A recent report revealed that after news of this lawsuit spread, the exchange faced significant challenges. Despite efforts to contain it, KuCoin users still migrated to other exchanges, causing a large capital outflow from the platform.

Allegations against KuCoin

On March 26, the United States Department of Justice (DOJ) and the Commodities and Futures Trading Commission (CFTC) filed consecutive lawsuits against global cryptocurrency exchange KuCoin.

The DOJ charged KuCoin and its two founders, Chun Gan and Ke Tang, with knowingly failing to maintain an adequate AML program. Additionally, KuCoin was accused of “operating an unlicensed money transfer business”.

As previously reported, the CFTC filed a complaint against the cryptocurrency exchange for illegally trading in “foreign exchange commodity futures transactions and leveraged, margined retail commodity transactions or sponsorship”.

Furthermore, the exchange was accused of failing to “register with the CFTC as a futures commission merchant (FCM)” and violating multiple Commodity Exchange Act (CEA) and CFTC regulations.

As a result, the price of the KuCoin (KCS) token dropped 10% just a few hours after the news spread. Since then, KCS has fallen 13.1% over the past week and is down 18.9% from its price 30 days ago.

It is worth noting that blockchain research and analysis firm Kaiko discovered during its research into KuCoin’s fees having the following impact: Although the DOJ claims there is no direct interaction between KuCoin and Tornado Cash is on the Ethereum blockchain, but all the funds stolen from the KuCoin hack in 2020 were “privatized” using Tornado Cash, representing a significant amount of ETH.

What is the impact of the indictment from CFTC and DOJ on KuCoin?

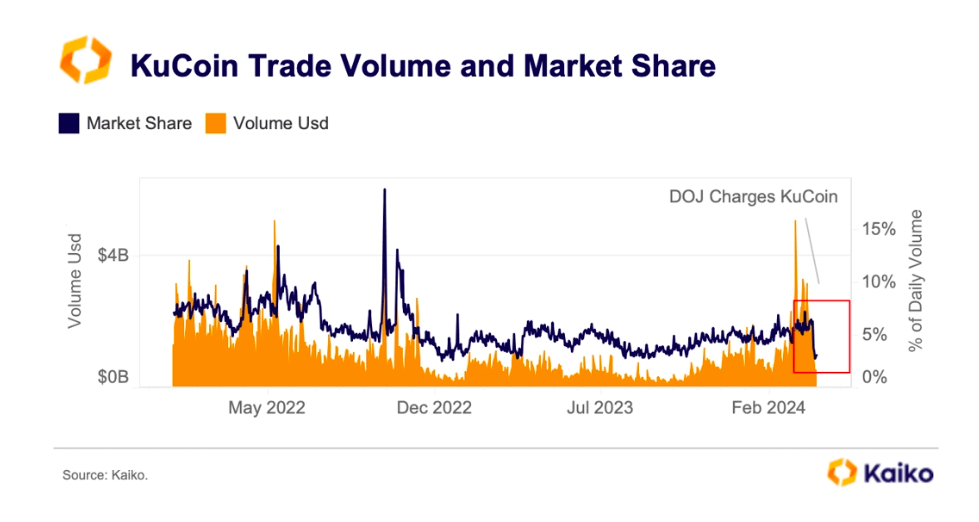

It is not only the price of KCS that is affected by the intervention of regulators on cryptocurrency exchanges. According to Kaiko, the charges from the CFTC and DOJ had a significant and immediate impact on the exchange.

Figures show that KuCoin has recorded a significant decline in several metrics over the past week, despite being known as one of the fastest growing exchanges this year. According to the report, KuCoin’s daily trading volume and market share have decreased since March 26. Daily trading volume decreased from $2 billion to $520 million, a decrease of 74%. Furthermore, its market share halved from 6.5% to 3%. Despite attempting to stem this decline by launching a $10 million airdrop, KuCoin was not successful.

Data from Kaiko shows that exchange outflows increased significantly after users moved their funds to other centralized exchanges such as Binance, OKX, Coinbase, MEXC and Gate.io. To protect their assets, users also transfer their assets directly to on-chain wallets.

Related: Kucoin Faces FUD, KCS Price Plummets Instantly

On March 26, the total value of outflows surpassed KuCoin’s inflows. More than 600 million USD, mainly USDT and ETH, were withdrawn from the exchange after information about the lawsuit spread.

The research platform emphasizes that these numbers only include on-chain transactions from the KuCoin wallet and other exchanges or wallets, and do not include transactions between KuCoin addresses.

According to data from Nansen, the total value of assets held by the exchange fell from about $6 billion to $4.82 billion. Currently, KuCoin’s total cash outflow value accounts for nearly 1.2 billion USD.

Another attempt to take the entire crypt into one hand, into the hands of the Fed

Govt wants to control crypto by all means