Tron founder Justin Sun made a $119.7 million transfer of 29,920 ETH to HTX after Ethereum dramatically surpassed the $4,000 mark. After the transfer, Ethereum fell sharply from over $4,000 to $3,500. The transaction sparked debate about Sun’s strategy—whether he was taking profits or preparing for bigger gains in the future.

Between February and August, Justin Sun purchased 392,474 ETH worth $1.19 billion, at an average price of $3,027. By December, he appeared to be cashing in on the gains. On December 5, Sun deposited 20,000 ETH worth $76.3 million into HTX, just as ETH’s price surpassed $3,800.

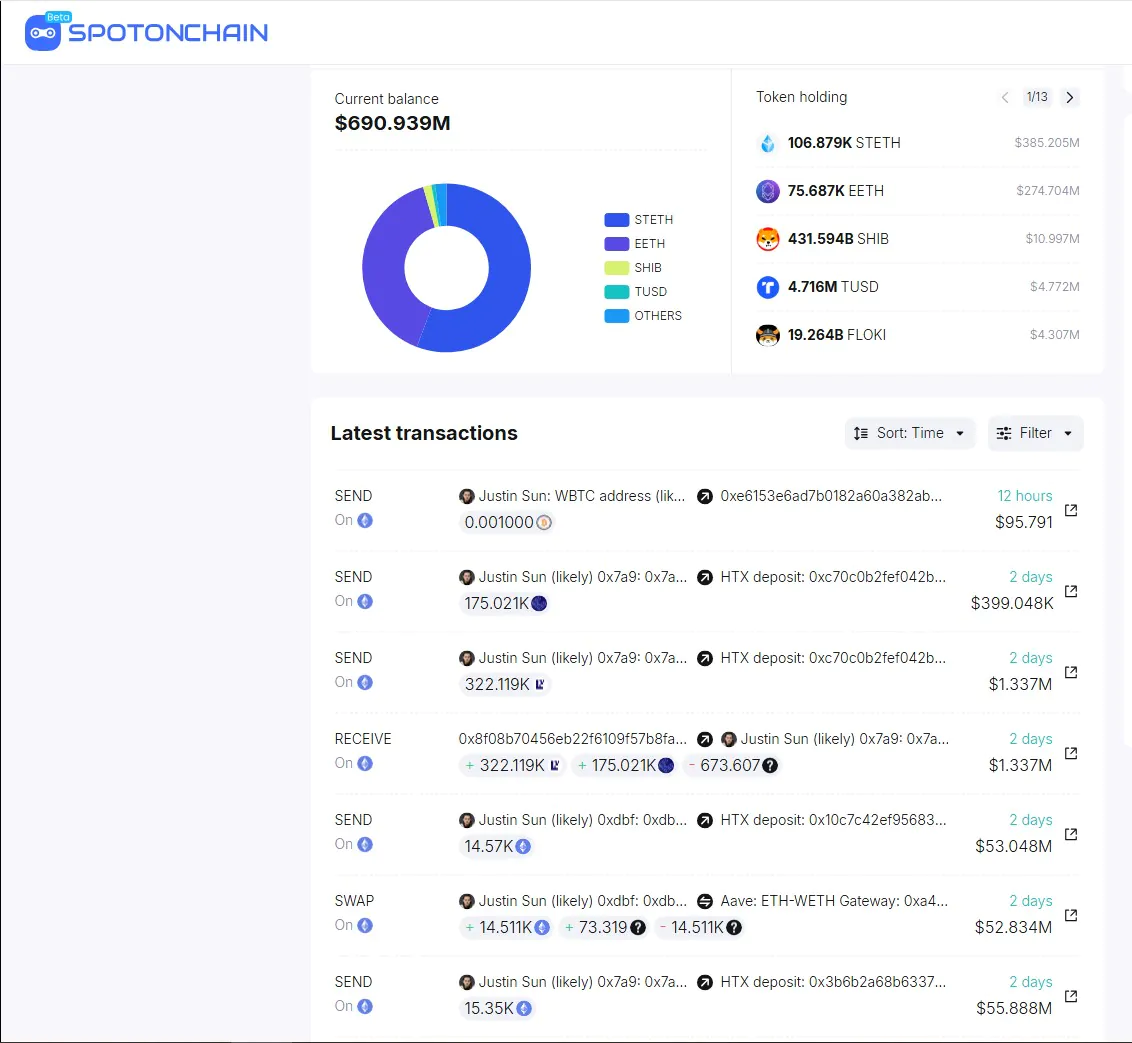

He then deposited 29,920 ETH worth $119.7 million into HTX on December 8, according to data from Spot On Chain, as ETH prices crossed $4,000. With Ether hitting $4,000, Justin Sun is estimated to have made a profit of $366 million, excluding staking rewards and airdrops.

Since the beginning of November, the Tron founder has also transferred 41,630 ETH ($145.9 million) to centralized exchanges, of which 39,000 ETH went to HTX and 2,630 ETH went to Poloniex at an average price of $3,505.

Read more: Bitcoin Plummets as Macro-Economic Conditions Take a Sudden Turn

In addition, Sun also deposited staking rewards into the cooperative, including 322,119 EIGEN tokens worth $1.44 million and 175,021 ETHFI tokens worth $516,000. These moves show that his strategy of profiting from Ethereum during the bull run is extremely effective.