Bitcoin has just gone through a sharp bout of volatility as long-term holders (LTHs) unloaded as much as 245,000 BTC amid ongoing global macro uncertainty. However, fresh signals from on-chain data and renewed dip-buying interest are prompting analysts to ask an important question: has Bitcoin already formed a market bottom?

Last week, Bitcoin briefly plunged below the $60,000 level, wiping out nearly $10,000 in value in a single trading session. The sudden drop shook market sentiment and forced many long-term investors to reduce exposure to risk assets. Since then, BTC has rebounded and is now trading back above $70,000, as buyers attempt to stabilize price structure after the sell-off.

On-chain data shows that LTHs cut exposure at the fastest pace since December 2024. Yet, an interesting divergence is emerging: the total supply of BTC held by long-term investors in 2026 has continued to rise. This “paradox” suggests the market may be undergoing a redistribution phase, with Bitcoin rotating from short-term hands into investors willing to accumulate at discounted prices.

Distribution Rises, but Supply Keeps “Aging”

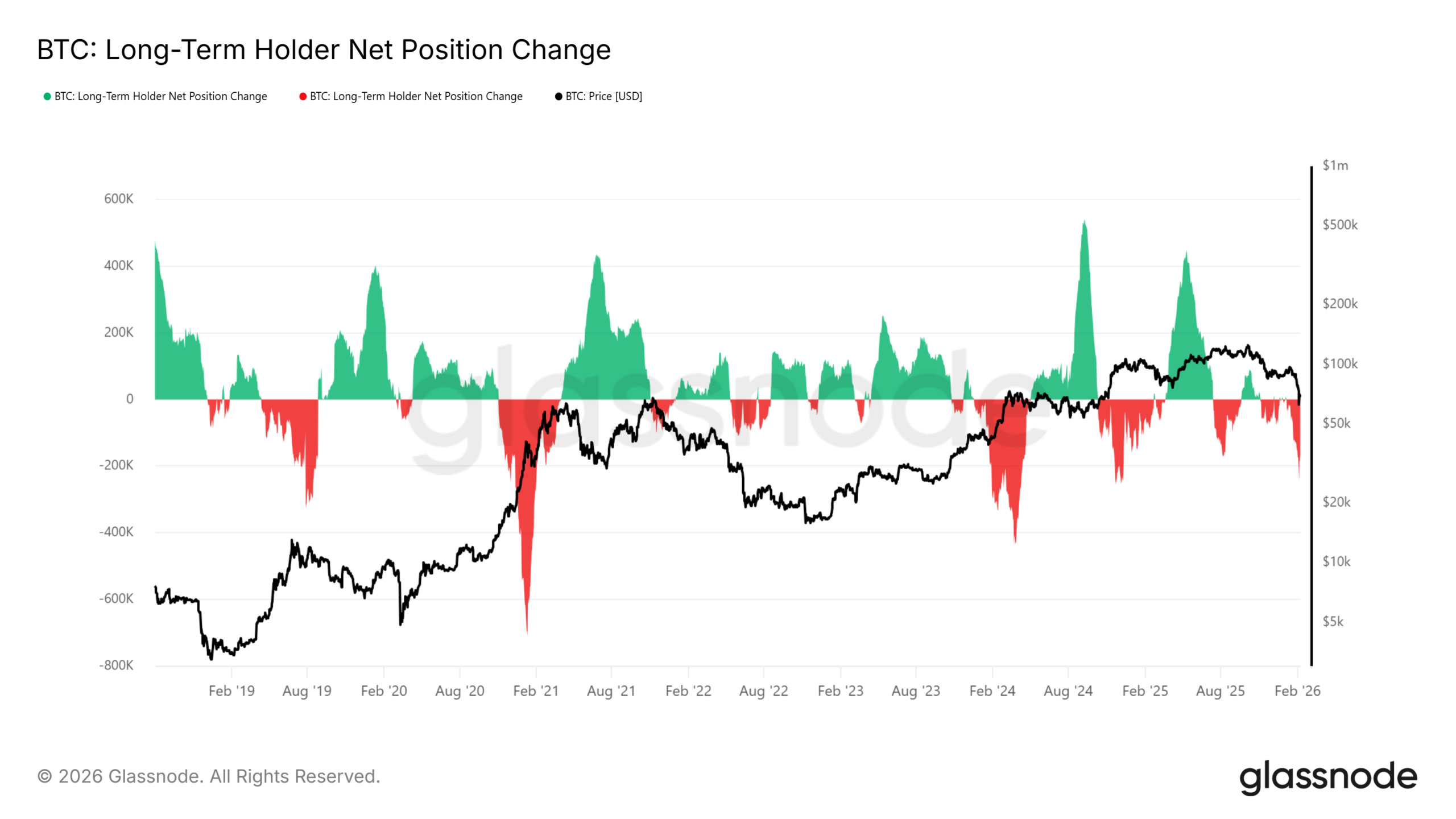

According to Glassnode, the LTH Net Position Change over the past 30 days recorded net distribution of about 245,000 BTC — a cycle extreme. Similar spikes were observed during corrective phases in 2019 and mid-2021, periods in which prices consolidated rather than entering prolonged downtrends.

