Ethereum Price Rebounds in 2023

Throughout December, Ethereum has shown remarkable resilience, bouncing back from a starting point of $2046 to a current high of $2403, marking a notable 15% growth. This positive momentum was underscored by a decisive breakout from a longstanding wedge pattern’s resistance trendline, hinting at the potential for further upward movement.

However, amidst this bullish rally, a brief pullback might be on the horizon to consolidate gains. The current ambiguity surrounding Ethereum’s price trajectory suggests a possible retreat to the $2250 mark. Yet, this setback could find solid support at key levels, notably $2250 and $2130.

Examining the intraday trading volume reveals a 34% loss, signaling a temporary decline in market activity. This could be indicative of a corrective phase, allowing the cryptocurrency to gather strength for its next leg up.

Will the ETH Price Rise to $3396?

The recovery journey of Ethereum traces back to mid-October, initiating from a rebound at the $1525 level and resulting in an impressive 58.3% surge, culminating in the current trading price of $2404. This ascent has been guided by a consistent uptrend within a rising wedge pattern, reflecting the coin’s resilience and steady growth throughout the year.

A pivotal moment in this upward trajectory unfolded on December 30th when Ethereum’s price confidently breached the upper trendline of the pattern. This breakthrough not only signaled a readiness for a more dynamic rally but also presented an entry point for eager buyers. With an intraday gain of 0.51%, the coin’s price might revisit the breached trendline to affirm its newfound strength and sustainability.

In summary, while a short-term pullback is conceivable, the overall chart patterns and market indicators suggest Ethereum’s potential to reach the $3000 mark. Investors may find opportunities amid this dynamic market environment, leveraging the coin’s recent breakout and sustained positive sentiment.

Related: SEC Postpones Verdict on Grayscale’s Spot Ethereum ETF

Capitalizing on this pattern, Ethereum (ETH) stands poised for a potential 51% surge, setting its sights on the coveted $3396 milestone. This projection gains credence when considering the interplay between Ethereum and Bitcoin prices.

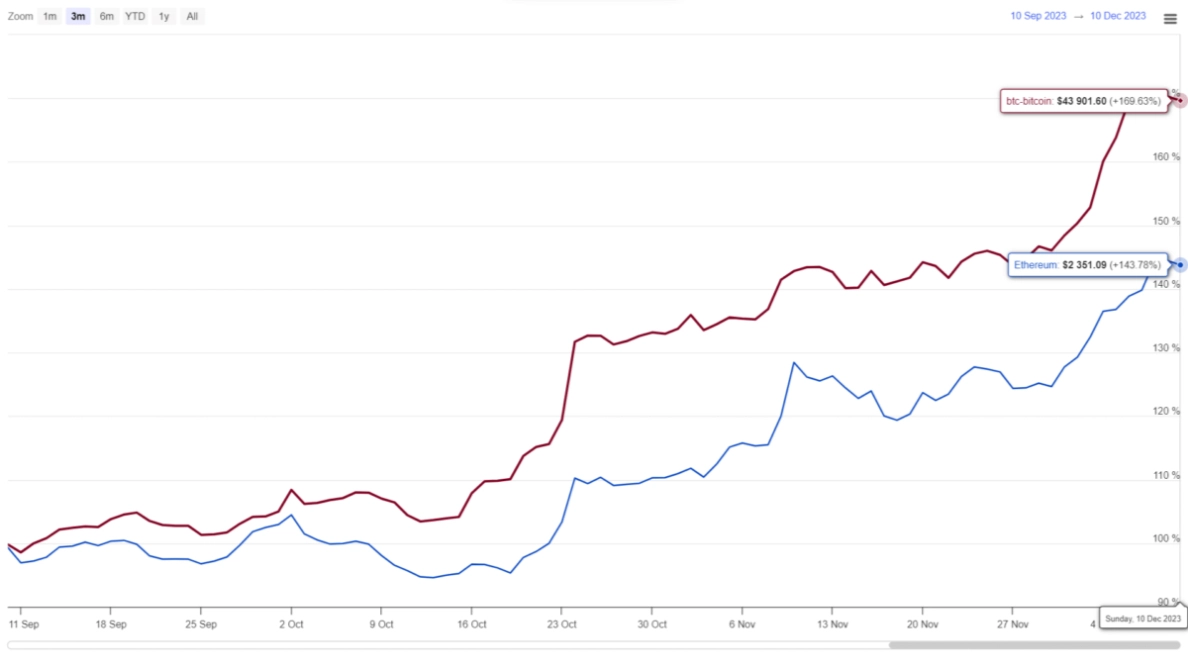

Bitcoin vs Ethereum

The cryptocurrency landscape has seen a robust recovery trend over the past two months, led by the two major players, Bitcoin and Ethereum. However, a nuanced distinction emerges in their price behaviors. Bitcoin’s price exhibits a steady ascent, instilling confidence in a reliable breakout opportunity. On the other hand, Ethereum’s price, characterized by greater volatility and intermittent drops, suggests that strategic pullback approaches might be more effective for traders eyeing ETH.

Analyzing the technical indicators further deepens our understanding of Ethereum’s current trajectory. The upswing in the upper boundary of the Bollinger Band indicator indicates strong buyer activity propelling the ongoing rally. Concurrently, the Average Directional Index (ADX) slope registering a 40% high signals the potential for a temporary correction in ETH’s price to sustain the overall bullish trend.

In essence, as Ethereum embarks on this upward journey, traders may anticipate a notable surge, aligning with the $3396 target. Nevertheless, the distinct market behaviors of Bitcoin and Ethereum underscore the importance of tailored trading strategies to maximize opportunities in this dynamic cryptocurrency landscape.