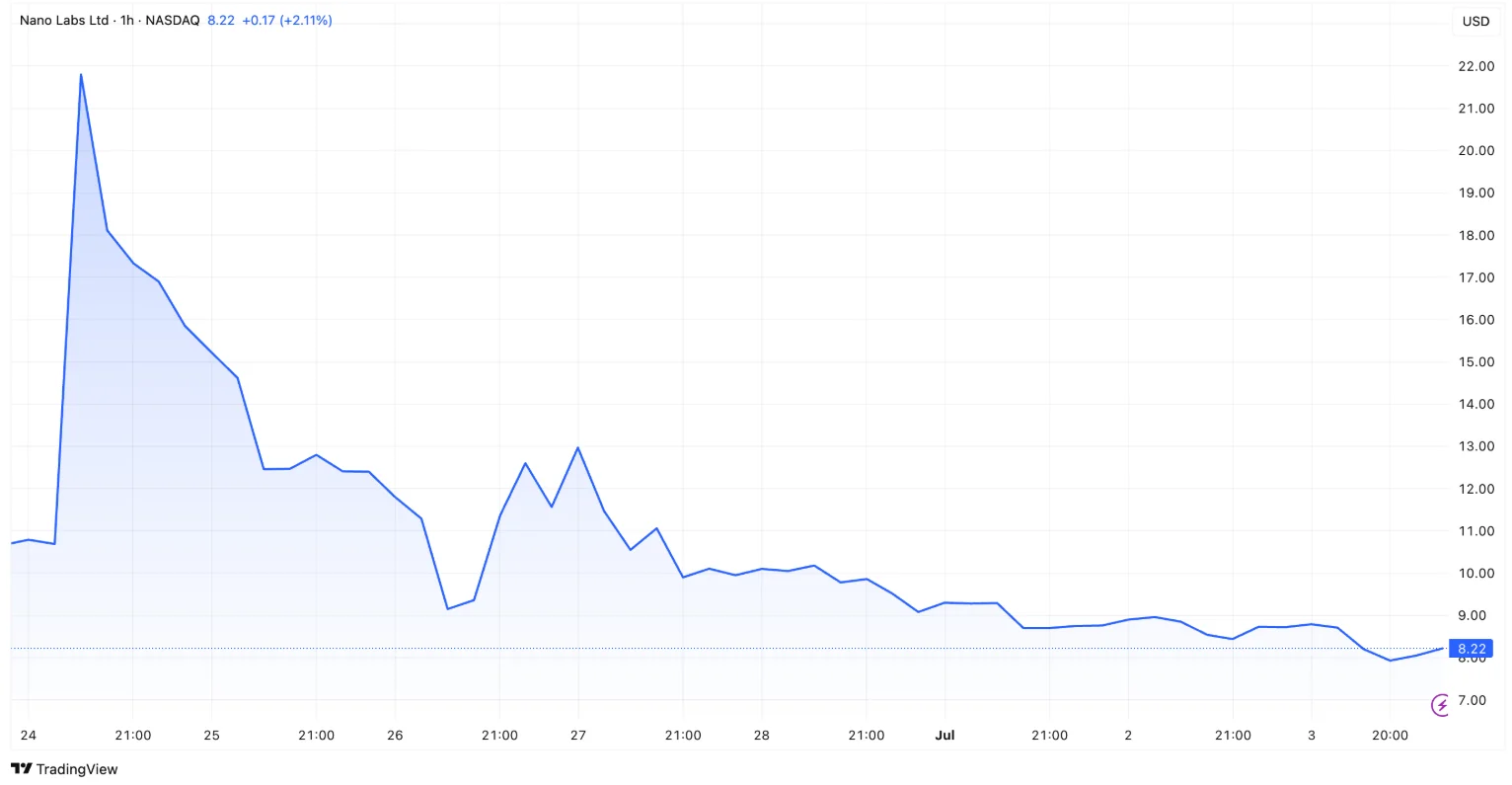

However, despite Nano Labs’ bold investment in BNB, its stock (ticker: NA) continues to decline. After a brief surge of over 100% on June 24 following positive news, NA has since erased all its gains. According to Google Finance data, the stock fell 4.7% by market close and slipped an additional 2.1% in after-hours trading.

Meanwhile, the price of BNB remains largely unaffected by the announcement.