KuCoin pays $22 million fine, blocks New York customers

According to Reuters, the KuCoin cryptocurrency exchange has agreed to withdraw from the New York market (USA) and pay $22 million to settle a lawsuit with the state government due to disguised securities listing and lack of operations license.

In the lawsuit, New York Attorney General (NYAG) Letitia James argued that the company failed to properly comply with its obligation to register with NYAG. The U.S. Securities and Exchange Commission (SEC) as well as the Asset Futures Trading Commission (CFTC).

As a result, KuCoin allegedly sold unregistered securities as KuCoin Earn. A lending and staking product of the exchange. The Attorney General’s Office also wants KuCoin to provide the identities of people who participated in purchasing securities or assets at the exchange six years ago. These allegations have forced KuCoin to cut its workforce by 30% and require strict identity verification (KYC) for all its customers.

KuCoin’s agreement to leave New York also means it will stop providing securities and asset trading services. Users in this state will not be able to access the platform until the latest information is available.

According to the disclosure, KuCoin’s $22 million fine includes payment of $5.3 million in fines to the state and $16.7 million in crypto to 177,800 New York investors.

Related: The US Tax Department Still Requires FTX to Pay 24 Billion USD in Taxes

Commenting on the incident, KuCoin CEO Johnny Lyu confirmed the news of paying the fine and leaving the New York market. He also warned users to beware of the risk of being scammed because of the information surrounding the exchange situation.

1/ I want to update all of you about our latest compliance action. @kucoincom has reached a settlement with the New York Attorney General (NYAG), solidifying our commitment to compliant operations.

— Johnny_KuCoin (@lyu_johnny) December 12, 2023

Before facing KuCoin, the New York Attorney General’s Office (NYAG) had taken legal actions against many other crypto companies, including:

-

October 2023: Gemini crypto exchange, a crypto lending company, went bankrupt. DCG Investment Company and CEO Barry Silbert for defrauding more than 230,000 investors. Among them, at least 29,000 investors in New York suffered losses worth more than 1 billion USD.

-

January 2023: The Attorney General’s Office further charged fraud against former Celsius CEO Alex Mashinsky and imposed a $45 million fine on Nexo at the same time.

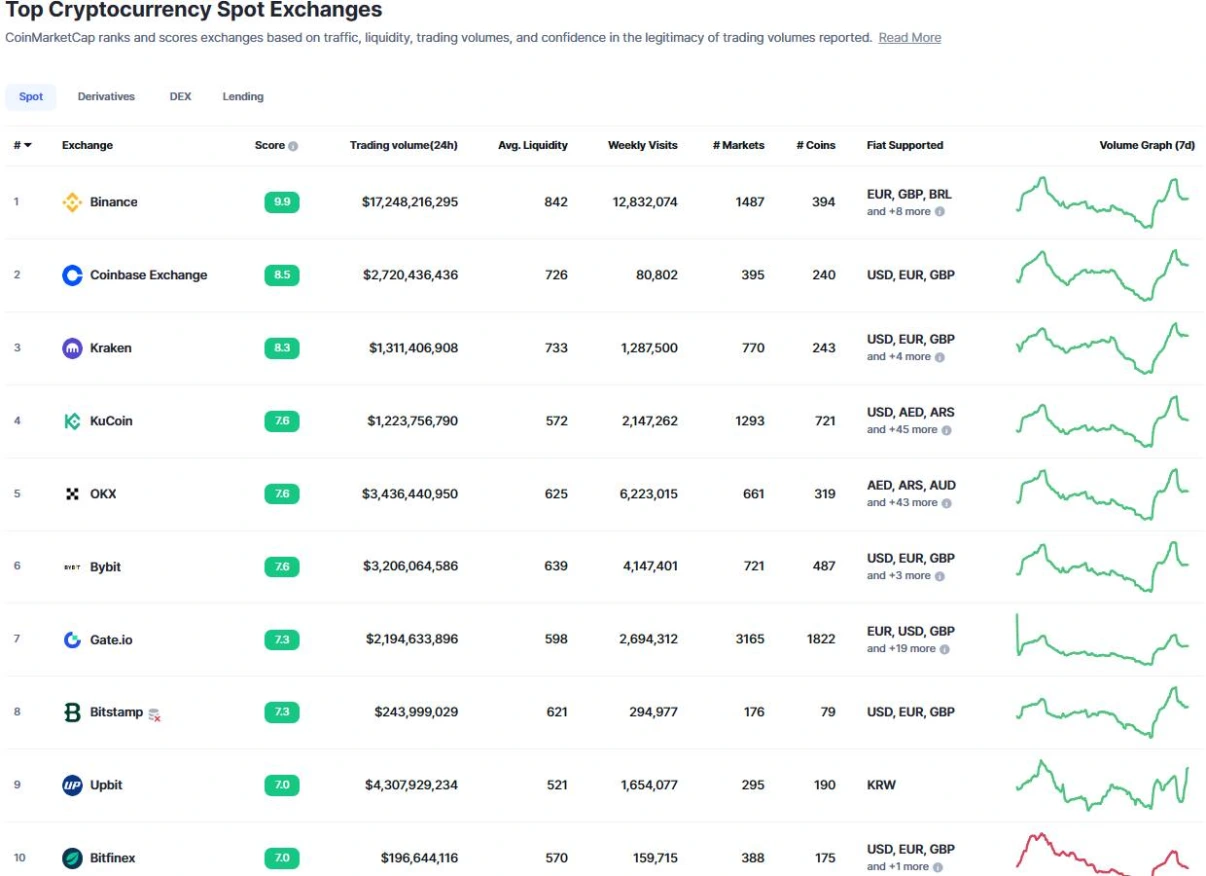

KuCoin is a crypto exchange operating since 2017, currently holding the top 4 exchange position after Binance, Coinbase and Kraken. According to CoinMarketCap, the exchange’s trading volume in the first half of this month reached 1.2 billion USD. This number is less than 10% compared to Binance’s figure of 17.2 billion USD.

List of top 10 crypto exchanges. Photo taken on December 13, 2023 on CoinMarketCap