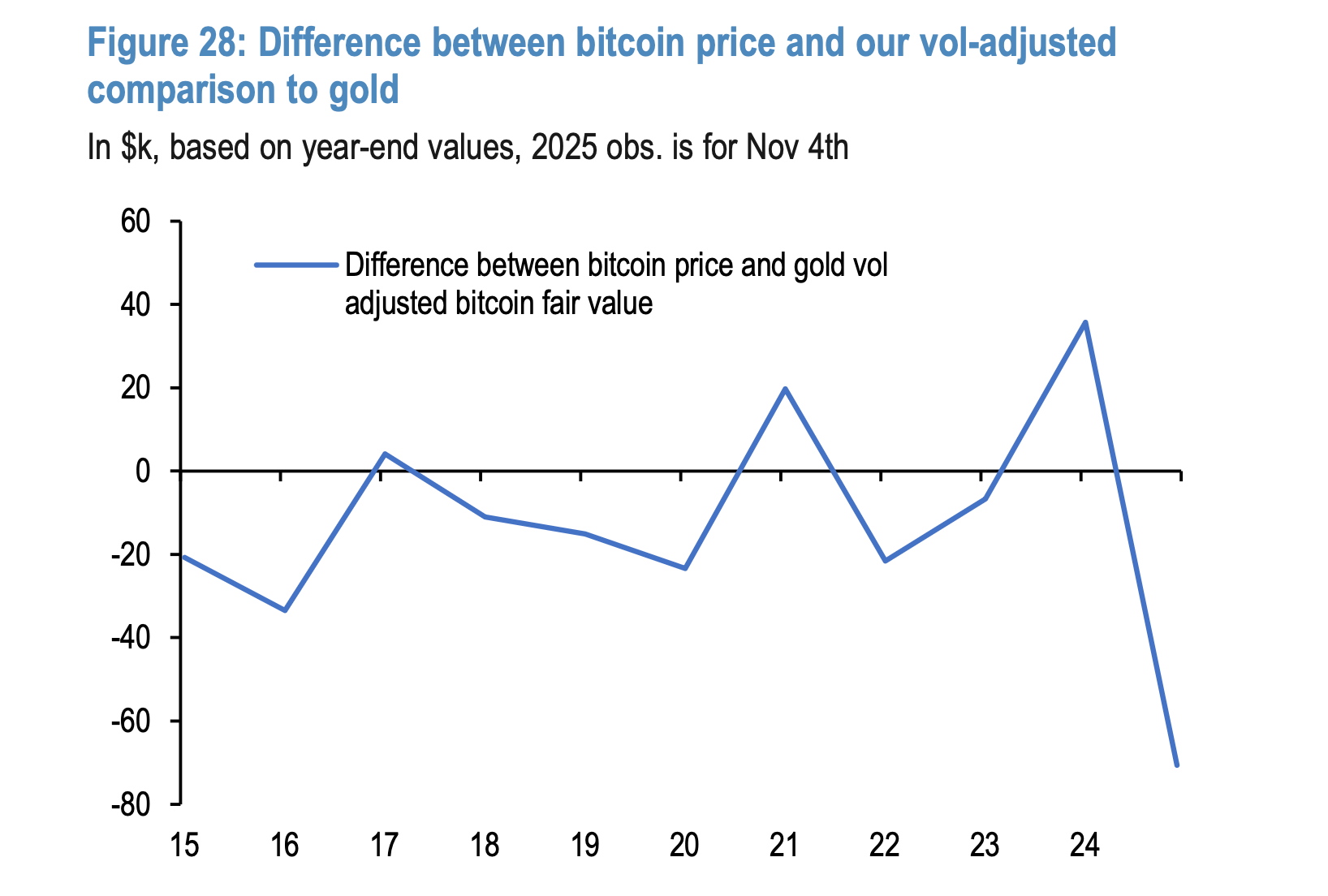

In a new report released on Wednesday, analysts at JPMorgan stated that Bitcoin (BTC) is currently trading below its fair value relative to gold — suggesting the cryptocurrency could see a strong upside in the next 6–12 months.

Key highlights:

-

JPMorgan estimates Bitcoin’s fair value at around $170,000, implying a potential 67% increase from its current price.

-

The Bitcoin-to-gold volatility ratio has fallen to 1.8, making BTC more attractive to investors amid gold’s surge to new all-time highs.

-

JPMorgan noted that Bitcoin now consumes relatively less risk capital than gold, leaving room for substantial growth.

According to the report, when adjusted for volatility, Bitcoin’s market capitalization should reach about $2.1 trillion — equivalent to a BTC price near $170,000 — to achieve parity with gold.

However, this optimistic projection comes as many other investment firms have lowered their Bitcoin forecasts. Over the past week, BTC fell below $100,000, marking its first breach of this key psychological support level in four months.

Investment firm Galaxy recently revised its 2025 Bitcoin target down to $120,000, from a previous $185,000, citing:

-

BTC whales offloading around 400,000 coins in October,

-

Investor rotation into competing narratives, and

-

The start of what it calls a “maturity era” for Bitcoin — a phase defined by institutional inflows, passive investment, and lower volatility.

Alex Thorn, Galaxy’s Head of Firmwide Research, explained:

“Bitcoin has entered a maturity era, where institutional absorption, passive flows, and lower volatility dominate — leading to slower but more sustainable growth.”

Despite the diverging outlooks, JPMorgan’s analysis rekindles optimism for a new Bitcoin rally, as macroeconomic conditions and market sentiment begin to tilt in favor of the world’s leading digital asset.