BTC Open Positions Surge as Bitcoin Options Expiry Approaches

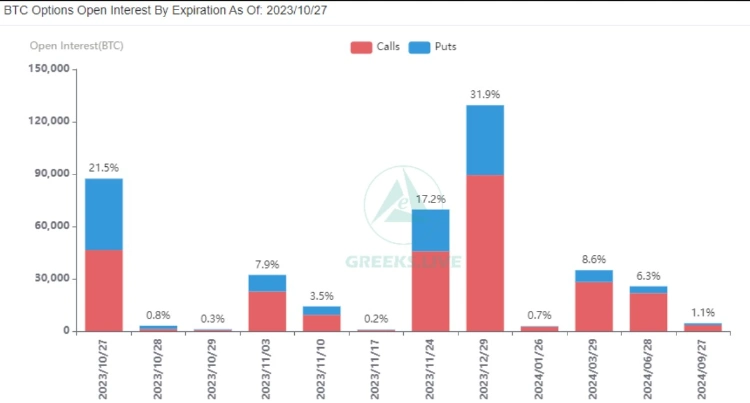

Ahead of the Bitcoin options expiry, the cryptocurrency market is abuzz with anticipation. A staggering 87,000 Bitcoin options are slated to expire, sporting a Put Call Ratio of 0.88 and a maximum pain point set at $29,000. Notably, open positions have recently surged, creating a flurry of activity.

Bitcoin’s recent rally, propelling its price to $35,000 earlier this week, has invigorated investors with a bullish outlook. This surge in optimism has emboldened traders to embrace higher risks. However, market participants are keeping a watchful eye on the imminent Bitcoin Options expiry.

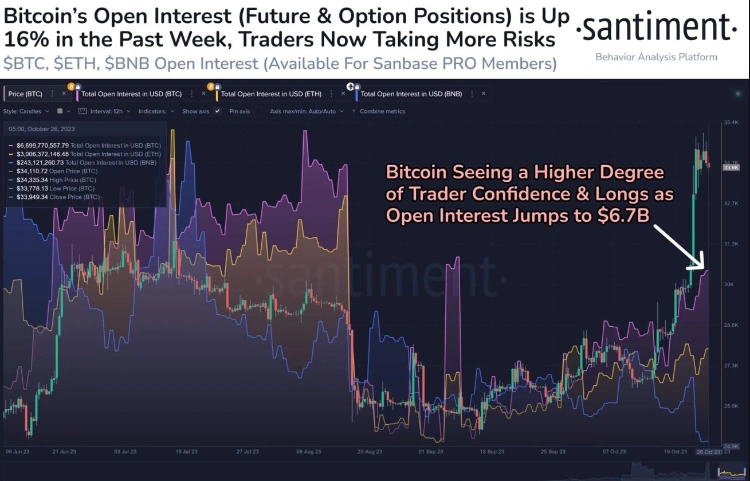

Santiment, an on-chain data provider, has reported a substantial uptick in both futures and open positions for Bitcoin. In the past week alone, open interest has swelled by a staggering $922 million. Nevertheless, it is crucial to remain vigilant for signs of FOMO (Fear of Missing Out) potentially affecting the market.

BTC Price Correction Looms

Over the last two days, Bitcoin’s price has experienced a modest retracement. As of the latest update, BTC is trading 1.81% lower, priced at $34,118, with a market capitalization of $666 billion.

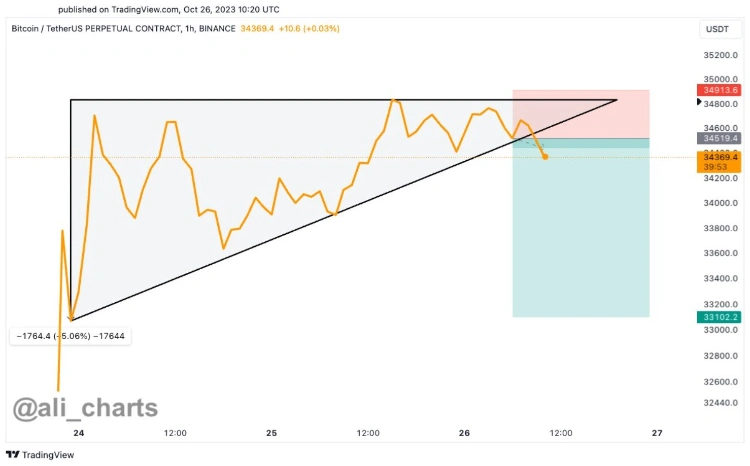

Well-known crypto market analyst Ali Martinez has observed that Bitcoin appears poised for a retracement before embarking on further upward movements. On the hourly chart, Bitcoin seems to have formed an ascending triangle.

