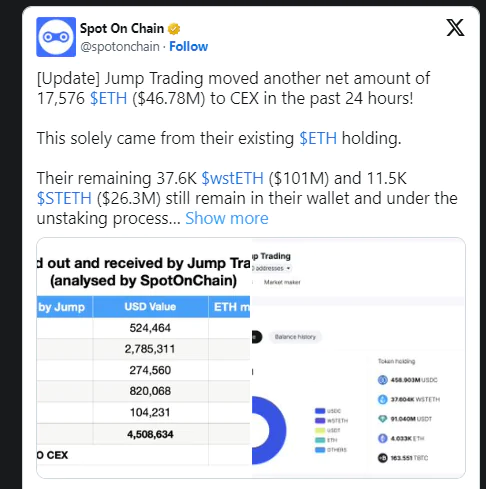

According to data from Spot on Chain, Jump Trading has transferred 17,576 ETH, worth $47 million, to centralized exchanges within the past 24 hours. This flurry of transactions has led to a 19.49% drop in Ethereum’s price, bringing it down to $2,340.

Rapid Liquidation

Jump Trading currently holds 37.6 thousand wstETH valued at $101 million and 11.5 thousand stETH worth $26.3 million in its wallet, totaling $587 million in cryptocurrency assets. Out of this, $481 million is held in USDC.

Over the past 10 days, Jump Trading has swiftly liquidated its cryptocurrency holdings. Since July 25:

- It has converted 83,091 wstETH (worth $341 million) into stETH.

- A total of 86,059 stETH, valued at $274 million, remains unstaked from Lido Finance.

- Approximately $300 million in Ethereum has been transferred to centralized exchanges.

These actions coincide with the cryptocurrency market’s collapse following a massive sell-off in Asian markets. The likelihood of a U.S. economic recession has significantly increased unless the Federal Reserve takes emergency measures. During the recent correction, the total number of new ETH addresses has dropped to its lowest point since the beginning of 2024, indicating a substantial decline in interest in Ethereum.

Is Solana the Next Target for Sale?

Reports suggest that Jump Trading is liquidating its cryptocurrency positions due to pressure on Solana. Market speculation indicates that Jump Trading’s founder, Ansem, might soon sell SOL. Last week, Solana’s price plummeted by 37% and is currently trading at $121, down 15.76%. Solana’s market capitalization stands at $56.5 billion.

Jump Trading’s recent maneuvers in the cryptocurrency market have investors on edge. The future performance of Ethereum and Solana is being closely watched. These rapid changes in the crypto market demand cautiousness from investors.

Jump Trading’s large-scale sell-offs have triggered significant market volatility, prompting investors to reassess their strategies. Amidst this heightened instability in the cryptocurrency world, it is crucial for market participants to take cautious steps.

Okay