Bitcoin (BTC) has managed to stay firmly above the $100,000 threshold for nearly a month. Remarkably, its strong upward momentum shows no signs of slowing down as supply shortage risks become increasingly evident.

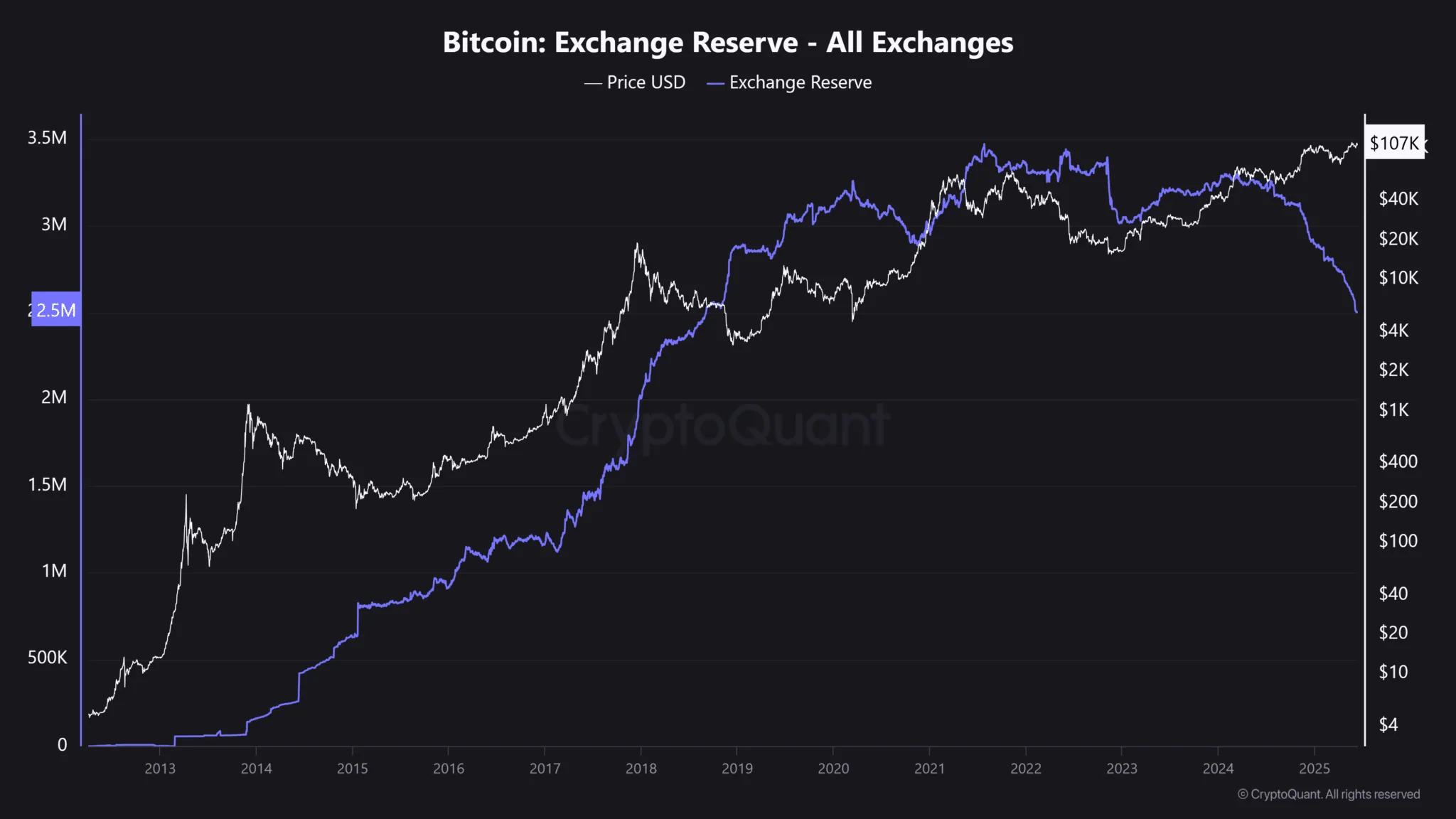

Widespread FOMO sentiment and surging demand from corporate treasuries are driving Bitcoin’s available supply into a tightening squeeze. On major retail exchanges, BTC reserves have dropped by over 21%, falling from 3.2 million BTC to just 2.5 million BTC in less than six months since the beginning of 2024.

This prolonged decline notably coincides with the launch of spot Bitcoin ETFs in the U.S., a development believed to have siphoned off a significant portion of circulating supply. In addition, institutional supply through over-the-counter (OTC) desks has also seen a sharp contraction. Specifically, BTC holdings at OTC desks have plummeted from over 211,000 to 135,000 BTC over the same period, marking a 36% decrease — far outpacing the decline seen on regular exchanges.

