Why is Bitcoin considered undervalued?

The MVRV Ratio has turned negative, signaling that Bitcoin has entered an undervaluation zone with potential for reversal. Since late August, whales have accumulated 56,372 BTC, strengthening the case for large-scale buying.

What data supports a rebound?

-

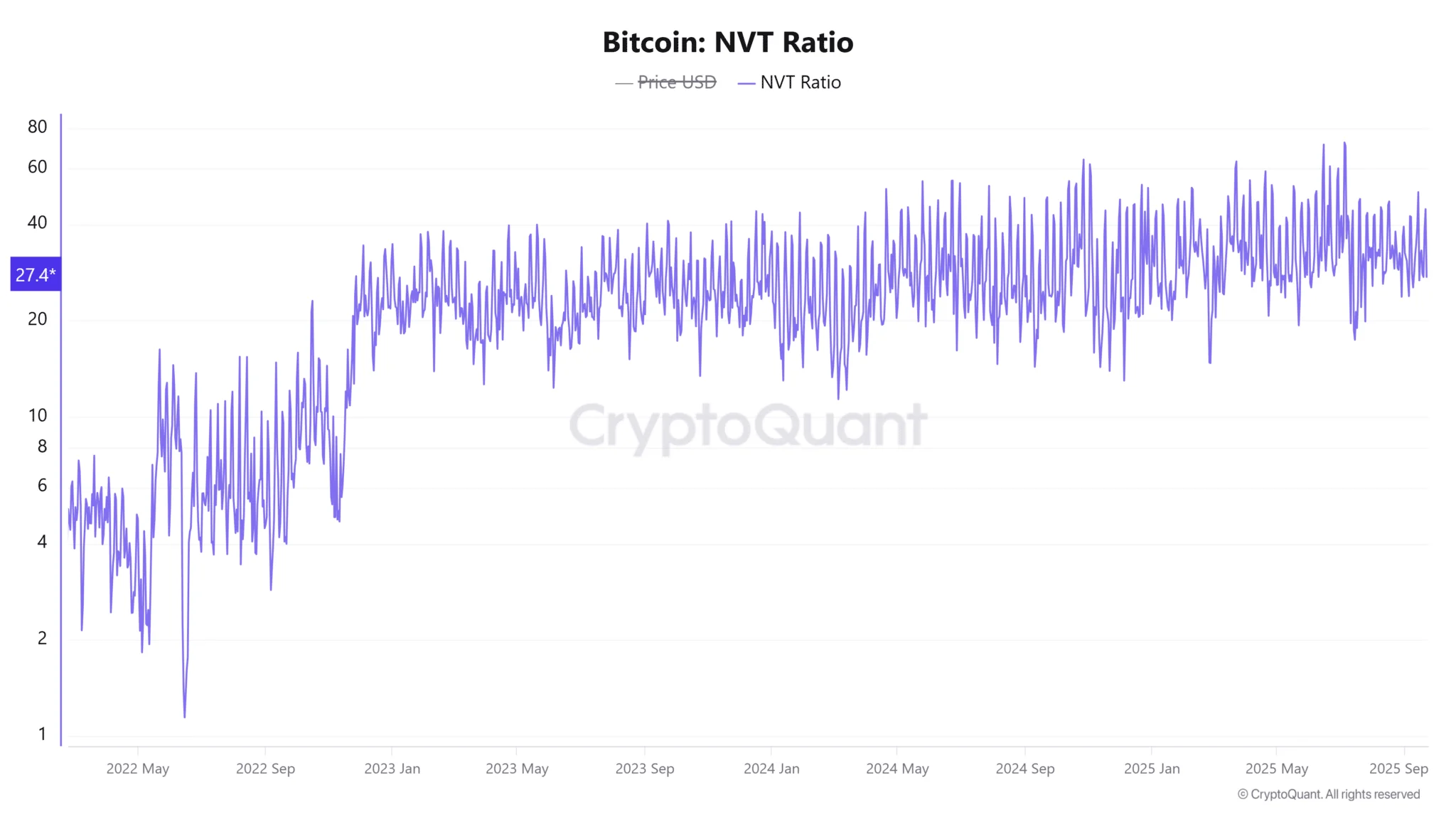

The NVT Ratio plunged 38% to 27.42, suggesting Bitcoin’s valuation is aligning more closely with actual network activity.

-

Market sentiment has recovered from deep negative levels to near neutral, reflecting fading bearish pressure.

