Their resurgence has attracted attention from the cryptocurrency community. Particularly noteworthy was an event that occurred last Saturday: an individual who participated in the initial coin offering (ICO) of Ethereum executed a significant transaction, transferring 2,000 ether. This marks the first transaction of Ethereum ICO since 2015.

The Ethereum ICO began on July 22, 2014, where investors purchased ETH. In the first 12 hours, 7 million ether were bought at a rate of 2,000 ETH for one BTC. With Bitcoin valued at $621 on that day, users purchased ETH at around $0.31 per unit. These transactions were recorded on the Ethereum ICO wallet labeled “Genesis” on etherscan.io.

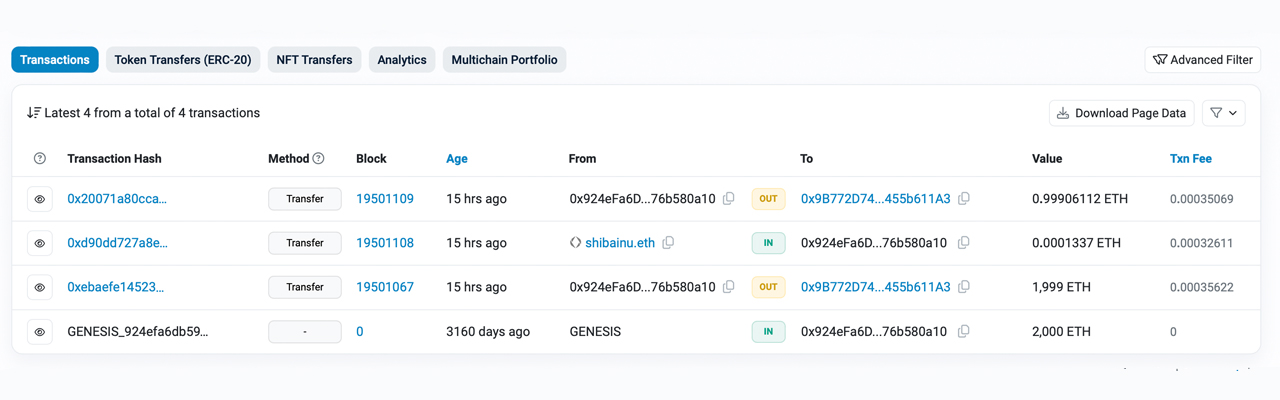

During that time frame, over 7 million ETH were traded. A blockchain transaction alert website, Whale-alert.io, detected a transaction for Genesis tokens over the past weekend. The investor’s address began transferring 2,000 ETH last Saturday, created on July 30, 2015, over a year after the ICO commenced.

At that time, the value of ETH had risen from $0.31 during the ICO to $2.92 per ether on July 30, 2015. This meant that selling 2,000 ETH could yield $5,840 for the owner, a significant profit compared to the initial investment of $621. However, the investor decided to hold onto it, and now that amount has grown to $6.8 million. These funds were distributed among several addresses before being consolidated.

Related: Ethereum Targets $3000 with Positive On-Chain Signals

In total, 8,893 people participated in the Ethereum ICO, allocating a total of 72,009,990 ether to the involved parties. About 2.2 million ETH remain unconfirmed in Genesis addresses to this day. Over the years, 69.7 million Genesis ether has been systematically distributed, including significant awakenings during the 2017 bull market, such as an address accumulating 40,000 ETH from the ICO and spending that amount in 2017.

While many chose to sell in 2017, others opted to wait until the market surged in 2021 and the present before executing their transactions. Similarly, a significant number of classic Bitcoin addresses have also been reactivated this month due to the continuous rise in Bitcoin’s value.

Good