Daily transaction volume on the Litecoin network has reached an impressive $9.6 billion, fueled by increasing activity from ETF issuers seeking to list their proposed Litecoin ETFs in the United States.

According to a Feb. 21 report by Santiment, Litecoin’s market capitalization jumped 46% between Feb. 2 and Feb. 19, signaling heightened investor interest. The analytics firm attributed part of this growth to the cryptocurrency’s expanding network utility, with transactions consistently processing $9.6 billion in volume over the past week.

Back in late August, Litecoin’s daily transaction volume stood at approximately $2.8 billion. The current figure represents a staggering 243% increase over the past five months. Additionally, Litecoin’s price has doubled since early November, outperforming the broader crypto market, which gained 42% in the same period.

“There is clearly growing excitement around a potential Litecoin ETF, 13 months after the SEC approved the first Bitcoin ETFs,” Santiment noted.

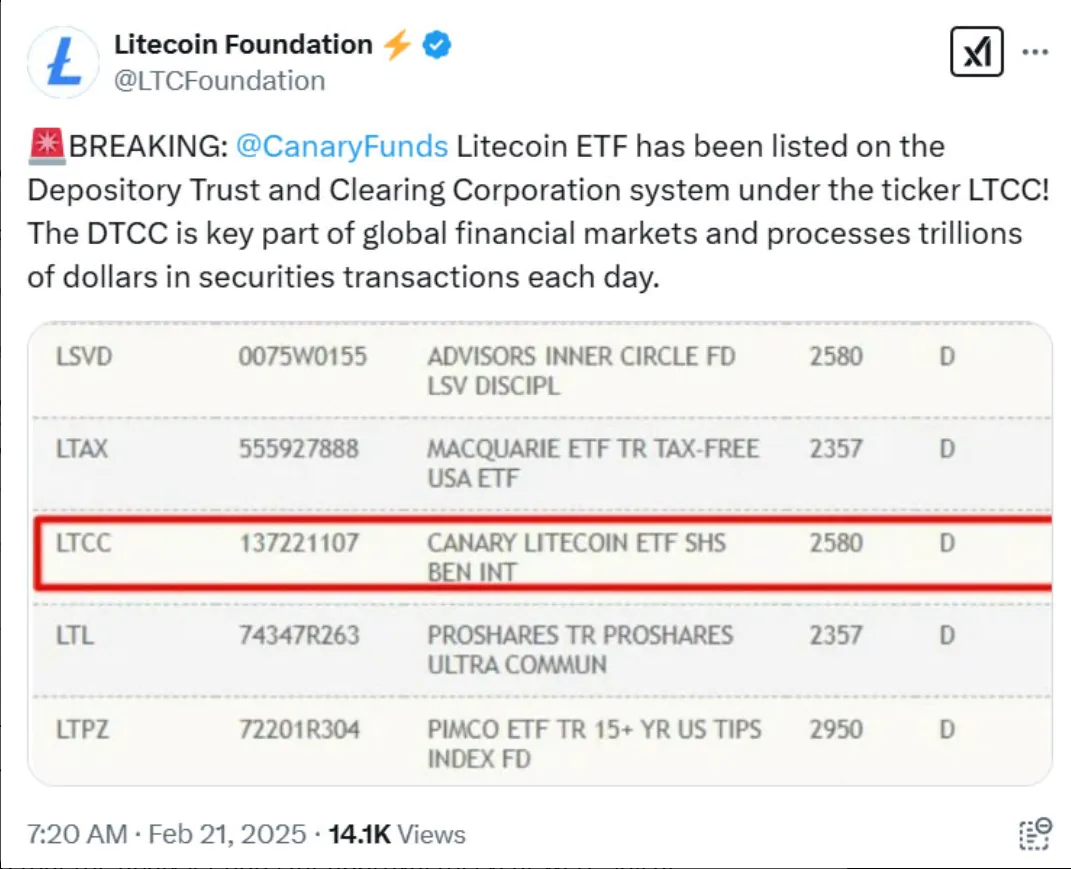

On Feb. 19, the U.S. Securities and Exchange Commission (SEC) acknowledged a proposed rule change to list the CoinShares spot Litecoin ETF on Nasdaq. Meanwhile, a Canary Capital Litecoin ETF listing was spotted on the Depository Trust and Clearing Corporation (DTCC) system under the ticker LTCC on Feb. 20.

The Litecoin Foundation emphasized that the DTCC, a crucial player in global financial markets that handles trillions of dollars in securities transactions daily, plays a vital role in preparing for the ETF’s potential launch.

However, Bloomberg ETF analyst Eric Balchunas cautioned that while the DTCC listing indicates preparatory steps, it does not confirm approval or imminent trading. He maintained that analysts still place a 90% probability on the ETF receiving approval this year.

In response to the DTCC listing, LTC’s price surged 8.5%, climbing from an intraday low of $127 to $138 before experiencing a slight pullback on Feb. 21.

Over the past two weeks, Litecoin has gained nearly 30%, outperforming Bitcoin, which has remained in a tight trading range since falling back into five figures in early February.