All eyes are currently on Ethereum as the Chairman of the U.S. Securities and Exchange Commission, Gary Gensler, announced that the approval of a spot Ethereum ETF is expected by the end of this summer. Although this news brings a certain level of optimism to the ETH community, it has not yet influenced the price of Ethereum, which remains below $3,500 at the time of writing.

Surging Demand for Ethereum

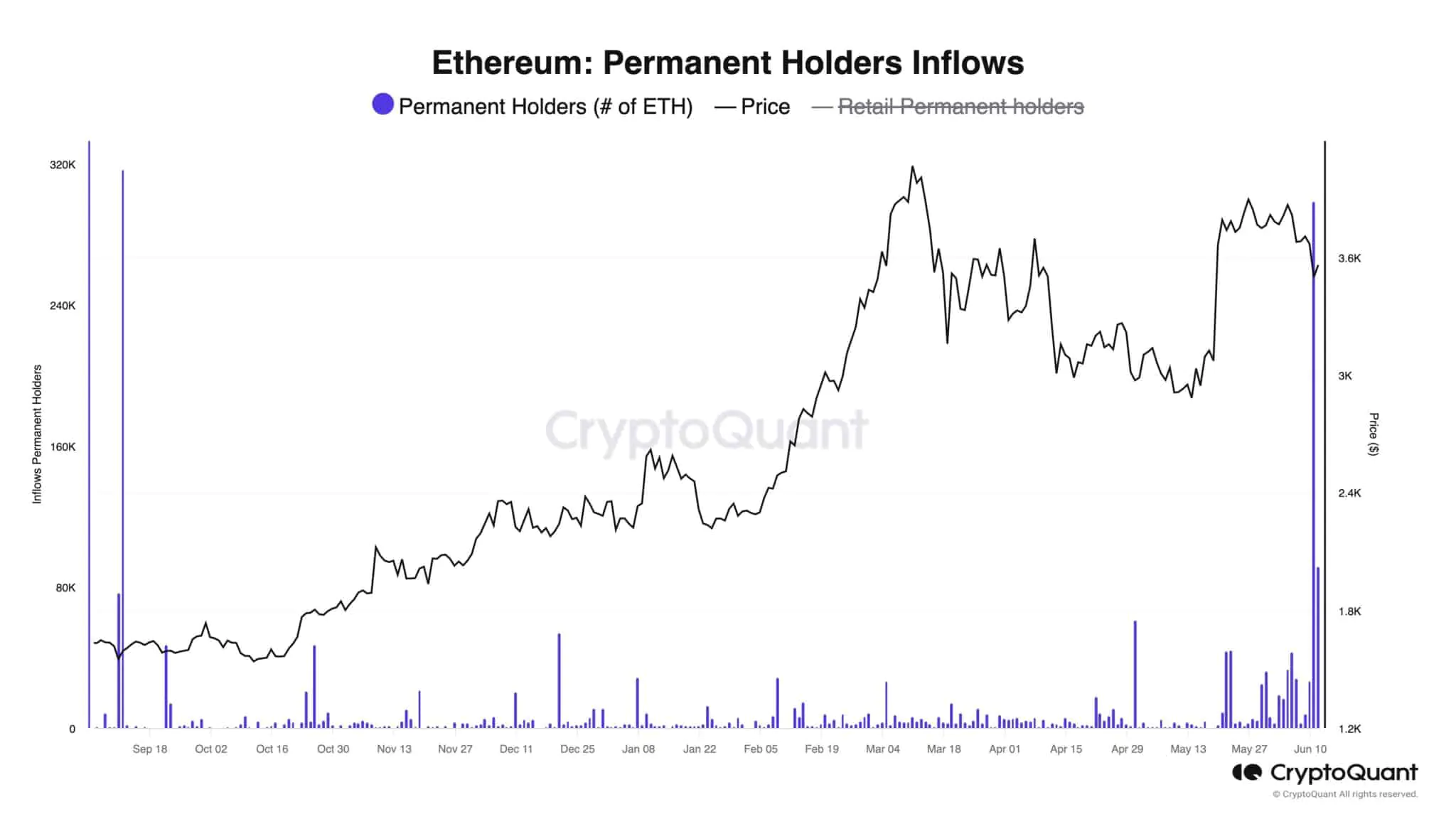

Julio Moreno, Head of Research at CryptoQuant, has reported a significant increase in Ethereum demand in the market. According to Moreno, long-term ETH holders purchased an astonishing 298,000 ETH yesterday, marking it the second-highest daily purchase ever recorded.

The highest daily purchase record remains on September 11, 2023, when ETH holders acquired 317,000 ETH. Nonetheless, the current surge in Ethereum demand highlights the growing interest and confidence of long-term investors in the cryptocurrency market.

This spike in demand comes as the price of ETH has adjusted down by over 9% in the past week. However, on-chain metrics continue to indicate the strength of the world’s second-largest cryptocurrency.

The amount of Ethereum withdrawn from Coinbase has surged to an impressive 300,000 ETH, making it one of the largest outflows of 2024. Consequently, the total value of Ethereum withdrawals has surpassed $1 billion.

Related: Bitcoin Falls to $66,000 as New Addresses Decline

Upcoming ETH Price Action?

Despite positive on-chain indicators, ETH bulls have yet to gain enough momentum to push the price above $4,000. Currently, Ethereum is trading just below the crucial support level of $3,500.

Previously, when ETH dropped below $3,500 in April, it resulted in a 25% decline, reaching a low of $2,814 on May 2. All eyes are now on how swiftly the SEC Chairman will make a decision regarding the spot Ethereum ETF approval. This move has the potential to inject substantial capital into the market, similar to the influx observed following the approval of the spot Bitcoin ETF.

Easy to trending