This persistent supply squeeze is emerging as a powerful catalyst that could propel Bitcoin prices higher, particularly as both strategic investment funds and retail investors continue pouring capital into the market. However, it’s important to note that exchange and OTC balances are not fixed, as new supply may enter the market when investors decide to take profits.

Beyond supply dynamics, global liquidity has also become a key driving force supporting Bitcoin’s price rally. According to Jamie Coutts, Head of Crypto Analysis at Real Vision, additional liquidity injections could potentially fuel significant price breakouts for Bitcoin. He observed, “Although Bitcoin’s sensitivity to the Global Liquidity Index (GLI) has gradually decreased over time, each 1% increase in system liquidity can still drive Bitcoin prices up by more than 20%.”

He further noted that in Q2 alone, the GLI surged by 2%, contributing significantly to Bitcoin’s recent rally of over 40%. This view is echoed by Andre Dragosch from Bitwise, who emphasized that global money supply has now reached its highest level in three years, creating further upside potential for Bitcoin.

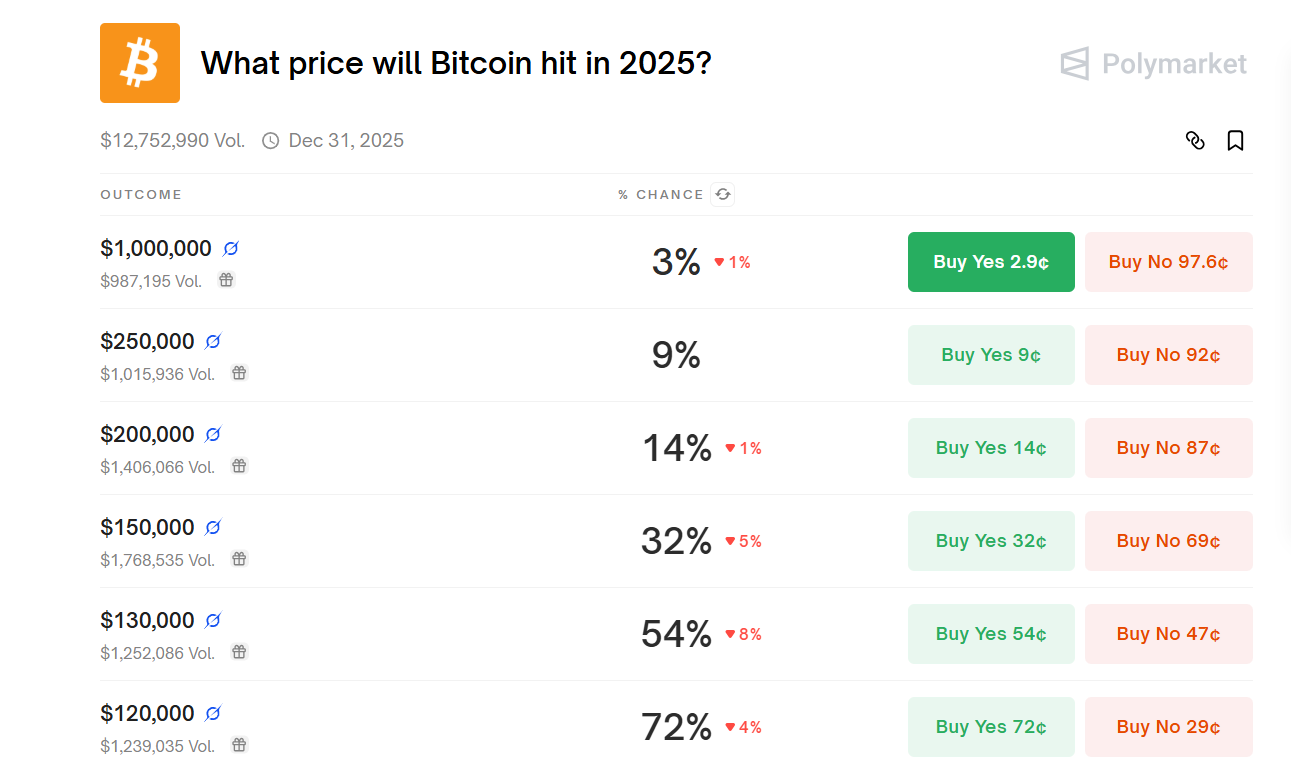

Looking ahead, data from prediction market Polymarket shows investors are heavily betting on Bitcoin reaching $120,000, with odds as high as 76%. Meanwhile, more ambitious targets for 2025 are also attracting significant attention: $130,000 with a 56% probability, and even $150,000 with a 36% chance.