MakerDAO, a prominent blockchain protocol, has strategically established itself as a leading player in the real-world assets (RWA) sector, garnering substantial attention in the cryptocurrency industry recently.

Diversifying Revenue with US Treasury Bonds

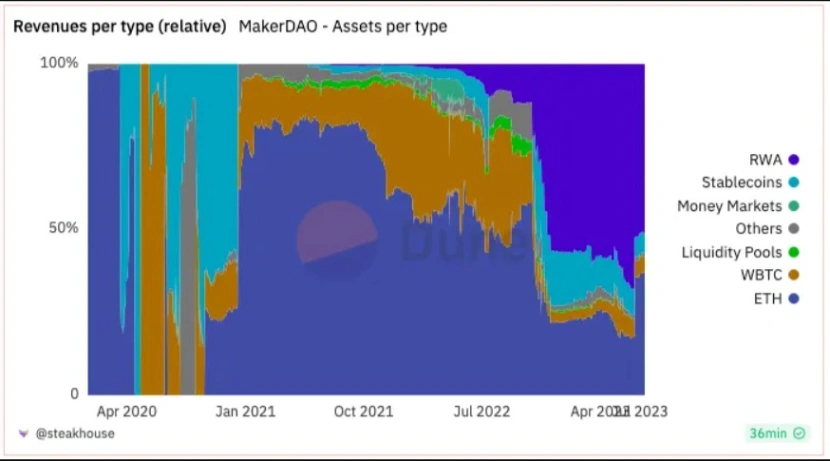

In a recent report, MakerDAO’s strategic revenue diversification takes center stage, particularly with the incorporation of US Treasury bonds into its portfolio. This calculated move has drawn positive outcomes, propelling MakerDAO to the forefront of the RWA sector.

RWA: A Significant Income Stream for Maker DAO

Recent findings highlight the impact of Maker DAO’s decision to invest in US Treasury securities in June 2023, showcasing its emergence as a powerhouse in the real-world asset realm. RWAs, representing on-chain equivalents of traditional finance assets, encompass a wide array of assets, from real estate to bonds and invoices.

“It is this strategic approach that propels MKR to the forefront, boasting impressive yearly returns among top RWA protocols. Notably, MKR dominates in average transaction volumes, hitting a daily average of $94.5 million in the second week of January.”

Enhancing Stability and Risk Profile

MakerDAO asserts that its emphasis on RWAs has not only contributed to financial stability, generating over $100 million in annualized revenue, but has also fortified the risk profile of its collateral assets. This strategic move underscores MakerDAO’s commitment to sustainable growth and resilience within the evolving crypto landscape.

In July 2023, MakerDAO asserted its prowess by raking in 80% of its fee revenue from Real-World Assets (RWA), signaling a strategic stronghold in the evolving crypto landscape.

Collateral Breakdown Reflects Regulatory Anticipation

MakerDAO, on its website, intricately categorizes its collateral RWA into Cashlike, Clean Money, Miscellaneous, and Physically Resilient sections. This meticulous breakdown indicates a proactive stance, anticipating potential regulatory crackdowns on RWA usage in the crypto space.

“Physically resilient RWA represents real-world assets resistant to easy seizure, empowering a DAO like Maker to maintain technical sovereignty over such assets.”

Despite the bear market challenges, RWA demonstrated resilience, with a staggering 450% growth in tokenized treasuries since the beginning of 2023. This growth significantly contributed to the $1.66 billion added to the sector in the previous year.

Related: Real World Assets: The Game-Changer in the Blockchain Universe?

Chainlink Report: Advocates for Blockchain Integration

In September 2023, a Chainlink report highlighted the potential for blockchain integration with assets beyond the digital ecosystem. The report envisions a transformative impact on financial systems, offering enhanced liquidity, increased transparency, and mitigating systemic risks. This aligns with the broader narrative of pushing boundaries and expanding the utility of blockchain technology in traditional finance realms.