Kraken, one of the largest cryptocurrency exchanges in the United States, has officially listed BNB—the native token of the BNB Chain ecosystem developed by Binance.

This move has not only captured the attention of the crypto community but is also seen as a strategic turning point. It may pave the way for a wave of BNB listings on other major U.S. exchanges such as Coinbase, Gemini, and more.

From Legal Barriers to New Opportunities

For a long time, U.S.-based exchanges had kept BNB at arm’s length due to legal concerns tied to Binance, the company behind BNB Chain. In 2023, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Binance, accusing it of issuing unregistered securities, including BNB.

This intense regulatory scrutiny made exchanges hesitant to list the token due to potential legal risks. However, the tide began to turn in late 2024 when Binance reached a settlement with U.S. authorities—agreeing to pay a $4.3 billion fine and implement stricter compliance measures.

This resolution effectively removed major legal roadblocks for BNB, and likely influenced Kraken’s decision to move forward with listing the token.

Clearer Regulations Boost Altcoin Confidence

Kraken’s listing of BNB may be more than a one-off event; it signals a broader shift in the U.S. regulatory environment for cryptocurrencies.

In early 2024, the SEC approved several spot Bitcoin ETFs—an achievement hailed as “historic” for legitimizing Bitcoin and digital assets in the eyes of institutional investors.

As regulators establish more defined frameworks for digital assets, the U.S. market is gradually opening up to altcoins, including BNB.

With positive policy signals emerging under President Donald Trump’s administration since his inauguration, this may be an opportune time for other exchanges to revisit their stance on BNB.

BNB Chain and Its DeFi Potential

BNB is more than just a native token—it plays a foundational role in the fast-growing BNB Chain blockchain ecosystem.

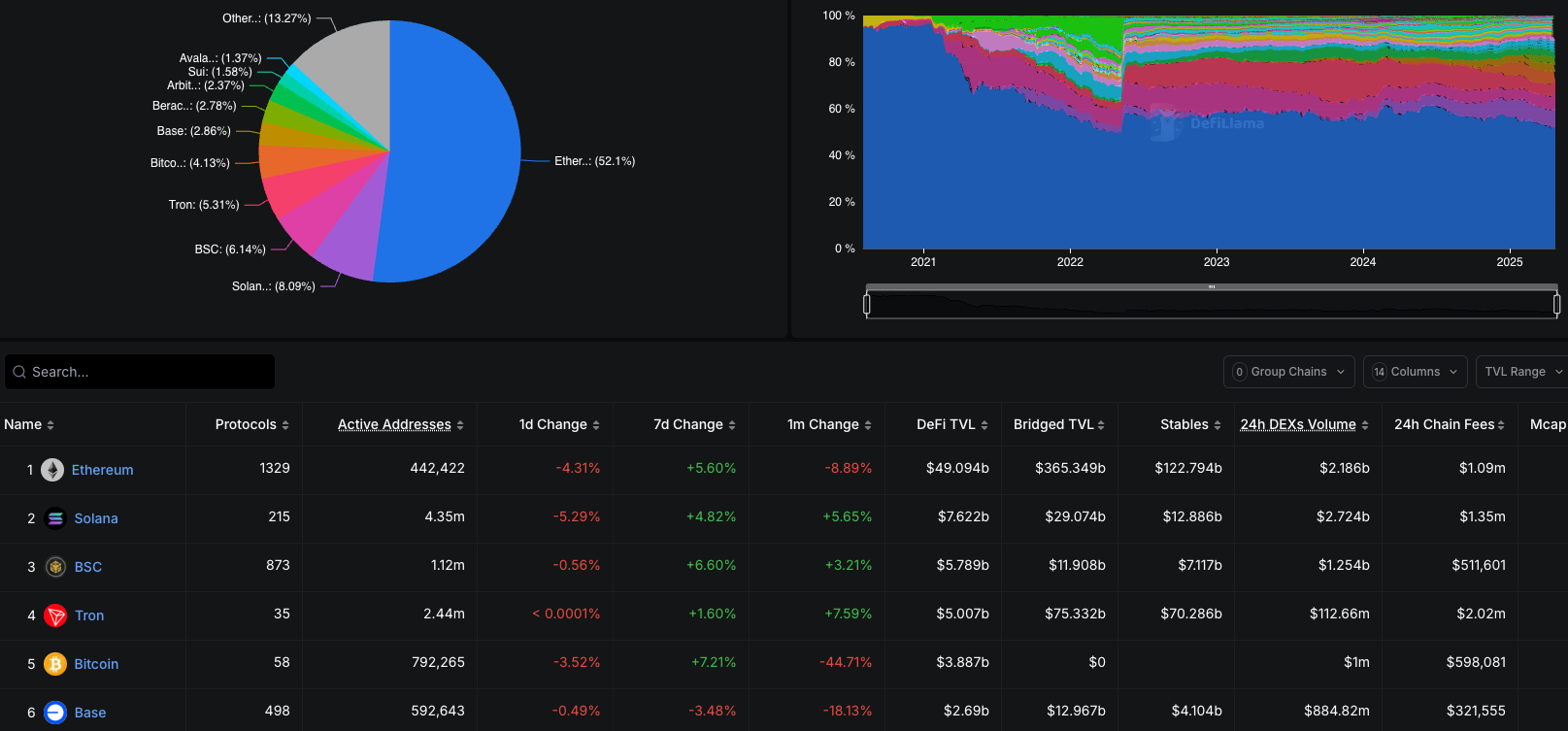

According to BNB Chain’s weekly ecosystem report, in just the first week of April 2025, the network recorded over 3.3 million daily active users and more than $7.1 billion in transaction volume. Major projects in DeFi, GameFi, and AI are thriving on the platform.

BNB Chain is also pursuing major technical upgrades in its 2025 roadmap: reducing block processing times to under one second, enabling gasless transactions, and integrating artificial intelligence (AI) into decentralized applications (dApps).

These advancements position BNB as a strategic asset, particularly attractive to exchanges seeking to engage DeFi users.

A Potential Domino Effect

Kraken’s decision to list BNB could spark a domino effect across the crypto industry. It suggests that U.S. exchanges are beginning to view BNB as a legitimate and high-potential asset.

At the same time, this shift reflects a broader change in strategy—from defensiveness in the face of regulatory risks to a more proactive embrace of the opportunities offered by the Web3 ecosystem.