The 61.8% Fibonacci Level Acknowledged and Upheld

XRP encountered a 17% decline between December 16th and 18th, eventually finding a modest rebound from the $0.57 support level. Despite this downturn, indications from technical analyses suggest that long-term investors need not succumb to panic.

Rather than signaling a cause for concern, the recent retracement in XRP prices is viewed as a strategic opportunity for investors to enter the market. The condition for a positive upturn hinges on Bitcoin bulls successfully defending the $42k zone and driving prices upward, promising favorable outcomes for both XRP holders and the broader market.

Examining the one-day price chart of XRP reveals a significant support zone spanning $0.57 to $0.61. This range, previously instrumental in establishing a bullish market structure in mid-November, propelled XRP to $0.7 before experiencing a subsequent decline. Despite the retreat to $0.6, the On-Balance Volume (OBV) has consistently risen, indicating sustained buying pressure and reinforcing the expectation of an impending XRP rally.

In the midst of this, the Relative Strength Index (RSI) currently stands at 45, reflecting a bearish momentum as of the present moment. The $0.6 level emerges as an attractive risk-to-reward buying opportunity for XRP bulls eyeing a target of $0.7 and beyond, contingent on Bitcoin avoiding a significant wave of selling pressure.

A Range Formation Strongly Indicates It’s on the Horizon

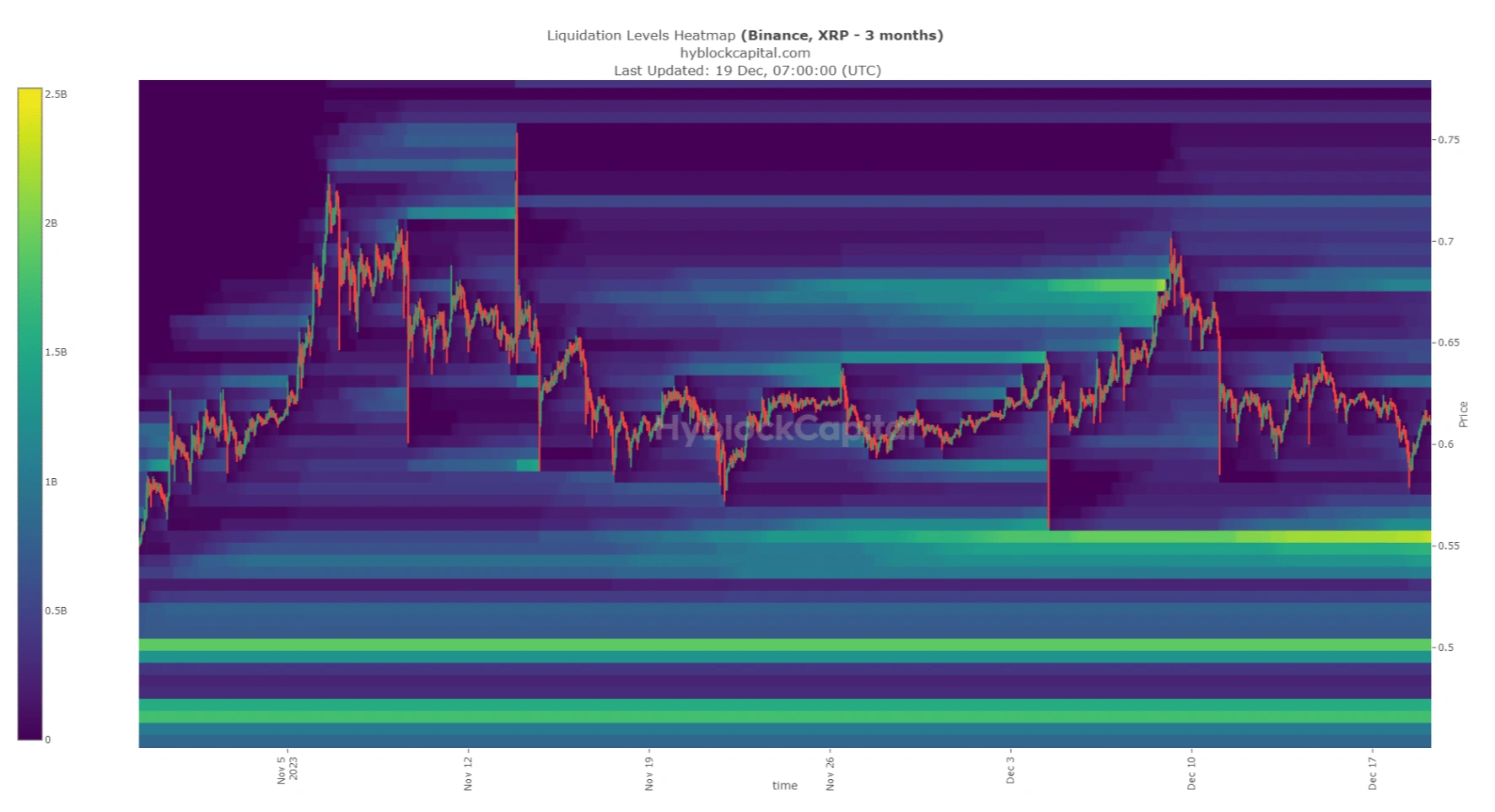

The emergence of a range appears increasingly plausible, as AZC News conducted an analysis of liquidation heatmap data provided by Hyblock. A retrospective examination spanning the last three months revealed that the $0.55-$0.565 range exhibited a substantial concentration of estimated liquidation levels.

A deliberate move to sweep through this range would likely be well-received, as subsequent price action could involve a noteworthy bounce to the upside. Looking ahead, the $0.63 and $0.68 levels also stand out as modest yet perceptible areas with heightened liquidity.

Related: Bold Analyst Prediction: XRP Set to Surge by 800%

Adding another layer to the analysis, the $0.686 threshold has demonstrated resilience as a resistance point since November 11th for XRP. Consequently, the prospect of a range taking shape within the $0.58-$0.68 bracket in the coming weeks gains credence. This potential consolidation could set the stage for nuanced price movements within this defined range.