Large institutions and “whales” are continuing their aggressive Bitcoin accumulation, as Strategy signals another potential investment that could be unveiled this coming Monday.

On April 27, Michael Saylor — co-founder of Strategy — subtly hinted at a new purchase on social media, following the company’s $555 million Bitcoin buy at an average price of $84,785 per coin.

“Stay humble. Stack Sats,” Saylor wrote, sparking speculation among investors about the scale of Strategy’s next investment.

Popular blockchain analyst RunnerXBT predicted that the upcoming purchase could range between $1.4 billion and $1.6 billion — three times larger than Strategy’s previous investment.

According to Bitbo data, Strategy remains the largest corporate holder of Bitcoin globally, currently owning over 538,200 BTC valued at approximately $50.5 billion.

The firm’s Bitcoin investment strategy has also inspired other companies, including Japanese investment firm Metaplanet, which surpassed 5,000 BTC holdings on April 24 as it aims to spearhead Bitcoin adoption in Asia.

ETFs Attract $3 Billion as Whales Continue Strong Bitcoin Accumulation

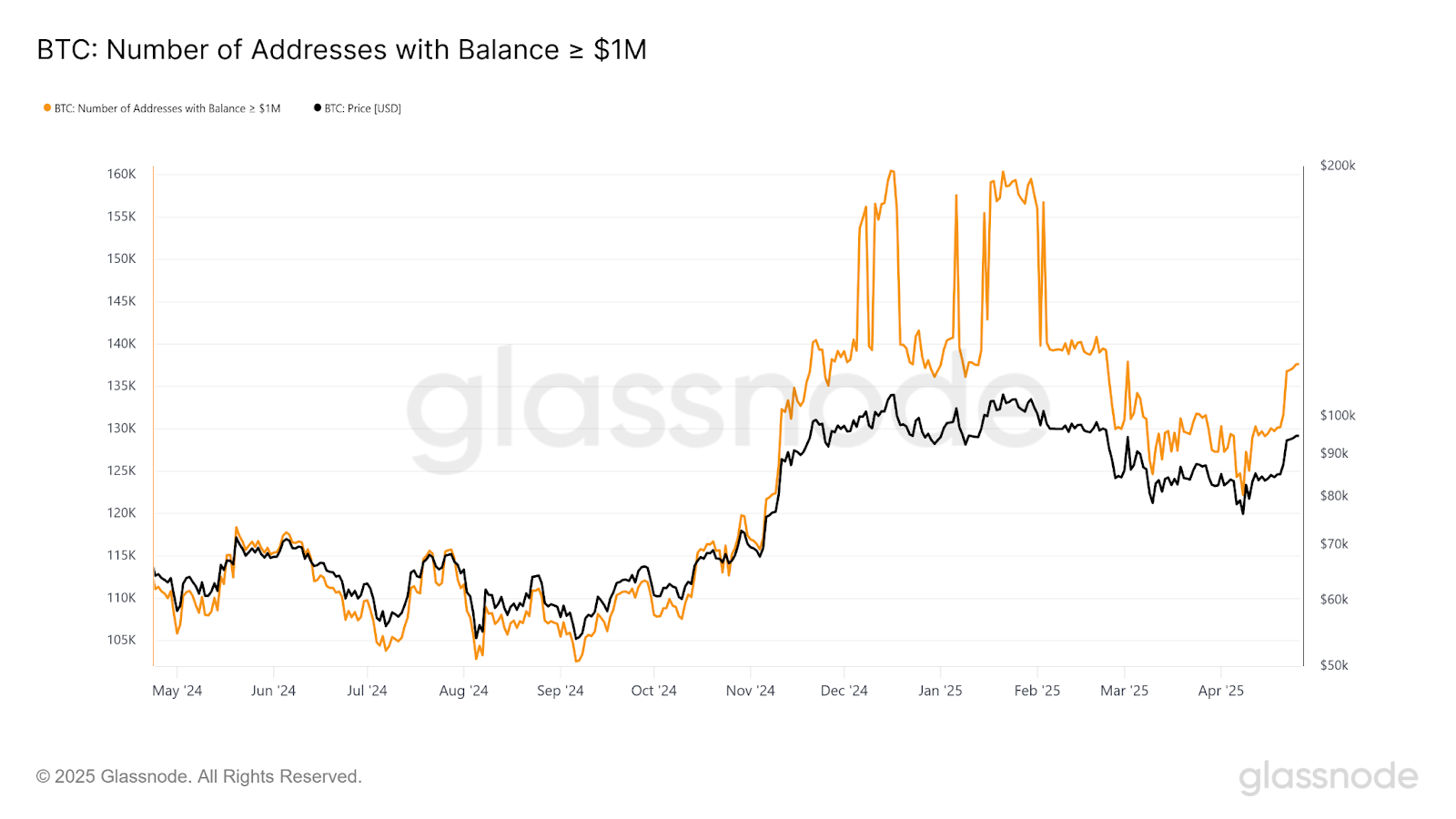

Meanwhile, large Bitcoin investors (whales) are also aggressively accumulating Bitcoin while its price remains below the psychological $100,000 threshold.

According to Glassnode data, the number of whale wallets — those holding at least $1 million worth of Bitcoin — began increasing again in early April, rising from 124,000 wallets on April 7 to over 137,600 wallets by April 26.

This strong accumulation helped Bitcoin recover above $94,000, noted Iliya Kalchev, an analyst at Nexo dispatch. He added:

“Wallets holding over 10,000 BTC have been aggressively accumulating, with a trend score of 0.90, while smaller investors are also shifting toward long-term holding strategies.”

Kalchev also commented on geopolitical developments: “Trump confirmed that discussions with China are ongoing, with Beijing offering exemptions on select U.S. imports, signaling a more conciliatory tone. However, markets are still awaiting concrete actions before reassessing global risk levels.”

Additionally, inflows into Bitcoin exchange-traded funds (ETFs) have contributed to Bitcoin’s nearly 12% recovery over the past week.

According to Farside Investors data, U.S. spot Bitcoin ETFs recorded cumulative net inflows of over $3 billion last week — marking their second-highest week of investments since launch.