-

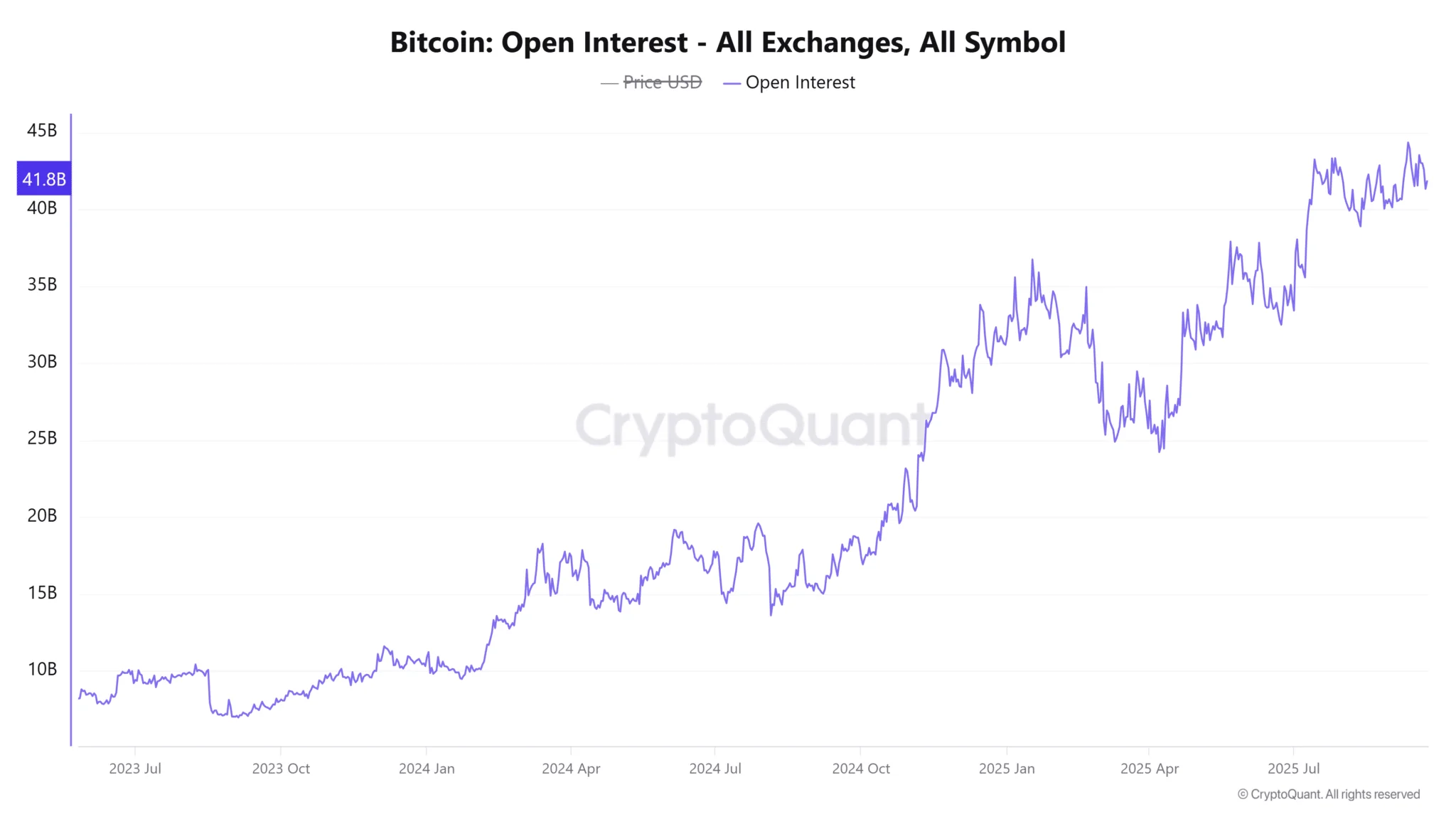

Open Interest climbed 1.47% to $41.97 billion, showing traders are holding positions despite downward pressure.

Signals pointing to steady accumulation

After falling 8.8% from its August 13 peak of $123,800 to $112,200, Bitcoin is testing investor conviction. Yet on-chain data tells a different story: exchange reserves continue to decline while whale accumulation remains steady.

Meanwhile, the sharp drop in the NVT Ratio highlights that valuation is moving closer to actual transaction volumes, implying improving organic demand. If network activity remains resilient despite volatility, Bitcoin could be entering a more sustainable growth phase.

Sentiment and trading activity show resilience

Santiment data revealed market sentiment has bounced back, though it remains cautious. Historically, recoveries from deeply negative sentiment often precede short-term relief rallies.

At the same time, persistently high Open Interest indicates that speculative money hasn’t left the market. While this brings the risk of sharp liquidations if volatility spikes, it also demonstrates traders’ determination to stay positioned.

Conclusion: A correction or an accumulation window?

The combination of undervaluation, a healthier NVT Ratio, improving sentiment, and resilient Open Interest suggests Bitcoin’s pullback may represent an accumulation window rather than a collapse.

Whale buying and falling exchange reserves reinforce this constructive outlook. While turbulence may persist, the evidence points toward accumulation taking shape—potentially setting the stage for a rebound once forced selling subsides.