High-leverage trader James Wynn declared he was “all-in,” betting on Bitcoin dropping below $92,000 despite optimism surrounding the potential end of the 40-day U.S. government shutdown. While many cryptocurrency investors welcomed the market recovery, some short sellers were caught off guard by the rebound.

According to Hyperdash data, Wynn’s main Hyperliquid account was liquidated multiple times in the past 24 hours, with the wallet’s value dropping to just $5,422. This unexpected recovery led to Wynn being liquidated 12 times in 12 hours, bringing the total to 45 liquidations over the past two months, according to Lookonchain.

Before the market recovery, Wynn held multiple Bitcoin short positions, essentially betting on the cryptocurrency’s price decline.

Key Highlights:

-

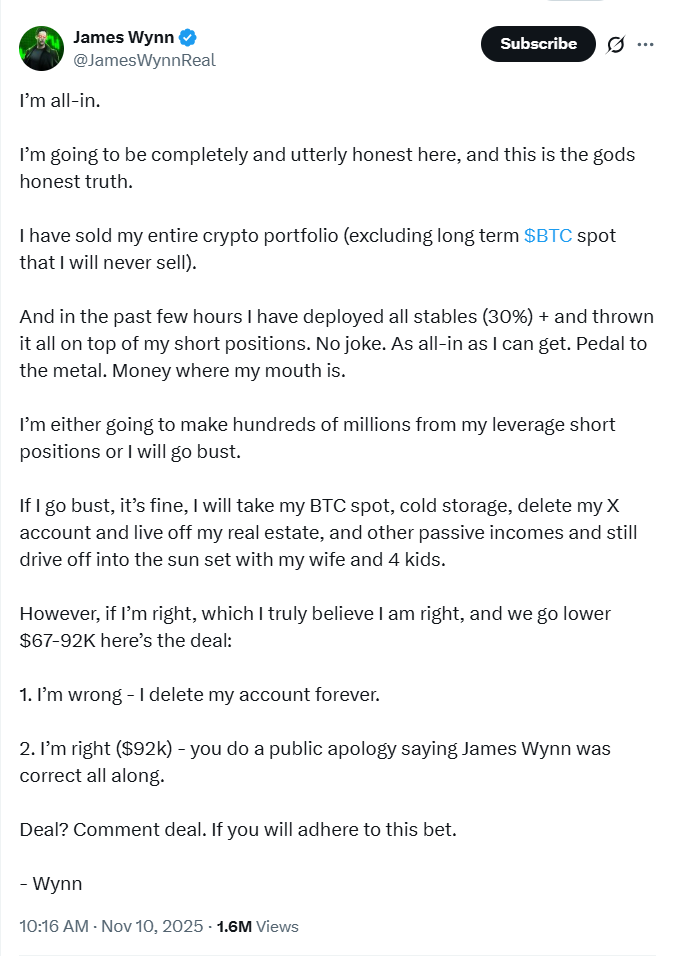

Wynn kept doubling down despite liquidations, transferring all his stablecoins into short positions, expecting Bitcoin to fall below $92,000.

-

He stated: “In the past few hours, I have deployed all stables (30%+) into my short positions. I’m either going to make hundreds of millions, or I will go bust.”

-

Wynn’s main account currently holds a 40x leveraged short position worth $275,000, which could be liquidated if Bitcoin recovers above $106,856.

-

When opening the short, Bitcoin was trading below $101,800, and Wynn faced an unrealized loss of $11,147, according to Hyperdash.

-

Many “smart money” traders on the Nansen platform are also betting on further Bitcoin downside, with a net perpetual short position of $223 million on Hyperliquid, and $5.2 million in new shorts opened in the past 24 hours.

Amid the market’s wave of optimism, Wynn’s “all-in” strategy has drawn intense attention, highlighting the extreme risks and potential rewards of high-leverage trading.