Given that BTC is currently trading below the diagonal line, there is an increased likelihood of a 5% correction, possibly retracing to the $33,000 level.

Another prominent analyst, Rekt Capital, has also opined that when a retracement unfolds in the coming months, it should be viewed as an opportunity for re-accumulation.

He further emphasizes that market cycles are characterized by extended periods featuring breakout surges and pullbacks. Consequently, investors may find opportunities to acquire assets at lower prices moving forward.

>>> Sudden Surge in British Bitcoin Buyers: Price Predictions for 2025?

Bitcoin Options Expiry Looms Large

Following a strong start to the week, Bitcoin traders are keeping a close watch on the options data as the October 27 expiry date approaches. According to data from Greeks.Live, a substantial 87,000 BTC options are set to expire, with a Put Call Ratio of 0.88, a maximum pain point pegged at $29,000, and a total notional value of $2.98 billion.

Bitcoin led the charge, reaching $36,000 at one point on the 24th, marking a new annual high. This rally triggered a surge in the full-term implied volatility, nearing its peak for the year. Consequently, the option delivery price for this week will be notably distant from the maximum pain point.

Nevertheless, it’s crucial to note that a significant whale has been primarily selling during the latter part of the week. While market sentiment has notably improved, it may not be sufficient to sustain the ongoing bull market. As such, Bitcoin faces a significant test ahead of the launch of the Bitcoin ETF.

Marathon Digital to Raise $750 Million Amid MARA Stock Surge

Marathon Digital, a prominent Bitcoin miner, is capitalizing on the bullish momentum in the crypto market, driven by a 100% surge in Bitcoin prices in 2023 following the harsh crypto winter of 2022. The company is gearing up for a significant fundraising effort, as indicated by its recent filing with the U.S. Securities and Exchange Commission (SEC).

Marathon Digital’s Ambitious Fundraising Plan

Marathon Digital has unveiled plans to secure up to $750 million through a hybrid equity offering, as outlined in their filing. As of September 30, the company boasted a substantial Bitcoin reserve of 13,726 and was generating over 1,000 Bitcoins each month.

To facilitate this fundraising endeavor, they have submitted a FORM S-3 filing to the U.S. Securities and Exchange Commission. The funds raised from this offering will be earmarked for investments in new mining equipment and an expansion of their operational capacity.

Marathon Digital is publicly listed on the Nasdaq stock exchange, trading under the ticker symbol “MARA.” Notably, in line with the robust Bitcoin price rally this week, the shares of Marathon Digital have seen a significant uptick.

Marathon Digital (NASDAQ: MARA) shares have surged by 23% in the current week. This surge is aligned with Bitcoin’s (BTC) 12% price increase over a similar timeframe, though it’s worth noting that BTC trades continuously, whereas stocks follow regular trading hours. Nevertheless, this correlation in price movements is consistent with expectations, as economic principles suggest such a relationship.

Year-to-date, MARA stock has witnessed a remarkable gain of 164%, with the current price standing at $9. However, it’s important to acknowledge that the stock is still trading at a 50% discount compared to its price of $19 earlier in July 2023.

Upcoming Q3 Revenue Report

Anticipation is running high for Marathon Digital’s upcoming Q3 2023 financial report, set to be released next month in November 2023. In the last quarter of Q2 2023, the Bitcoin mining giant reported a threefold increase in its revenue, surpassing the $80 million mark. Additionally, the company managed to narrow its losses during the same period and is expected to continue this trend moving forward.

With the surging price of Bitcoin this year, many Bitcoin miners have opted to sell their holdings, capitalizing on the bullish market sentiment.