In just five days, the decentralized finance (defi) sector has witnessed a remarkable surge, with the total value locked (TVL) soaring from $80 billion to an impressive $91 billion, edging closer to the elusive $100 billion milestone not seen since the era predating Terra’s stablecoin crisis.

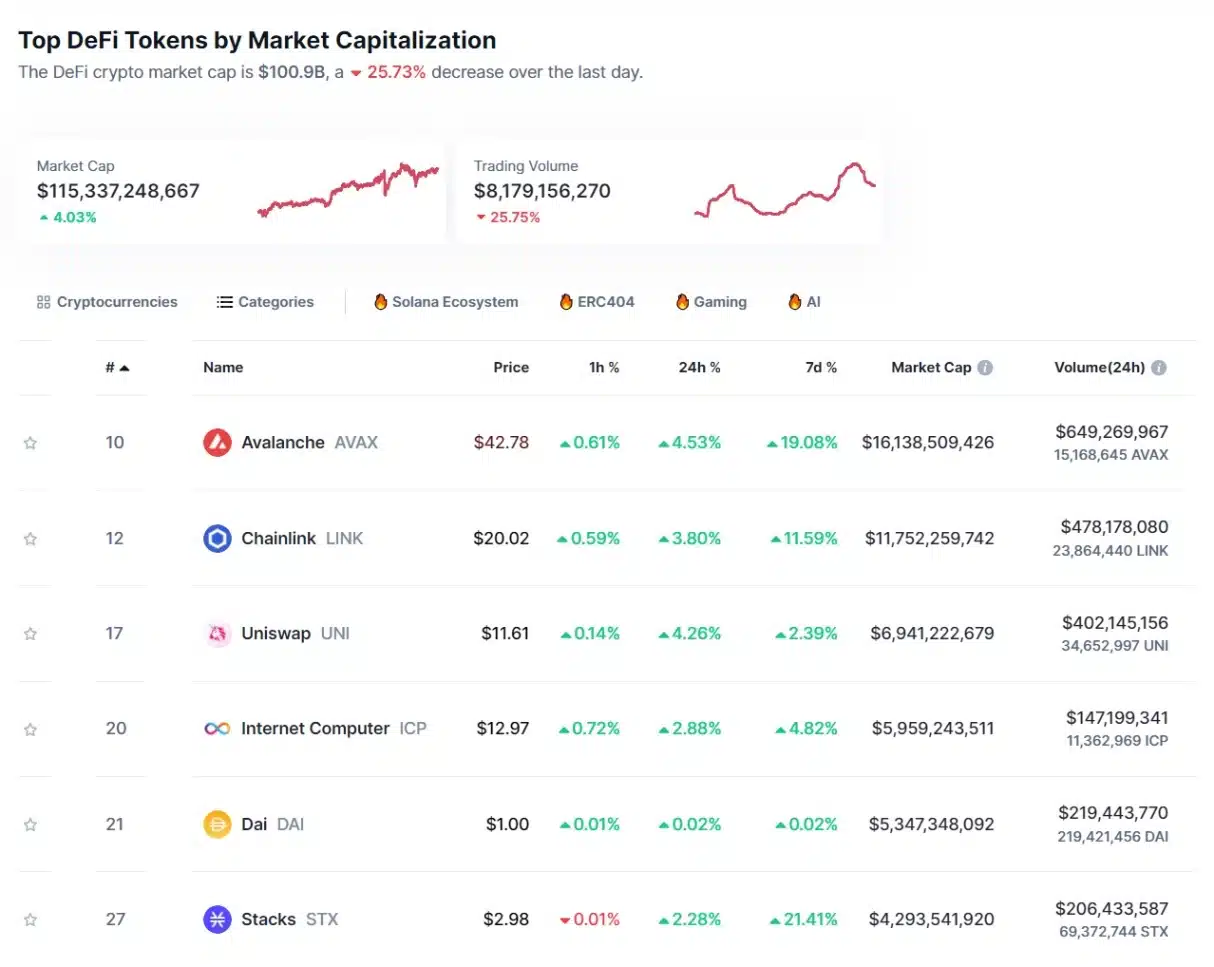

The defi landscape’s growth is unmistakable, with the combined market value of defi tokens reaching an impressive $115.46 billion as of March 2024. This marks a noteworthy increase of $12.79 billion from the $102.66 billion recorded on February 24, 2024.

Recent performance highlights include avalanche (AVAX) surging by over 19%, while chainlink (LINK) witnessed an 11.5% ascent. The majority of defi tokens, including INJ, STX, GRT, and THETA, have experienced significant gains, propelling the sector forward.

Over 29 Protocols Exceed $1 Billion in Value Amid Defi Sector Expansion

The surge in TVL over the past week is spearheaded by Lido, the leading liquid staking protocol, commanding an impressive $33.849 billion in total value locked. This substantial figure is mainly attributed to the 9.84 million ethereum (ETH) it holds, positioning Lido as a dominant force in the defi space, representing 36.83% of the total defi TVL.

Aave follows closely with a TVL of $10.09 billion, constituting 10.98% of the overall defi TVL, while Eigenlayer and Maker boast TVLs of $9.81 billion and $9.24 billion, respectively. Justlend is not far behind with a TVL of $6.97 billion.

As of March 1, 2024, an impressive 29 defi protocols each hold over $1 billion in value, with Ethereum-based protocols leading the charge, contributing $52.47 billion or 60.03% to the current defi TVL. Tron’s TVL stands at $9.47 billion, and BNB commands $4.95 billion at the start of March.

Related: Blueberry DeFi Protocol Temporarily Pauses Lending

The decentralized exchange (dex) landscape is vibrant, featuring top platforms such as Uniswap v3, Jupiter, Orca, Pancakeswap, Uniswap v2, Curve, Thorchain, Raydium, and Quickswap. Each of these dex protocols boasts a 24-hour global trade volume ranging from $109 million to an impressive $1.3 billion, reflecting the dynamic and active nature of the defi ecosystem.

This is awesome developments, we’re together.

youssoufn5@gmail.com

good