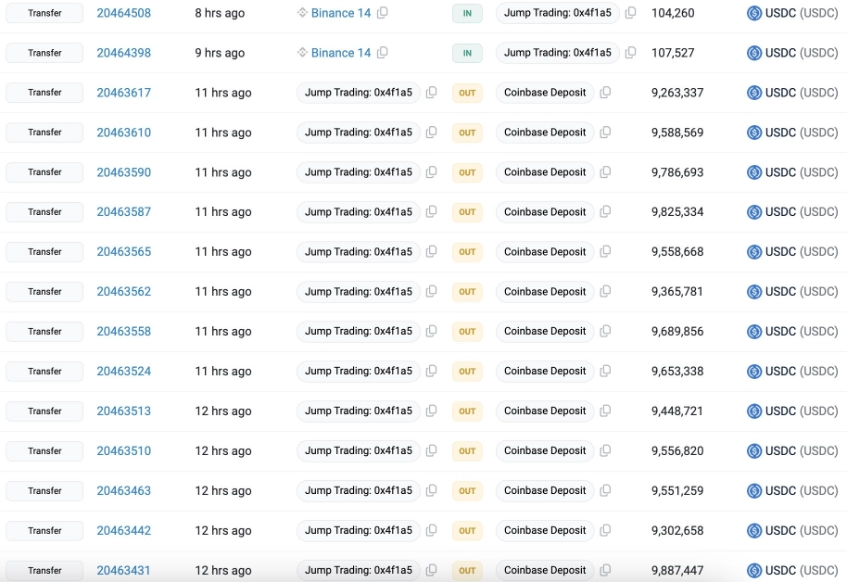

Jump Trading has just made large cryptocurrency transactions involving a significant amount of USDC stablecoin and is expected to withdraw $440 million, according to on-chain analyst Lookonchain.

The company withdrew approximately $606 million USDC from Binance. After withdrawing from Binance, Jump Trading deposited $440 million USDC onto the Coinbase exchange.

According to a post on the social media platform X (formerly Twitter), Lookonchain indicated that the deposit on Coinbase is then expected to be withdrawn, although the reason behind this strategy remains speculative.

The asset transfer from Binance to Coinbase could be seen as Jump Trading aiming to minimize legal risks from the U.S. or to take advantage of the trading conditions and better liquidity available on the Coinbase exchange.

USDC is a stablecoin designed to maintain a 1:1 value pegged to the U.S. dollar.

Jump Sells ETH, Triggering a Sell-Off

On Monday, the cryptocurrency market experienced a significant downturn. Jump Crypto, the cryptocurrency arm of Jump Trading, liquidated a large amount of Ethereum on centralized exchanges (CEX) such as Binance, OKX, Bybit, Coinbase, and Gateio, as the cryptocurrency market witnessed a sell-off.

Data from Spot On Chain, a blockchain analytics platform, shows that Jump Crypto transferred 17,576 ETH, valued at around $46.78 million, to various CEX platforms.

Related: Jump Crypto Sells Off ETH Amidst Intense Market Volatility

Nice one