At its recent annual shareholder meeting, Microsoft dismissed a proposal to include Bitcoin on the company’s balance sheet. The proposal was submitted by the National Center for Public Policy Research (NCPPR), a Washington, D.C.-based think tank advocating for free-market policies. According to NCPPR, integrating Bitcoin into Microsoft’s investment portfolio would not only diversify returns but also enhance shareholder value.

During the meeting, a video was shown with the opening message: “Microsoft cannot afford to miss the next wave of technology, and Bitcoin is that wave.” However, the rejection of the proposal reflects Microsoft leadership’s stance, emphasizing that the company is exploring various investment options, including Bitcoin.

Historically, Microsoft experimented with accepting Bitcoin as a payment method in 2014 but discontinued it in 2016 due to low adoption rates and regulatory hurdles. This cautious approach aligns with the perspective of co-founder Bill Gates, who has expressed skepticism about cryptocurrencies.

Related: Donald Trump’s Son Predicts Bitcoin Will Reach $1 Million

Market Impact and Broader Trends

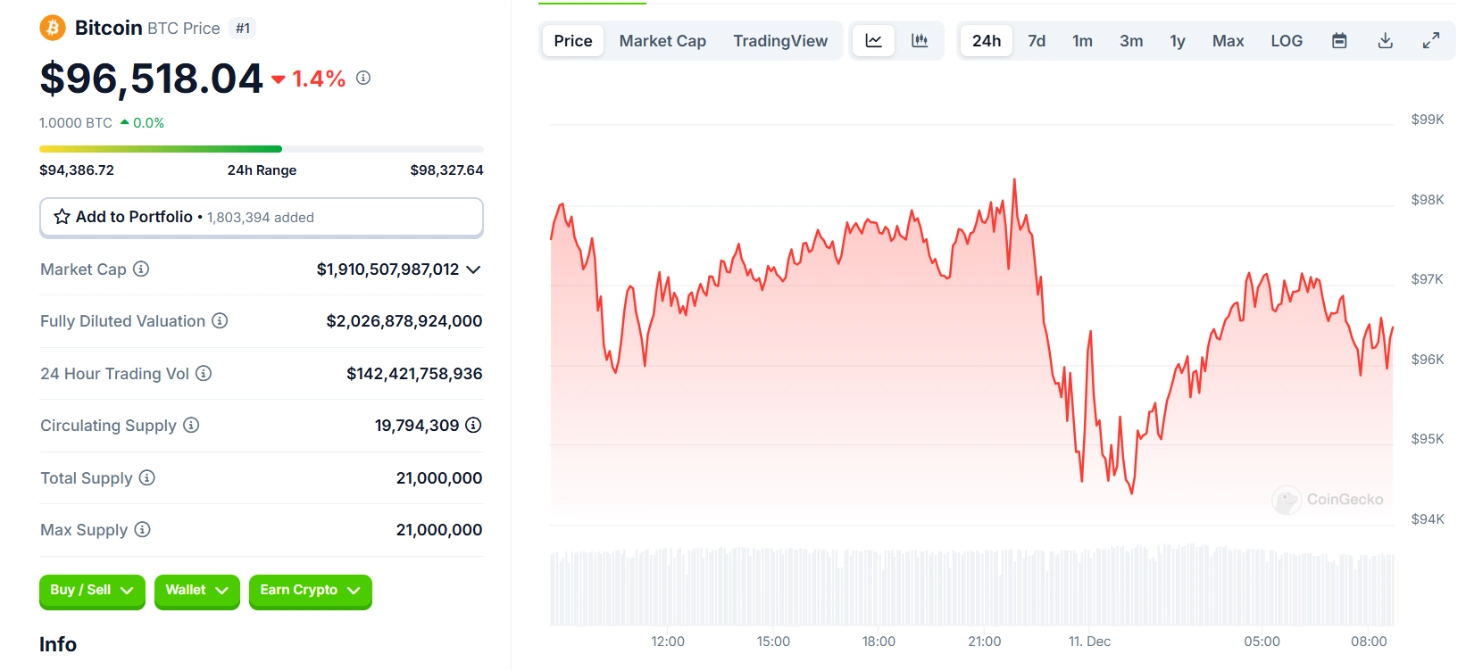

Over the past 24 hours, Bitcoin’s price has dropped by 3%, contributing to a broader downturn in the cryptocurrency market. According to data from CoinGecko, the global crypto market capitalization has declined nearly 5%, falling to $3.73 trillion.

Although Microsoft declined the proposal, discussions around the adoption of Bitcoin by major corporations are becoming increasingly common. Gordon Grant, a cryptocurrency derivatives trader, remarked:

The fact that a leading global corporation like Microsoft is even discussing the possibility of holding Bitcoin demonstrates the growing significance of the asset, regardless of the outcome.

Grant also highlighted the rising trend of Bitcoin being used as a catalyst in capital markets, citing MicroStrategy’s recent issuance of convertible bonds. He added:

Bitcoin is gradually being recognized as a tool for financial diversification, a medium for transferring value, and a gateway to global digital capital investment—just as Michael Saylor of MicroStrategy describes it.

Additionally, the emergence of new derivative products, such as options on BlackRock’s Bitcoin ETF, along with increasing liquidity across global exchanges, has further solidified Bitcoin’s role in the financial markets.