John Patrick Mullin, founder and CEO of Mantra, has officially begun the process of unstaking 150 million OM tokens in preparation for sending them to a burn address. This move aims to reduce the circulating supply and help restore the value of the OM token.

Mantra announced on April 21 that the unstaking process was underway and expected to be completed by April 29. After that, all of Mullin’s OM tokens will be permanently removed from circulation via a burn address.

Mullin emphasized that this was “just the first step in rebuilding trust with the community — and certainly not the last.”

In parallel with the CEO’s action, Mantra is also in discussions with key ecosystem partners to burn an additional 150 million OM tokens. If successful, the total number of tokens burned will reach 300 million.

The initial 150 million burn will reduce OM’s total supply to 1.67 billion tokens. The number of staked tokens will also fall by over 26%, from 571.8 million to 421.8 million OM. As a result, staking returns (APR) are expected to increase, as the bonded ratio drops from 31.47% to 25.30%.

Token Burn Initiative Follows OM’s 90% Price Crash

This decisive action comes just two days after OM’s price plummeted by 90% on April 13. At the time, Mullin announced on X that he intended to burn all of the tokens he had received during the blockchain’s mainnet genesis in October — tokens originally set to unlock starting in 2027.

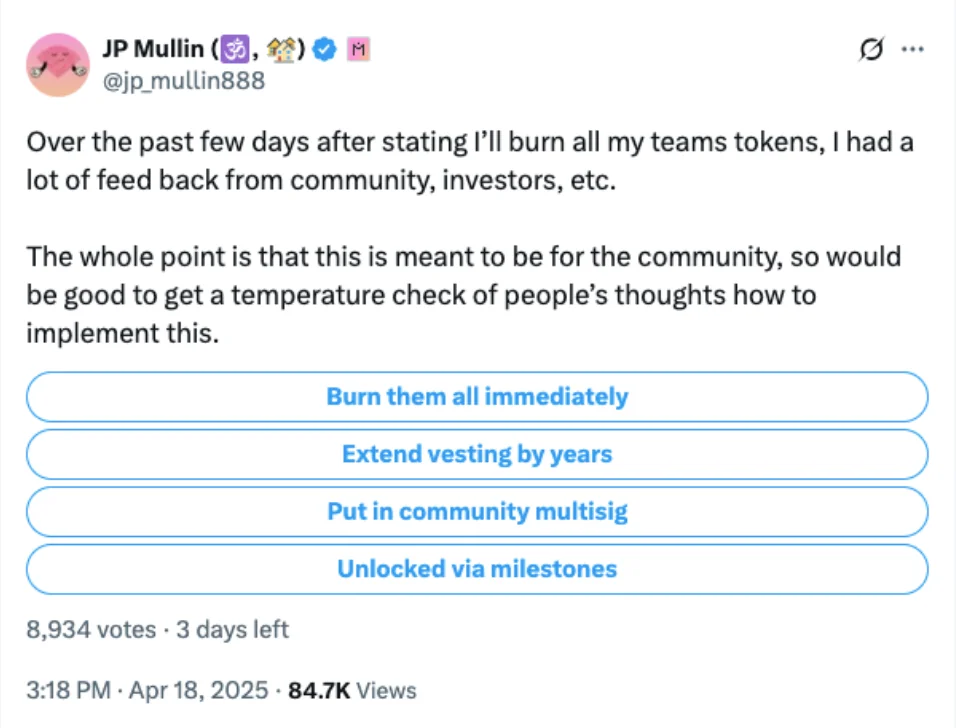

He also launched a community poll on X to gather feedback on other possible options, such as extending the vesting period or unlocking tokens based on specific milestones. The poll, which had nearly 9,000 votes at the time of writing, sparked mixed reactions, with some users criticizing it as an attempt to walk back the burn commitment.

The burn is part of a broader “OM Token Support Plan” announced by Mantra following the price crash. This plan also includes a token buyback program, which Mullin says is already “well underway.”

In addition, Mantra has released a tokenomics dashboard to improve transparency as it works to rebuild trust within the community.

As of this writing, OM is still trading at below $0.55 — down roughly 90% from its early April high of $6.30.