According to on-chain data, the team behind the meme coin MELANIA has quietly sold off 82.18 million tokens—equivalent to 8.22% of the total supply—in just four months. These sales were distributed across 44 wallets and executed primarily by adding and removing liquidity on decentralized exchanges to avoid triggering attention from direct sell orders. At current Solana prices, the team pocketed around $35.7 million.

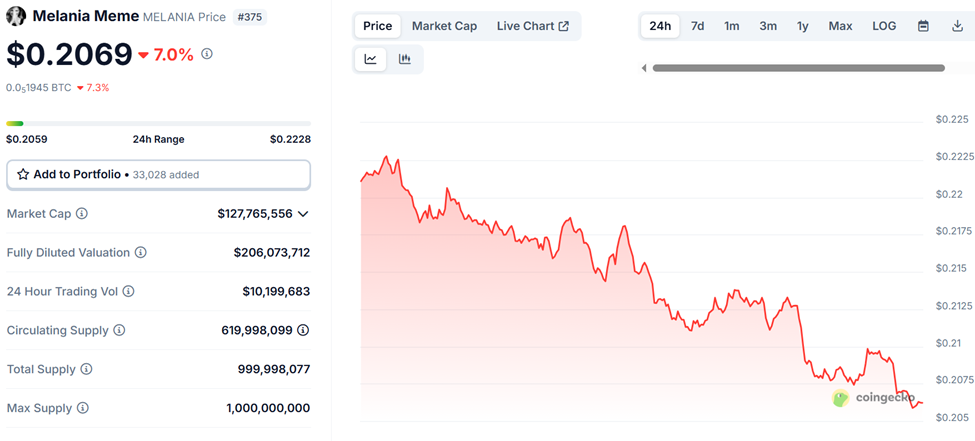

This aggressive offloading has only deepened MELANIA’s ongoing downtrend. Over the past 60 days, the token has dropped 59%, and as of now, CoinGecko lists it at $0.2069—its lowest price since launching on January 19. Despite lacking any clear product or development roadmap, the token still maintains a surprisingly high market cap of around $127 million.

What’s more, the project’s official documentation openly admits that MELANIA has “no functionality” and no plans to reinvest proceeds into product development, community growth, or innovation. In short, it is a pure meme coin play driven entirely by hype and sentiment.

In early June, MELANIA announced a seemingly promising partnership with leading market maker Wintermute to improve liquidity and reduce slippage. According to blockchain analytics platform EmberCN, 150 million tokens (worth about $50 million at the time) were moved from the community wallet to new addresses, including 20 million tokens sent directly to Wintermute.

While the deal did boost trading volume across platforms, it failed to stop the downward spiral. Each time the price showed signs of recovery, new sell-offs from the team pushed it back down, frustrating investors. One community member summed it up: “The Trump token sucked all the liquidity and dumped—now Melania’s here to finish the job.”

Despite growing skepticism, MELANIA remains one of the most prominent tokens in the PolitiFi sector. The partnership with Wintermute suggests that institutional players still see potential in meme coins—at least from a market-making perspective. But unless the project shifts direction and provides a real roadmap or utility, MELANIA’s fate will likely hinge on speculative cycles rather than long-term fundamentals.