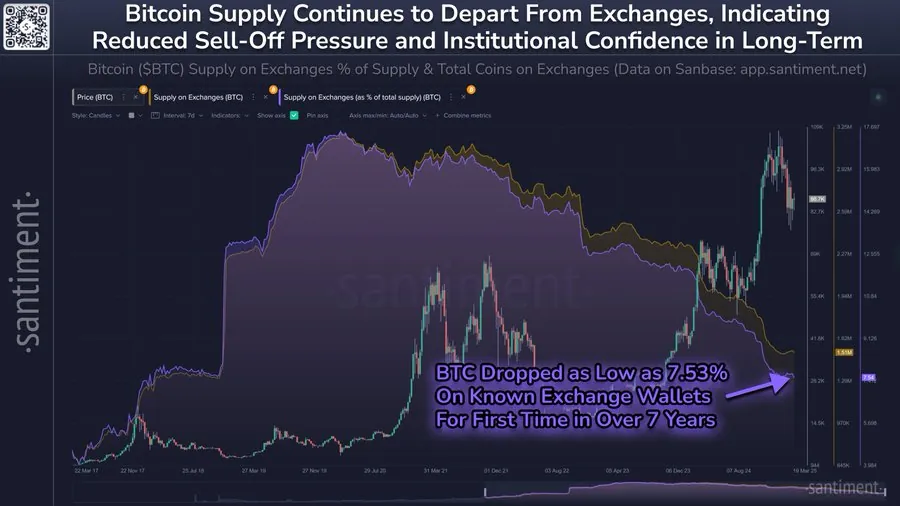

The supply of Bitcoin on exchanges has dropped to 7.53%, marking its lowest level since February 2018. Currently, Bitcoin is trading around $87,000, showing a slight increase over the past 24 hours.

The growing preference among investors to “hodl” rather than sell reflects strong institutional confidence in Bitcoin’s long-term potential. With fewer sellers in the market, volatility may rise due to lower liquidity.

The sharp decline in exchange supply indicates a significant shift in investor sentiment — from short-term profit-taking to long-term holding. This demonstrates increasing confidence in Bitcoin’s future growth potential.

As the available supply of Bitcoin continues to dwindle, price volatility may intensify if demand surpasses supply. Market confidence is further reinforced when fewer participants are willing to sell, tightening the exchange supply even more.

Additionally, network activity reveals growing investor interest. The number of active addresses has risen by 1.16% to 10.17 million, indicating heightened user interaction, whether for sending or receiving funds.

Moreover, total transactions have increased by 0.74%, surpassing 418,000. This rise in activity reflects greater market participation, potentially driving demand and putting upward pressure on prices in the future.

Current technical analysis also signals positive momentum on the Bitcoin (BTC) price chart. Data shows that the Fibonacci retracement level at 0.236 — approximately $81,325 — is serving as a crucial support point.

Meanwhile, the RSI is at 51, indicating that BTC is neither overbought nor oversold. This suggests there is still room for price movement in either direction. If BTC holds above key support levels, a potential breakout could occur in the near future.

BTC liquidation data also reveals a notable balance between both sides of the market. Specifically, long liquidations reached $3.65 million, while short liquidations stood at $3.56 million.

This balance reflects a neutral market sentiment, with both optimistic and cautious traders adjusting their positions. It may signal that the market is awaiting significant price movement in the coming period.