Jump Crypto, the cryptocurrency arm of the trading giant Jump Trading, has made a significant move in the market by selling a large quantity of Ethereum (ETH) on top centralized exchanges (CEXs) like Binance, OKX, Bybit, Coinbase, and Gateio. This action comes amidst a period of strong sell-offs in the cryptocurrency market.

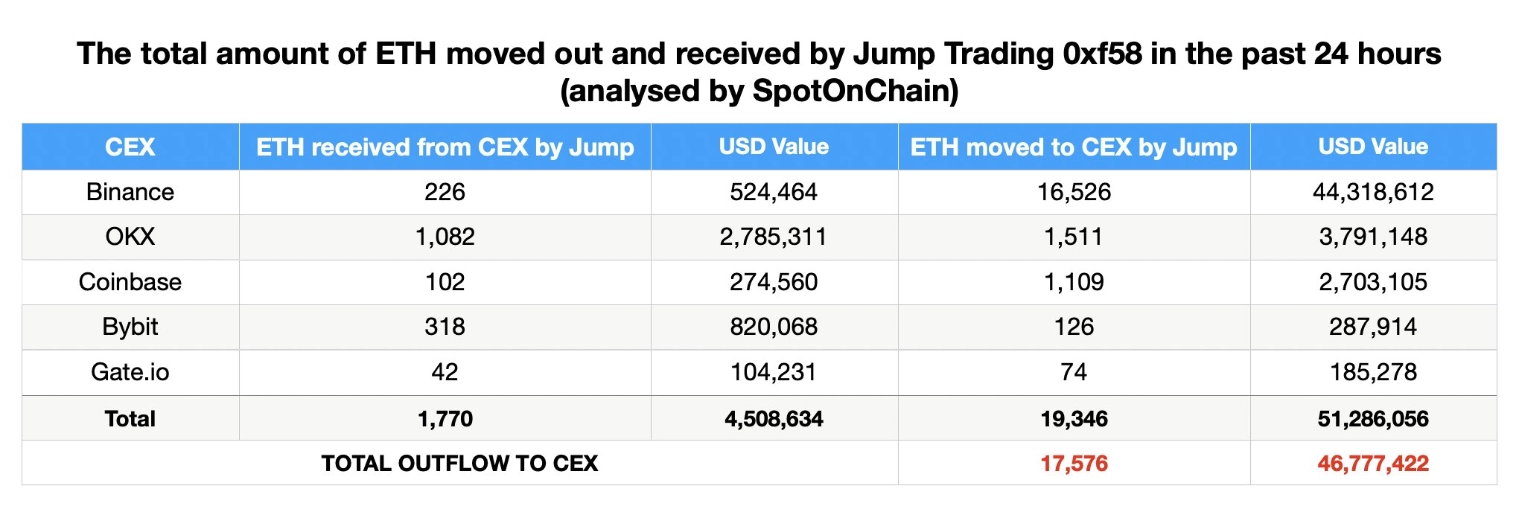

According to data from blockchain analytics platform Spot On Chain, Jump Crypto has transferred 17,576 ETH, worth approximately $46.78 million, to centralized exchanges within the last 24 hours. Notably, the company still holds 37,600 wstETH (worth $101 million) in its wallet and 11,500 STETH (worth $26.3 million) currently in the process of being unstaked from Lido Finance.

This sell-off follows Jump Trading’s conversion of 83,091 wrapped staked Ethereum (wstETH), valued at $341 million, into 97,600 staked Ethereum (stETH) on July 25. Subsequently, they withdrew 86,059 stETH, equivalent to $274 million, from the leading decentralized staking platform, Lido Finance.

In total, Jump Trading has net deposited 72,213 ETH, worth $231 million, into major centralized exchanges. This move is reminiscent of the 2021 cryptocurrency market crash and is exerting significant downward pressure on Ethereum’s price.

Jump Crypto’s liquidation of a large amount of ETH raises concerns about the downward price pressure and reflects the liquidity and depth of the cryptocurrency market. These transactions indicate a shift in the company’s Ethereum asset management strategy, possibly signaling portfolio restructuring or anticipation of upcoming market volatility.

Interestingly, this move comes amid internal upheaval at Jump Crypto. In June, President Kanav Kariya resigned just days after the Commodity Futures Trading Commission (CFTC) launched an investigation into the trading firm. The CFTC’s investigation primarily focuses on Jump Crypto’s trading and investment activities in the cryptocurrency sector.

Related: Institutional Sell-Off Drives Ethereum Down to $2200

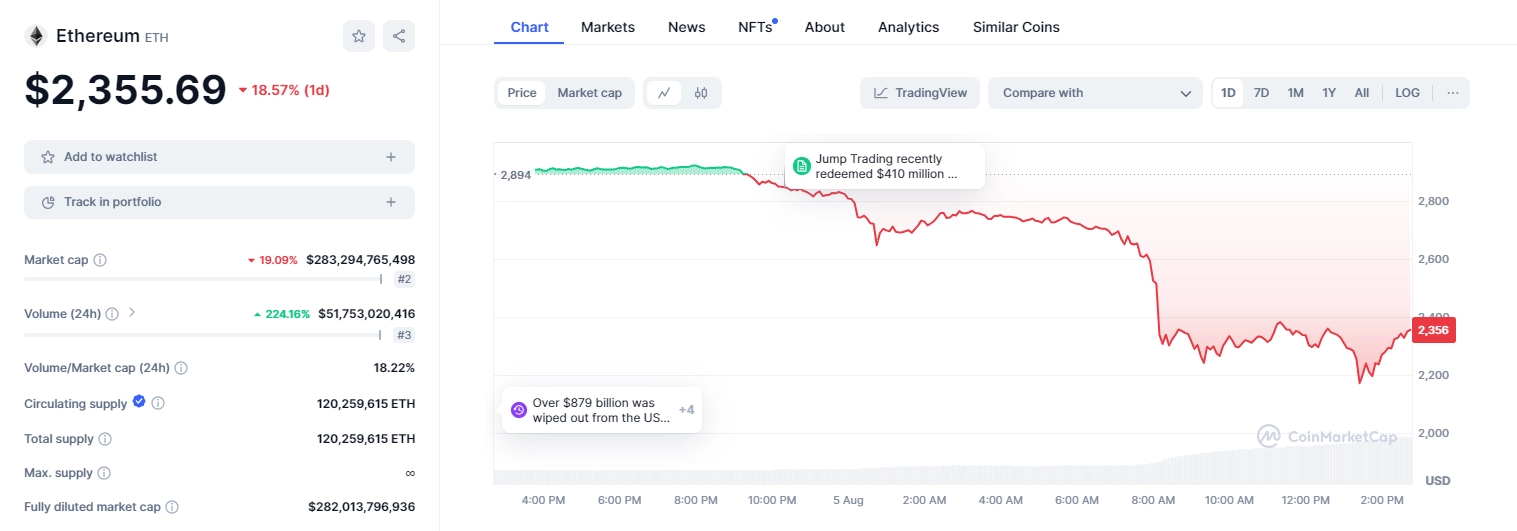

Ethereum (ETH) Price Fluctuations

At the time of writing, Ethereum is trading at $2,355, down 19% over the past 24 hours.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE