Bitcoin (BTC) appears to be gearing up for a new wave of institutional investment. According to BlackRock’s latest report, financial advisors – who collectively manage over $100 trillion in assets – will soon have easier access to Bitcoin than ever before.

This news has ignited a fresh wave of optimism in the crypto market. While institutional demand is no longer a novelty, the current pace of adoption is exceeding all expectations.

With a clearer regulatory framework and the growing popularity of Bitcoin ETFs, financial advisors now have a more transparent and convenient path to incorporate BTC into their diversified portfolios. BlackRock’s statement reflects this clear trend and suggests that the next wave of demand may come from institutions that had previously remained on the sidelines.

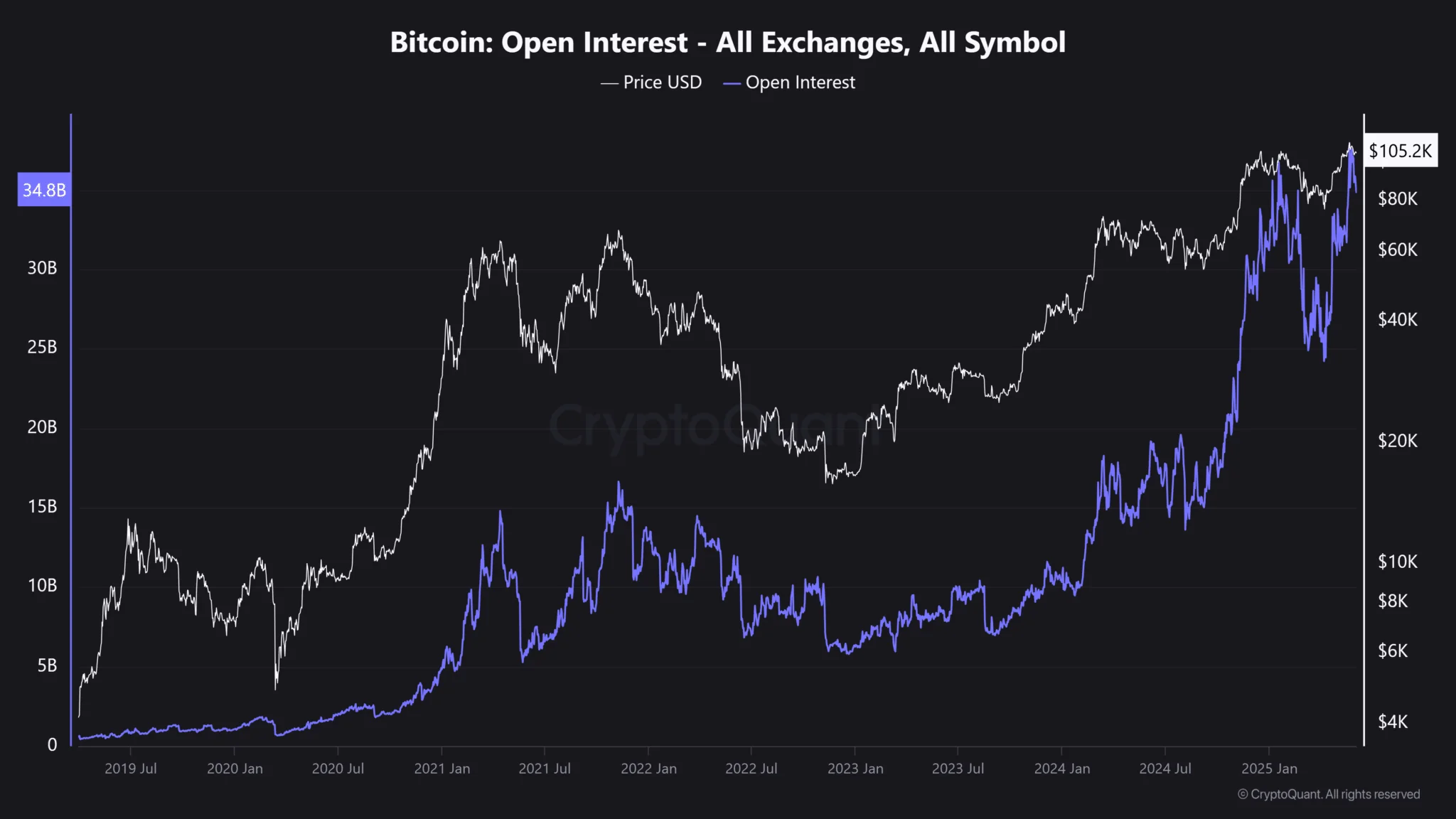

Traders are already picking up on these signals. The market has responded almost immediately. Since major institutions began ramping up their activity, Bitcoin’s open interest has been rising steadily without showing signs of slowing down.

