Most investors in BlackRock and Fidelity’s spot Ethereum ETFs are facing steep losses as Ether’s price plunges below their average entry points, amid market volatility triggered by former President Trump’s trade policies.

According to blockchain analytics firm Glassnode’s May 29 report, investors in BlackRock and Fidelity’s Ethereum ETFs are currently sitting on an average unrealized loss of around 21%.

BlackRock’s spot Ether ETF has an average cost basis of $3,300, while Fidelity’s is even higher at $3,500. Meanwhile, Ether is currently trading at just $2,601, based on CoinMarketCap data.

Ether began its downward trend after February 2 — the last time it traded above $3,000 — when former U.S. President Donald Trump signed an executive order imposing import tariffs on goods from China, Canada, and Mexico. The coin hit its yearly low of $1,472 on April 9, the same day those tariffs took effect.

Glassnode noted that ETF outflows accelerated whenever Ether’s spot price dropped below the average investor cost basis, particularly in August 2024, and again in January and March 2025.

Despite this, Ether has rebounded strongly over the past month, rising 44.25% as concerns over a full-blown trade war began to ease. Since May 16, spot Ethereum ETFs have seen nine consecutive days of inflows, totaling $435.6 million.

Adding to the optimism, a U.S. federal court blocked most of Trump’s tariffs on May 28, which some analysts believe could drive further gains in the crypto market.

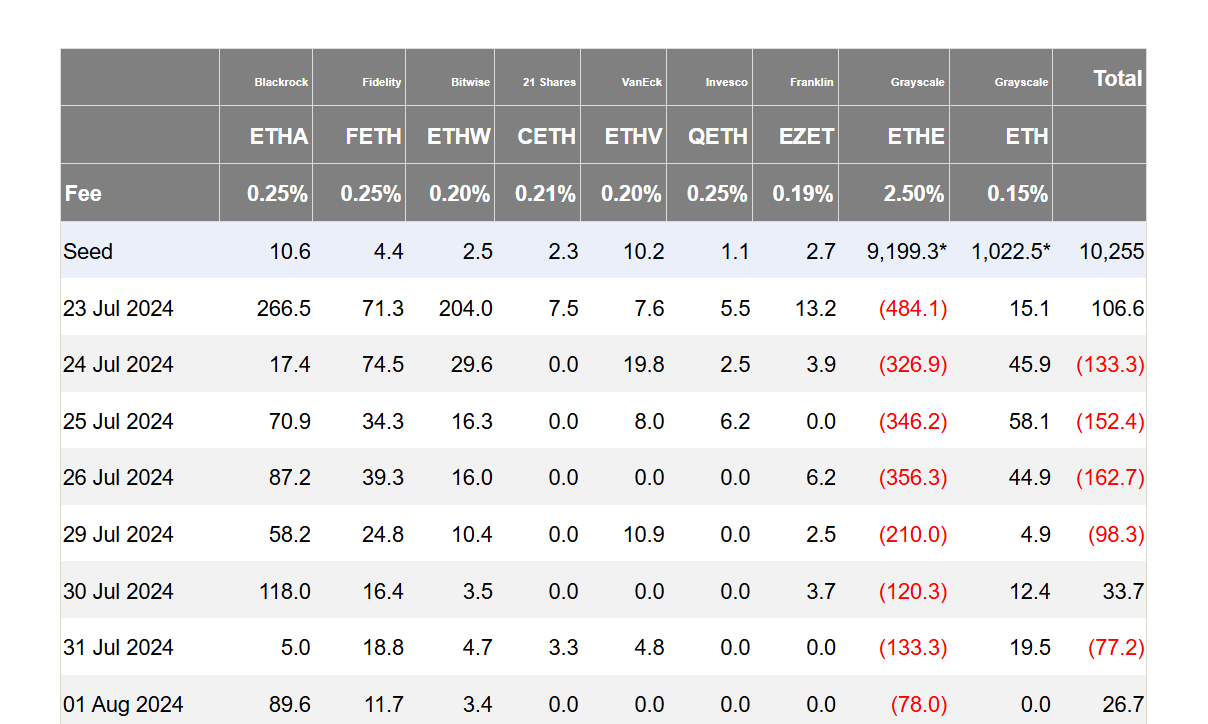

Since launching in July 2024, Ethereum spot ETFs have attracted a total of $2.94 billion in inflows. On launch day, July 23, Ether was trading around $3,536.

However, Glassnode noted that the ETFs have had only a modest impact on Ether’s spot price. At launch, ETF trading volume accounted for just around 1.5% of the total spot market — a sign of relatively lukewarm investor reception.

The funds saw a temporary surge in activity in November 2024, when their share of spot market volume climbed above 2.5%. That coincided with Trump winning the U.S. presidential election, which sparked a month-long rally in the broader crypto market, pushing Ether to a high of $4,007 on December 8. Since then, ETF activity has declined back toward 1.5%.

At the Digital Asset Summit on March 20, Robbie Mitchnick, Head of Digital Assets at BlackRock, acknowledged that spot Ethereum ETFs are still “less perfect” without integrated staking capabilities.