According to Bloomberg’s ETF experts, there is a 90% probability that the U.S. Securities and Exchange Commission (SEC) will approve a spot Litecoin ETF before the end of the year.

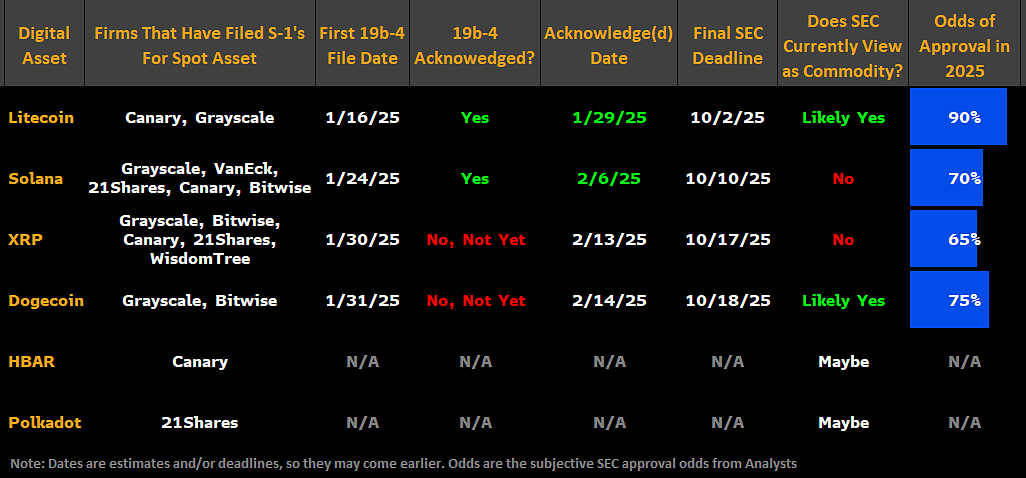

Analysts James Seyffart and Eric Balchunas believe Litecoin has a stronger chance of approval in 2025 compared to other proposed crypto ETFs, such as those for XRP, Solana, and Dogecoin, which they estimate have approval odds of 65%, 70%, and 75%, respectively.

Originally launched in 2011 as a faster alternative to Bitcoin, Litecoin operates on a similar proof-of-work consensus mechanism. Seyffart and Balchunas noted on X that Litecoin’s regulatory path appears more straightforward, given that its S-1 and 19b-4 forms have already been submitted and acknowledged. Additionally, the SEC’s likely classification of Litecoin as a commodity could further ease its approval process.

The surge in demand for crypto ETFs has been fueled by the success of spot Bitcoin and Ether ETFs, which have collectively recorded $40.7 billion and $3.18 billion in net inflows since their respective launches in January and July 2024, according to Farside Investors.

Although Seyffart does not anticipate Litecoin ETFs to generate comparable demand, he noted that they could still be a viable option for fund issuers, even with as little as $50 million in assets. “They don’t need to generate massive inflows to be worthwhile from an issuer’s perspective,” he explained.

According to Seyffart’s analysis, the SEC’s final decision on the proposed Litecoin, Solana, XRP, and Dogecoin ETFs is expected between October 2 and October 18. However, Seyffart suggested that a Litecoin ETF could potentially launch even earlier.

He and Balchunas also acknowledged that Canary Capital and 21Shares have filed applications for Hedera and Polkadot ETFs, though they have yet to assign approval odds for these filings.