This reflects a growing confidence in an emerging supply-demand imbalance. Capital flowing into derivatives markets – through options and futures contracts – is a strong indicator that large institutions are betting on significant price movements, often in a bullish direction.

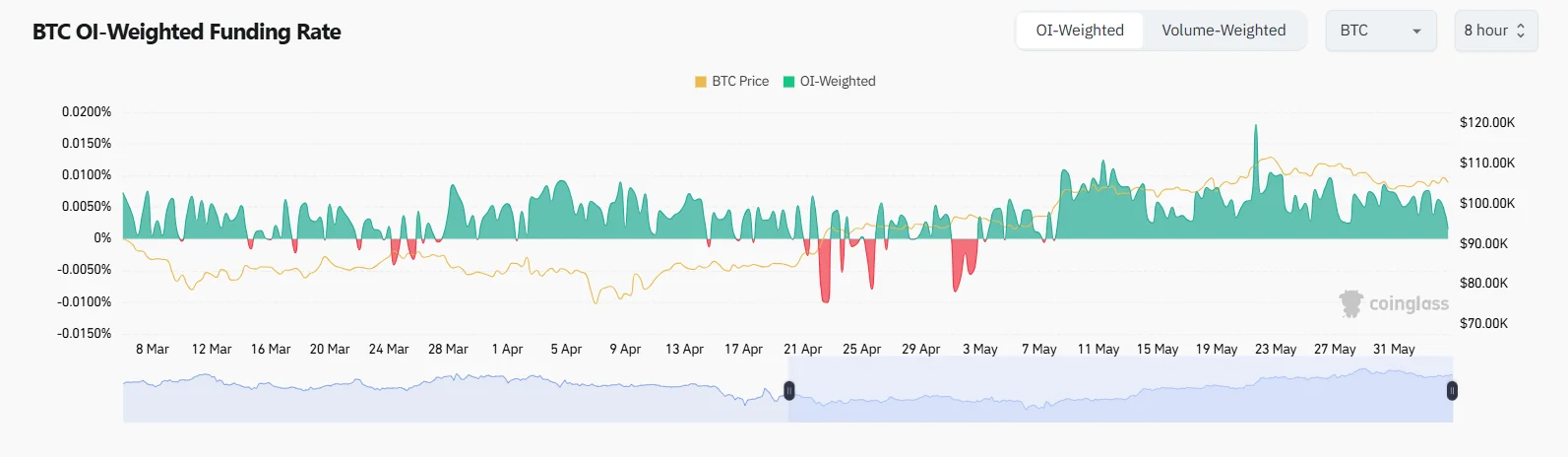

At present, market sentiment continues to lean toward the upside. Not only is open interest rising, but Bitcoin’s funding rate is also trending higher. A positive funding rate typically indicates that more traders are opening long positions, expecting prices to rise further.

The combination of a rising funding rate and institutional news often sets the stage for powerful price breakouts. However, this can also trigger short-term volatility. If the market becomes overbought, a correction may occur. But if institutional capital truly enters the space, strong buying pressure could offset any short-term dips.

Is a Supply Shock on the Horizon?

All eyes are now on Bitcoin’s supply. With a fixed cap of only 21 million coins and a decreasing rate of issuance after each halving event, institutional buying pressure could spark a genuine supply shock.

Unlike retail investors, institutions often adopt long-term strategies – buying and holding. Even a small allocation from their multi-trillion-dollar portfolios into Bitcoin could rapidly drain liquidity from exchanges – potentially pushing BTC prices to unprecedented highs.