The investor’s bet on the Solana-based meme coin came after Milei reposted LIBRA on his X account. In his first public response to the controversy, Milei clarified that his post was not intended to promote the token but rather to raise awareness and support for Argentine businesses engaged in crypto. This triggered extreme volatility, with LIBRA’s price surging to $0.75 within minutes before plunging 50% just hours later.

LIBRA Whale Takes a Massive $2.78 Million Hit

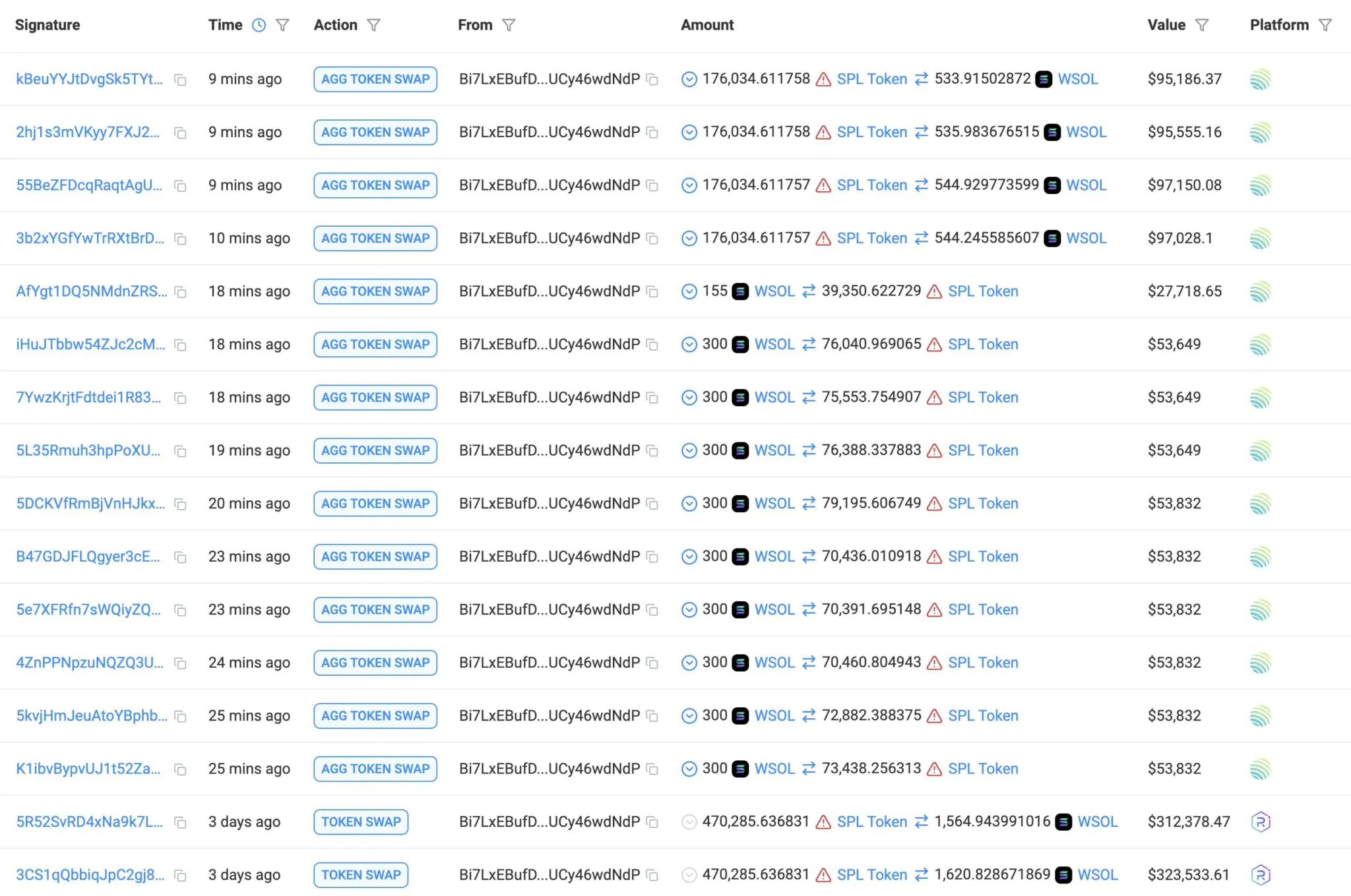

The whale’s miscalculated trades resulted in a substantial financial blow. Three days ago, they invested 17,450 SOL (around $3.25 million) to acquire LIBRA. However, upon selling their holdings for 3,200 SOL ($595,000), they suffered a devastating loss of 14,250 SOL—approximately $2.65 million.

Undeterred, the whale attempted a second trade after Milei’s retweet regarding LIBRA’s purchasing methods. This time, they spent an additional 2,855 SOL ($531,000) on the token. Unfortunately, the trade ended in another loss, as they sold for 2,159 SOL ($412,000), incurring a further deficit of 696 SOL ($129,000), according to on-chain data from SolScan.

Despite an earlier spike to $0.75, LIBRA has since fallen 50%, trading at $0.3625 at press time. However, it remains up 34% on the daily chart, with trading volume skyrocketing 740% to $162 million. The latest pump-and-dump cycle in the meme coin market has ensnared traders chasing quick profits amid a staggering $4.5 billion in insider trading activity.

Argentina’s President Javier Milei Denies Wrongdoing in LIBRA Meme Coin Scandal

As the LIBRA meme coin scandal unfolds, Argentina’s President Javier Milei has defended himself against mounting lawsuits and impeachment calls. While confirming his meeting with LIBRA’s creators, Milei emphasized that his social media posts were not intended to promote investment.

Instead, he stated that his goal was to raise awareness about the initiative, which aims to support Argentine businesses through cryptocurrency. Speaking to local news outlet Todo Noticias, Milei said:

“I’m not an expert. My specialty is economic growth, with or without money. As a technology enthusiast, I saw the potential of this tool to fund entrepreneurial projects and shared it.”