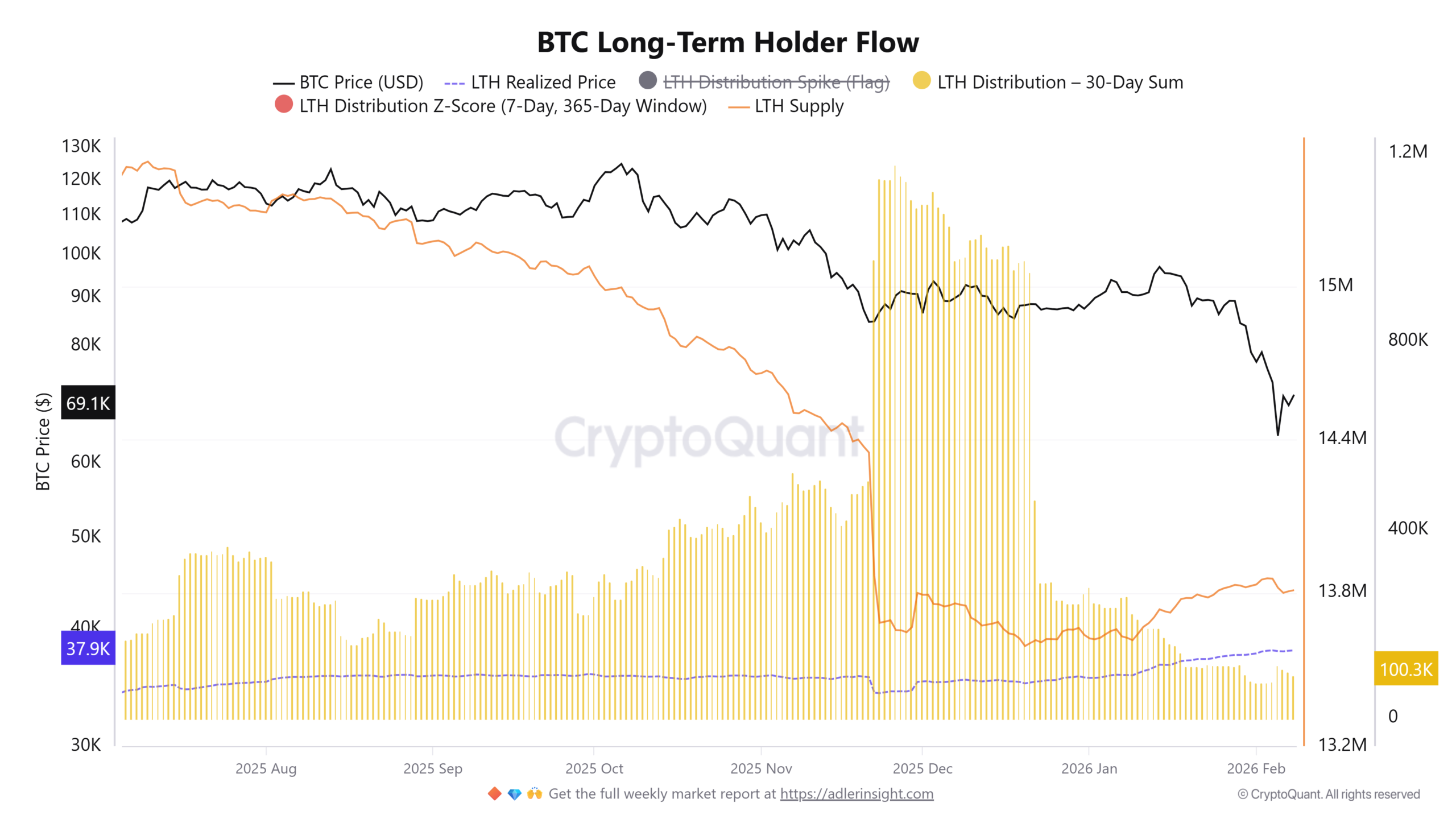

Meanwhile, data from CryptoQuant shows total LTH supply increased from 13.63 million to 13.81 million BTC in 2026, despite selling pressure. This divergence stems from the time-based nature of LTH classification. When short-term holders reduce activity during uncertain conditions, their coins “age” into long-term status. As a result, LTH supply can rise even while older cohorts are taking profits.

Another constructive signal is that the LTH spent output profit ratio (SOPR) has reclaimed levels above 1, indicating that transactions are once again being realized at a profit after a period of loss-taking. With Bitcoin trading above the realized price near $55,000, markets often enter a base-building or bottoming phase before the next trend emerges.

Macro Conditions Still Drive Near-Term Risk

Despite improving on-chain metrics, macroeconomic forces remain the dominant driver of near-term volatility. This week, the U.S. is set to release January CPI data, a key input for interest rate expectations.

According to CME FedWatch, markets are currently pricing in an 82.2% probability that the Federal Reserve will keep rates unchanged at the March FOMC meeting, reflecting persistent inflation and a restrictive policy stance. In addition, uncertainty around the possible appointment of Kevin Warsh as the next Fed chair has added pressure to risk assets.

U.S. 10-year Treasury yields remain near multi-month highs around 4.22%, while financial conditions stay tight. Historically, periods of elevated real yields coincide with weaker crypto liquidity and muted spot BTC demand.

On the other hand, the U.S. Dollar Index (DXY) has slipped below 97 after rebounding from January lows, remaining an important variable for Bitcoin’s capital flows.

Where Is Bitcoin Headed?

Heavy distribution from long-term holders alongside rising long-term supply and renewed dip-buying suggests the market may be entering a re-accumulation phase. However, Bitcoin’s next major move will largely depend on upcoming U.S. economic data and the Federal Reserve’s policy direction in the weeks ahead.